10+ Best Global Payroll Services for International Companies

The best international payroll providers of 2026 include Multiplier, Deel, Lano, Remote, PapayaGlobal, and ADP. Get pricing, feature breakdowns & comparisons, and more below.

Global payroll software allows businesses to hire workers internationally. The best platforms let you choose between hiring people as contractors or full-time employees through an Employer of Record service, with nearly the same ease.

Regardless of the method, these tools take a fairly complex process and make it seem as simple as if you were hiring locally. From the same platform, you’ll be able to manage payroll in multiple countries while remaining compliant with local laws and regulations.

We’ve carefully selected the top global payroll systems that are best for businesses with a multi-country workforce. As this software category has grown, most of these companies have expanded to offer all sorts of workflows for the international team, like onboarding, employee self-service, and even compensation management.

To find the best global payroll systems, we’ve demoed dozens of products over the years and are in constant touch with our community of HR and payroll experts. We’ve been writing about this type of software since 2021, when it was still a fairly novel idea, and we’ve followed the product and company journeys of many HR tech vendors quite closely.

The goal with this guide has always been to recommend the best products, but also present a selection that would benefit a wide range of organizations. Here’s more detail on how we evaluate HR tech vendors.

The featured international payroll providers all score consistently highly on usability, pricing, flexibility, and, of course, each company’s track record. In all cases, we thought of products with which it would be easy to make a switch, whether upgrading plans with the same vendor or migrating employee data elsewhere.

- Usability: Running payroll in a multitude of countries may not be the most fun thing on earth, but we favored payroll platforms that make it a smooth and relaxed experience thanks to their intuitive workflows and aesthetically pleasing dashboards.

- Pricing: This list covers all kinds of budgets, from SMB-oriented payroll tools that help you start paying contractors overseas to enterprise payroll service options that allow you to migrate your entire international payroll to one platform.

- Flexibility: Among the dozens of products we tried, we preferred those that offer a good variety of payroll processing options (like paying contractors and employees, full-time or part-time) on an EOR or PEO scheme, with the ease of moving from one to another.

- Track Record: Some of these companies are unicorns in their field, others do great in the SMB segment, and you can see why if you talk to their users. For each, we made sure there were solid and steady growth markers for years to come.

Seeking payroll software for a specific country or industry instead? Our guides on the best Canadian Payroll Software and Trucking Payroll Systems might just be what you’re looking for.

.png)

Deel

.png)

Deel can manage payroll compliance in 150+ countries and has a notably easy-to-use interface, using one platform for all countries.

PROS

- 24/7 customer support with a rapid response time of 1.25 minutes and quick onboarding within 2-3 days.

- Deel HR is free for all company sizes.

- Integration with 100+ HR platforms natively; APIs are also available.

- User friendly with self service features and identity verification usually within 24 hours.

- Automated invoicing for payments in English.

- Excellent 24/7 customer service with fast onboarding (2-3 days) and local payroll experts in each jurisdiction.

- Seamless integration with platforms like QuickBooks, BambooHR, and Greenhouse, plus custom integration options.

- User-friendly, self-service features enable quick setup; identity verification often takes under 24 hours.

- Automated invoices simplify payments, provided they're in English.

CONS

- Key features like onboarding automation are add-ons, which may increase costs.

- Limited flexibility in modifying contracts or service agreements; changes often require an addendum.

- Invoices cannot be generated in languages other than English.

With Deel, companies can hire employees in a multitude of countries without it getting messy. From the same dashboard, you can manage international payroll, benefits, taxes, and compliance in over 150 countries.

Deel was one of the first companies to offer global payroll as their primary service. Their composite of contractor and freelancer management + EOR and PEO capabilities, as well as their sleek design, made them stand out early in the category's history.

Nowadays, they’re also notable for having expanded their tool quite a bit, adding Core HR capabilities to their platform. Other newer Deel features include immigration support, background checks, and their Shield module, devised to protect you against compliance issues.

Deel has been used by over 35,000 companies worldwide. Some of them are Brex, Google, and HomeLight.

Deel offers global payroll solutions with Deel EOR at $499/month, Deel Payroll at $29 per employee/month, and Deel US Payroll at $19 per employee/month.

As a new product, Deel has changed a lot since its inception. Its newest offering, DeelHR, allows companies to complete most of their HR operations tasks in Deel.

Best For

Companies, big or small, who wish to stay compliant when hiring people in multiple countries can make good use of Deel. The vendor is also great for those who wish for an EOR / contractor management balance.

We use it to track our contractors, pay their invoices, collect W9s. As our EOR, it allowed us to bypass the financial and time costs with establishing a subsidiary overseas. It keeps us in compliance with international labor laws, includes global payroll, offers benefits/participates in local social welfare programs and ultimately retains key employees we would have lost as 1099 contractors.

I like that the process and layout is very similar regardless of which product and service you use from them - quite intuitive. It supports employers ability to maintain compliance by listing out requirements and flagging missing items or expired items. Lastly, being able to file 1099s digitally is a luxury I hadn't had previously. A total time saver.

We implemented Deel initially as a way to pay our onshore 1099 contractors, track their contracts and contact information outside of our HRIS. After two years, we had a new problem to address and changed our Deel platform to include an EOR. We had offshore contractors that we wanted to bring on as full-time employees to retain them and ensure compliance with the IRS. The change was seamless and the EOR is intuitive, informative and our offshore employees have been satisfied with the service from their end.

I think there is room to improve the connection between employer and the EOR service representatives in that a dedicated point-of-contact that is in house with Deel and not an international partner. Another consideration for EOR is having to pay a month's salary deposit up front for payroll is not ideal for cash flow. Lastly, I would love to see more employee and contractor features that you might find on a traditional HRIS because I believe it would be a better and more enriched experience for them.

For 1099 contractor management, oftentimes you use an ERP or accounting SaaS which has limitations. Deel bridges the gap between accounting SaaS/ERPs and an HRIS. For EOR, Deel is middle of the road in value. It is a great option for smaller OPEX budgets, but there are other EOR companies who offer more desirable features and better in-house service partners.

Consider the number of contractors or employees you would need for the upfront and annual costs to be justified. Whether or not you are familiar with global payroll, consider how much compliance support you need or is desirable for you. Lastly, consider whether you are up to converting your local currency to the international currency. Deel does not currently offer this in the employee profile, they only show the employee's local currency.

There is better customer service and help tutorials. Further, I have found there is an increase in the amount of educational materials available through Deel in order to stay current on contractor and global payroll trends and compliance.

I have known it to be used by HR and Finance professionals alike. Payroll administrators, regardless of where they fall organizationally, will find this tool beneficial. I believe organizations where these contracts or payrolls are relatively straightforward can benefit. Running payroll and paying invoices takes 10 mins or less per pay period.

I believe complex and large organizations may not find Deel to be scalable to their needs. At volume, Deel is not the best for tracking or reporting. For smaller teams, these features are acceptable and function appropriately.

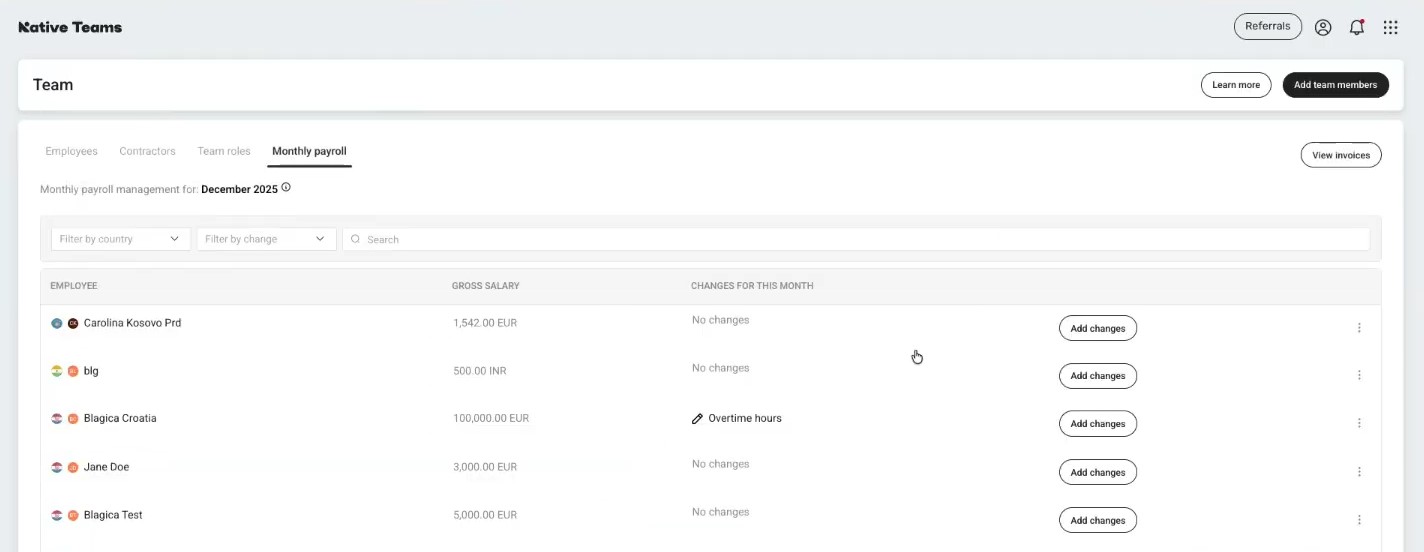

Native Teams

Native Teams impressed us with one of the most flexible and affordable global payroll lineups we’ve seen. Starting at as little as $19 per month, this platform supports payroll for all types of workers, from full-time employees to freelancers and gig workers.

PROS

- Affordable, distinct global payroll plans tailored to EOR, contractor, and gig workers.

- Payroll available in 95+ countries, with localized tax support.

- Built-in wallets and multi-currency payouts with optional employee cards.

- Automated workflows for salary updates, bonuses, absences, and expense reimbursement.

- Mobility and visa services are bundled into the payroll dashboard for EOR customers.

- Good range of EOR services with compliant contracts, payroll, benefits, and visa support.

- Pricing is half the typical EOR rate, and a free trial is offered.

- Built-in wallet and debit card for employees, with 1% cashback on balances.

- Contracts are bilingual and can be partially customized with legal team review.

- Visa and mobility support embedded in-platform for 20+ countries.

- Automated workflows for bonuses, tax allowances, and leave tracking.

CONS

- Fewer countries are supported compared to some competitors.

- Integrations with HRIS and Zapier are still on the roadmap.

- Lacks compensation benchmarking or pay analytics tools.

- The user interface and onboarding process can be more user-friendly.

- User interface lacks polish, and navigation can feel unintuitive.

- Onboarding can be slow, especially when syncing legal documentation.

- No HRIS integrations or open API (planned for 2026).

- Does not offer compensation benchmarking or planning tools.

If you're building a global team with a mix of employment types and need a simple, cost-effective payroll tool to match, Native Teams is well worth exploring.

Our first impression of this employer of record is that it is built for flexibility. Instead of bundling payroll into one monolithic product, Native Teams separates it into four clear plans based on employment type: Employer of Record, Contractor Pay, Gig Pay, and Contractor of Record. This modular approach gives companies far more control over costs and compliance.

Better yet, the pricing is fairly affordable to most teams. In particular, if you're hiring full-time employees abroad, the EOR plan starts at just $99 per month, which is the lowest we've seen in the category. For independent contractors, Contractor Pay begins at just $19 per month, while those paying gig workers or short-term freelancers at scale can opt for Gig Pay or Contractor of Record, depending on how hands-on they need to be with tax and compliance.

In our demo, we tested payroll flows for the EOR worker type. Adding bonuses, changing salaries, or submitting expenses was easy thanks to the automation. The payroll dashboard was insightful with data on country-specific tax breaks, vacation schedules, and details of what gross-to-net salary costs actually look like.

We also liked the digital wallet and Mastercard Native Teams offered to its clients’ employees and contractors, as these individuals can receive payments in multiple currencies and earn 1% cashback on balances. It’s not something we see often from competitors.

However, Native Teams’ country coverage (95+ countries) is still short of vendors like Deel, Remote, and Rippling (100+ countries). Furthermore, given that this EOR provider is working on HRIS integrations and Zapier support, finance and HR teams may have to rely on manual exports or custom workarounds for now.

Semos Cloud, Mad Head Games, Kaiko Systems, inDrive, STURM

Native Teams offers four payroll options:

- Employer of Record (EOR): Starts at $99/month per employee.

- Contractor Pay: Starts at $19/month per contractor.

- Gig Pay: Custom pricing.

- Contractor of Record: $99/month per contractor.

Best For

Native Teams is best for startups and lean global teams needing flexible, affordable payroll across multiple worker types.

Remote

Remote global payroll software enables employers to hire and pay contractors and employees in locations around the world. They also offer IP protection, data security, 24/7 localized customer service, and ample platform customization.

PROS

- Flat fee structure. No deposit is required (conditions apply), and there is no extra charge for benefits administration.

- Mobile apps are user-friendly and frequently updated.

- 24/7 local support via email and live chat.

- Equity-based compensation available.

- Helpful HR tools and global employment guidelines are free to access via Remote’s website.

- Fast and compliant payroll in 170+ countries.

- Live chat support with local payroll experts.

- Flexible, localized benefit packages.

- Flat-rate pricing structure, no deposits or hidden fees.

- Mobile app streamlines expense reimbursement with autofill from receipt photos.

CONS

- It may be out of reach for small teams with limited budgets.

- Only supports direct deposit and wire transfers, and no off-cycle pay runs.

- No phone support is available.

- Doesn’t have a free trial.

- Redundant for organizations solely recruiting within the U.S.

- Help center documentation isn’t easiest to understand.

Remote is one of our top picks for global payroll solutions.

Remote offers localized payroll services, handling benefits administration, payroll processing, and contractor payments. Remote owns legal entities in more than 60 countries, so it’s one of the most effective solutions for growing teams who employ and pay international employees and independent contractors.

As an Employer of Record (EOR), Remote handles employment's administrative and legal aspects, like payroll processing, benefits administration, tax, and legal compliance. For those who have handled tasks like these close to home, it’s not difficult to imagine how profoundly complicated and error-prone global payroll is. With the help of Remote, companies can focus on doing their actual work, whatever that may be, rather than learning the intricacies of payroll across the planet.

Loom, GitLab, DoorDash, HelloFresh, Workato, Semrush, Teamway

Remote’s Global Payroll is priced at $50 per employee per month.

Best For

Great pick for either remote-first businesses or those with distributed workforces.

I use remote.com to hire contractors in multiple countries for our company. Once we find a candidate we want to hire, we send an offer letter and start the onboarding process in remote.com. Employees create their invoices at the end of the month and we complete payment through remote.com immediately.

- Ease of use - ability to learn how to use the system in a day

- You are able to contract from over 100 countries in remote.com

- Reporting is clear and easy to understand

As a small organization we were looking to hire many contractors in various countries. Remote.com is extremely easy to use and makes hiring internationally simple. I have been using Remote.com since March 2023.

- Customer service was not helpful and very rude. I had to get a manager involved.

- The system is not very robust. It really is just a payment and time tracking services system, any organization would need an employee performance management system.

- The integrations are underdeveloped and could be improved.

This is the first contractor tool that I have used, and I am very impressed. Remote.com does everything we need so I do not see us needing to switch to a different product.

I think people should assess what countries they need to hire contractors in, and make sure that remote.com is able to hire in those countries. Furthermore the cost of remote.com is pretty reasonable for the price that it costs.

I have not really seen a difference since I have been using it since March 2023. I will say that the reporting is great and I am always happy to improve my process while using it.

Companies with multiple contract workers

Companies with the majority of their hires in the United States.

ADP

ADP GlobalView is the solution for international payroll from one of the most reputable and long-standing companies in the space.

PROS

- Native, all-in-one technology suite for recruitment, payroll, and compliance.

- 17 RPO service centers in 14 countries and provide services in 42 different languages.

- Dedicated team of AIRS-certified recruiting professionals.

CONS

- Technology options outside ADP’s dedicated HR tools are limited.

If you intend to manage global payroll for thousands of employees, ADP’s GlobalView should be on your list of vendors to consider. The payroll giant has put together a solution that’s specific to big businesses, providing them with a single system to unify all global employee payroll data while letting you stay compliant.

For this product, ADP also operates with local experts. You can process payroll yourself, or outsource most of the back office payroll functions to ADP’s team. Finally, GlobalView works only in 40 countries, but it can be combined with ADP Celergo to extend their coverage to up to 140 nations.

Among others, ADP’s global payroll solution is used by the likes of PayPal.

Like with most ADP products, pricing details aren’t available online, since they’ll likely provide a custom quote once you request and have a demo.

Best For

Large enterprises that want a single place from where to manage an international workforce.

I use ADP weekly to provide employees with resources they might need. It could be for a pay stub, to calculate how much they make in 2 weeks, or to check their right to work. I especially like the feature that links to e-verify. That has been very helpful to us. We also use ADP for benefits and open enrollment. I also often point employees or former employees to the tool for self-service options.

I like that our data sits in one place - makes it easier to find. I especially like the link to e-verify, that brings me peace of mind. I also enjoy the way the user experience is set up for the pay profile.

I was not a part of the organization when they decided to begin using ADP. My understanding is, we were using a PEO, and decided to move in-house utilizing the ADP tool. It's been great for payroll and for onboarding employees. I have used it for 2.5 years at this organization within HR, and as a user at other companies. ADP has been great for managing benefits, employee pay statements, etc. It is nice to have a system that employees can self-serve.

I am not sure if I am unaware or if we just haven't done this, but I wish ADP linked to our HRIS. It has been difficult to enter manual data and an integration would be helpful. Sometimes, I also feel like the user experience as a whole is a bit wonky. It is not always the most intuitive tool to use.

I have not really used other competitors, so I can't speak to this question.

Consider integrations with your HRIS and how that would work - how manual would your processes be? Ask yourself how open enrollment could benefit from this tool. Additionally, consider how employees would find the user experience. Consider which options you will utilize and how you will communicate about them. Also, talk to ADP about what their customer service setup will look like for your organization, what will the level of support be?

The e-verify feature has been a big one. It’s been great to have that functionality for our business.

I'd say a mid to large but imagine it is good for smaller organizations, too. Large-size organizations can benefit from having data in one place.

I am not sure smaller organizations could afford the tool and get the use they would need out of it.

Multiplier

Multiplier’s global payroll solution helps you process payroll in over 120 currencies. You can also use the platform to administer benefit plans, give bonuses and grant equity to employees, among many other things.

PROS

- Multiplier offers a comprehensive platform that combines compliance, payroll, onboarding, and timesheets, providing a streamlined solution for managing these aspects.

- The platform supports multi-currency payments in over 150 countries, facilitating global business operations.

- Instantly generated multi-lingual contracts enhance efficiency and convenience for users.

- Multi-currency payments in local currencies

- Multi-lingual contracts made instantly

- Compliance, payroll, onboarding, and timesheets, all in one platform

CONS

- Integration options are currently limited, with Multiplier only integrating with BambooHR, Workday, Personio, and HiBob for HCM-type tools. However, they are actively working on expanding their integrations.

- Customers have expressed a desire for more customization options, particularly in relation to contract clauses and leave types, to better align with their specific needs.

- Some users have reported experiencing slow response times from the customer support team.

- Limited integrations. As of Summer 2024, Multiplier only integrates with BambooHR, Personio, Workday, and HiBob for HCM-type tools, although they are working on adding more.

Multiplier’s self-service global payroll solution is worth checking out if you’re looking to pay employees and contractors in local currencies and in compliance with local laws in over 150 countries.

Through the platform, employees and contractors can submit invoices for completed work for you to review and approve within the agreed-upon frequency. Employees are also able to access their payslips and contracts and track expense requests, bonuses, and other benefits from their accounts, which is quite handy.

From the employer side (admin account), you’re able to track the attendance of your global workforce, approve leave requests, and review timesheets for more context into what invoices/billable time are for.

Besides global payments, you can do quite a bit through Multiplier’s EoR platform, including hiring and onboarding employees, as well as giving them local health insurance and optional benefits such as bonuses and stock options.

Amazon, Fusion, Graphisoft, ServiceNow, Linklaters, and Korn Ferry are a few of the companies that use Multiplier’s global employment solution.

Multiplier’s pricing depends on who you’re hiring and paying; employees or freelancers. You get to cancel anytime, and no credit card is required for initial sign-up.

Be aware that apart from the mentioned plans, the employee insurance package is priced seperately. The basic coverage plan starts at $20 per employee per month, and the pricing may vary depending on the level of additional coverage required. Furthermore, pricing may also differ based on the geographical location.

Moreover, Global Payroll is offered as a standalone product suitable for businesses regardless of whether they have local entities or not. The pricing for Global Payroll also begins at $20 per employee per month

Since 2024, Multiplier have expanded the HR offering of their tool to include a whole HRIS module.

Best For

Multiplier is a great bet for organizations expanding their global workforce across the Asia-Pacific landscape, even though their reach extends beyond this domain. The platform's attributes cater to startups, mid-sized enterprises, and large corporations. An illustration of this versatility lies in their adeptness at managing a diverse array of contracts. Whether it involves nurturing an on-demand workforce, administering fixed-term arrangements, or orchestrating full-time engagements, Multiplier can adeptly navigate these intricacies.

We use Multiplier as an EOR for employees in specific countries within APAC and EMEA where we do not have offices. Typically, there are 2-4 new hires monthly in these areas, and the company continues expanding into similar regions. We use Multiplier for onboarding and contracting new hires, tracking work hours, and ensuring that these employees are paid in compliance with local laws, including handling final payments at termination.

It saves a significant amount of time and money by eliminating the need to manage local compliance in new regions. It makes hiring and onboarding new hires easy, saving internal HR and payroll resources, with integration to BambooHR. We appreciate the ease of terminating employees with the assurance that it is handled in compliance with local laws, particularly with regard to final payments.

Our company has been scaling globally at a rapid pace over the past two years. We were hiring sales executives in regions within APAC and EMEA where we did not have an established presence. To quickly and efficiently hire and onboard new sales employees without setting up a business entity, we found Multiplier to be an effective EOR (Employer of Record) solution.

The support is sometimes lacking, especially with terminations that require timely action. The tool may be inaccessible depending on internet connection quality. It could benefit from additional data analytics features.

The ease of use and real-time dashboard/display are features our previous EOR provider did not offer. The overall presentation and user-friendliness are also superior.

If HR is recommending or purchasing this tool, it is crucial to meet with senior leadership to explain the cost in alignment with the company’s growth goals and compare it with other available options.

So far, we have not observed much evolution in the tool since we started using it.

Multiplier is ideal for companies experiencing rapid global growth and in need of a secure, efficient, and swift solution for hiring employees or contractors in regions without a business entity.

Multiplier may not suit organizations that do not need an EOR; other more comprehensive HR/payroll platforms may be more appropriate in these cases.

Oyster

Among several global payrolls in the market, Oyster stands out for being flexible enough to manage payroll in over 120 currencies while integrating features for expense reimbursement, time-off request, and bonuses.

PROS

- Oyster’s global payroll supports salary payouts in over 120 currencies.

- You can sign up to explore the platform, help docs, and HR tools, only paying when you hire someone.

- Provides transparent flat rates for employees and contractors and a tool that can quickly calculate potential costs and risks of hiring in a new country.

- Whether your employees are in one country or 100, Oyster can accommodate them accordingly, and this is a feature few platforms can boast of.

- Helpful customer support and help center. Thorough guidance on global employment (available for only the highest-priced plan, though).

- Intuitive: The platform is easy to navigate and makes logical sense.

- competitively priced: The flat rate for employees and contractors makes cost comparisons simple, and is competitive in the market.

- Targeted for a remote workforce: Whether your employees are in one country or 100, Oyster can accommodate them accordingly, and this is a feature few platforms can boast.

CONS

- There may be some salary delays in transfers.

- Only supports bank transfers for payments.

- Monthly pricing varies by where the employees are based.

- Slight delays in processing times for payments in the local currency are somewhat common.

- Immediate communication via phone support is not an option, but they do offer live support via Zoom when necessary.

- An initial security deposit is necessary to begin the engagement and is refundable.

- The platform lacks native time-tracking functionality and provides only an in-app tool for managing time off.

- If you’re looking to co-employ your employees and partially outsource HR responsibilities, Oyster isn’t for you. They are more akin to employer of record services (EOR) than a Professional Employer Organizations (PEO).

Among several options in the space, Oyster is flexible enough to manage payroll in multiple currencies and locations globally and has integrated features for expense reimbursement for traveling employees. Running payroll on Oyster was easy. We could process both employee and contractor payroll in one platform and choose the preferred currency and payroll frequency (monthly/bimonthly), depending on country payroll regulations. We’re also happy with its simplicity in managing tax withholding and accounting. While Oyster did well in ensuring employees working under different currencies are paid correctly and compliantly, we wished to see more withdrawal options in the platform rather than just bank transfers.

Oyster is one of a few vendors that can accommodate teams hiring people in over 180 countries. The platform also provides a self-service portal where employees can request time off and reimbursements. We liked that each time one submitted a request, we instantly saw it in Oyster’s admin dashboard, highlighted under the Requiring Attention section. Related tools like the cost calculator, global recruitment guides, and invoice management were placed right in the dashboard, making it easier to access and get the needed help.

Some of Oyster's customers are Juno, Demodesk, Chili Piper, Quora, Wagestream, Impala, and Grover.

Oyster has three pricing plans:

- Contractor: It starts at $29 per contractor per month and includes hiring contractors in 180+ countries, drafting, editing, signing compliant contracts, processing invoices, and paying contractors in 120+ currencies.

- Employee: The plan starts at $499 per employee per month when billed annually and includes features for hiring full-timers in 120+ countries with compliance and liability coverage, automation, IP protection, global payroll, expenses, allowances, and bonuses in 120+ countries.

- Scale: The plan has custom pricing and includes a discounted rate, dedicated client service, and support to navigate global employment and bulk hiring.

- Local benefits plans are provided as add-ons for Employee and Scale plans.

- You can create an account, explore the platform, and access Oyster’s HR tools and resources for free. You’ll only pay once you’ve engaged a team member.

- Discounts are available for nonprofits and businesses hiring refugees.

Their country offering always tends to expand, and the same can be said for their integrations with other software. While they started out fairly limited in the latter regard, they've been working hard to make their product able to talk to other HR tools. Some of the recent integrations include Slack, Greenhouse, Personio, Workday, Expensify, HiBob, Okta, BambooHR HRIS, NetSuite, and BambooHR's ATS.

Best For

Distributed teams whose current and future contractors, employees, or both are based in countries listed on Oyster’s 120+ country coverage. Nonprofits and businesses looking to hire refugees in countries where Oyster has local entities would also benefit from the platform’s special discounts.

Oyster is regularly used as part of our global HR operations, particularly when hiring and managing international team members. The platform plays a central role in our onboarding process by allowing us to issue compliant employment contracts and set up payroll across multiple countries.

We rely on Oyster to manage benefits, track time-off policies, and handle region-specific employment compliance requirements. It also provides valuable resources on global compliance laws, supporting a streamlined and compliant HR workflow. This has helped maintain a smooth experience for our international employees.

- I like Oyster because it simplifies global compliance by managing local employment laws, taxes, and benefits.

- The platform is intuitive for onboarding and managing international employees.

- Their support team is responsive and provides helpful resources for global hiring best practices.

Oyster was considered to streamline international hiring and manage global employment compliance efficiently. It enabled us to confidently hire talent in new markets without the need to set up local entities, saving significant time and reducing legal risk.

The platform makes it easy to onboard international team members, manage their contracts, and comply with local regulations. These benefits addressed our need for a scalable and compliant global hiring solution.

- The cost can be relatively high.

- The system is complex, requiring dedicated time with the onboarding specialist to ensure each feature is utilized effectively.

- Some features may take time to fully understand without hands-on guidance.

Oyster stands out from competitors like Rippling due to its strong focus on global compliance and user experience. Compared to other EOR platforms we’ve used, Oyster offers more transparent pricing and better country-specific insights.

Their support team is more responsive and knowledgeable about international employment regulations. I also value the localized benefits recommendations, which help us remain competitive in global hiring. Overall, Oyster acts more like a strategic partner than a standard service provider.

When buying a global employment tool like Oyster, it's important to assess its compliance capabilities—make sure the provider has expertise in local labor laws and tax requirements in your target countries. Customer support quality is also crucial; verify that the team is responsive and knowledgeable.

Look for pricing transparency to avoid unexpected costs. Finally, evaluate how quickly the provider can onboard employees in new regions, especially if your organization is scaling rapidly.

Oyster has evolved significantly to support the growing demands of a global workforce. They have expanded their country coverage and improved onboarding speed, making it easier to hire talent in more regions with reduced delays.

Oyster is well-suited for large organizations that frequently hire internationally.

Oyster may not be a good fit for small organizations that do minimal or no international hiring.

Rippling

Rippling stands out from other global payroll companies because it handles every aspect of the payment process. Very few global payroll companies directly administer all of the steps needed to pay employees across the globe.

PROS

- Nested within HRIS

- Hire, pay, and manage people under a single system of record

- All-in-one platform for employee management + PEO services offered, and even a suite of other IT products

- With 500 integrations, it’s very likely that they integrate with other key tools from your tech stack.

- Operates globally with any currency

- Workflow automation

- Analytics opportunities

- Provides a holistic view of company outflows—headcount costs included

CONS

- Not advisable for very small companies with slow growth

- While you can buy a base tier and add payroll, the real “magic” of this system requires total immersion in the Rippling environment

- Total buy-in to Rippling is essential

- Very SMB-oriented, in case you’re a larger company.

- New features tend to be buggy in ways that tech teams are not accustomed to fixing

Rippling went the extra mile on their global payroll product. They solved a business problem better and before anyone else in their weight class. At this point in their growth, they are agile enough to move quickly, but have just enough mass and inertia to put thousands of hours of labor into doing a complex thing right.

As we pointed out before, Rippling’s global payroll suite stands out from other global payroll companies because it handles every aspect of the payment process; from tracking hours to calculating and filing taxes. Very few global payroll companies directly administer these kinds of steps while also offering a full HRMS to plug it with.

With the exception of payroll titans like Workday, most businesses offering global payroll services are actually “aggregators” of other businesses– they arrange connections between an array of third-party vendors who are unified under one company name. This has some serious drawbacks. Like a game of telephone, a lot can be lost in translation as data is passed from one entity to another.

Built-in is better. This feature’s proximity to the HRIS means the integration process is simple. According to Rippling, it takes “about 90 seconds” to set up an employee for global payroll if you’re already using Rippling. Being built-in also results in seamless access across all dimensions of employee information.

Best For

We use Rippling for many different things, but some of the most important are payroll and benefits. If we didn't have Rippling, we would likely need to hire a full-time payroll person who could also manage benefits administration. Additionally, because we are so small, we likely wouldn't have great options for benefits whereas with Rippling we have more options.

It is very comprehensive, providing everything I need, which eliminates the need to connect multiple different platforms. Also, the site is clean, and it runs smoothly and quickly.

We use Rippling for a variety of functions including employee offer documents, onboarding, payroll, PTO, expense reimbursements, and benefits. Without it, we would need to hire several different people, which isn't feasible as we are a smaller company. It makes sense for us to use Rippling instead of hiring a large number of support staff.

There's nothing I really dislike about it; I feel like it gets everything I need done without any headaches.

With one of the companies I used in the past, it felt like I still needed many other tools and platforms to connect to it, whereas Rippling seems to have everything integrated already.

I think it depends on the cost-benefit for you. For us, as a small company, it makes sense to use Rippling rather than multiple different platforms and people. However, for a larger company, it might be more cost-effective to manage these processes in-house.

I haven't noticed any changes myself.

I think it's best for small to mid-size organizations that would benefit from having everything in one place with one provider.

Maybe a larger company, as they may have more economies of scale where the cost-benefit of using different platforms or hiring more support staff could be more beneficial to them.

G-P

G‑P helps companies hire, pay, and manage workers in 180+ countries without setting up entities, handling everything from EOR and contractor payments to payroll taxes and compliance. The G‑P Meridian platform and AI assistant G‑P Gia bring automation and clarity to cross-border employment, making it easier for teams to grow internationally with confidence.

PROS

- Centralized payroll, HR, and compliance in 180+ countries

- G‑P Gia automates contract creation and HR workflows

- Supports full-time employees, part-timers, and contractors

- Strong legal and regulatory coverage with in-house experts

- Scales well with mid-sized and enterprise teams

- Their G-P Meridian platform is heavily focused on the EOR space, but it’s offered in several plans that can cater to varying needs, even those that might only need to hire people as contractors.

- Using their tool also implies access to a team of HR and legal professionals with significant experience in each country they operate in.

- Their UX has evolved continuously and gotten more intuitive and modern each time we delve into the product.

CONS

- Contract editing requires the Meridian Prime plan

- Add-ons like IT support and equity management increase total cost

- No free trial; demo required to explore functionality

- Customizing a contract is only possible with the G-P Meridian Prime plan.

- Features like background checks, equity management, and IT equipment— to name a few— are only available as add-ons.

- There is no way to try out the software product unless you sign up for a demo and request a proposal.

G‑P (formerly Globalization Partners) is a global payroll and employment platform that enables businesses to hire and pay contractors, freelancers, or full-time employees in over 180 countries. The company pairs software with local HR, tax, and legal infrastructure, helping users stay compliant without the need to set up foreign subsidiaries.

Their G‑P Meridian platform covers everything from localized payroll to benefits, expense reimbursements, onboarding, and offboarding. G‑P Gia, their AI assistant, simplifies contract creation, country-specific labor law guidance, and employee inquiries. This makes G‑P particularly helpful for companies entering unfamiliar regions or scaling quickly across borders.

G‑P isn’t the lowest-cost provider and doesn’t offer a free trial, but its ability to cover nearly any employment model—EOR, contractors, or freelancers—within one platform makes it a strong choice for teams that prioritize compliance and scale.

Used by thousands of global companies, including Zoom and Zeeto.

Pricing is not publicly listed and depends on country, employee type, and service tier. A custom quote is provided after a demo.

Since our last review, G‑P has launched G‑P Gia, an AI assistant that supports hiring workflows, generates compliant contracts, and answers labor law questions. The G‑P Meridian platform also added expanded contractor support, expense tracking, and better visibility across multi-country payroll and HR tasks.

Best For

Teams hiring across multiple countries that need one platform for paying contractors, full-timers, and freelancers—without the complexity of local entity setup.

The primary use was payroll. We added the employee to the system under G-P legal entity in Canada, dictated how often they'd be paid and what their salary was, and G-P handled the rest, including benefit offerings. We also used the platform to process bonus payments, as we have a yearly bonus that is paid to all employees. Although G-P does offer other services, such as background checks, integrations, and reports, we did not use those features.

The breakdown of costs is easy to understand, as the pay slip provides the cost of wages, social fees and taxes, and the management fee. It is easy to add new employees to the solution, as the onboarding process is straightforward. The widespread coverage of G-P is very good, as they cover many countries, making setup easy.

We had a key member of our staff relocate to Canada, where we did not have a legal entity set up to pay them. We needed to continue to payroll this employee, provide benefits, and comply with Canadian employment laws. G-P was able to do this on our behalf for a reasonable price, and we did not have to manually process any payroll. They handled engaging our employee, paying them directly, and addressing any disputes raised by the employee or the government. We used them for just over a year.

Payroll is cumbersome, and there is no clear way to learn how to do it without trial and error. Adding something as simple as a bonus was unclear. Customer service is slow and unprofessional. Without a phone line, emergency situations are not resolved quickly, and their answers to questions are short and incomplete. The website is also hard to navigate, as you lose the navigation panel whenever you go into a module.

G-P is similar to other global payroll/HCM systems but is more cumbersome than the competition. The price isn't better to warrant this lack of intuitiveness either. They recently added a direct Advisor feature, which is very nice, but other competitors have had this feature for some time.

If you are doing business outside of your home country, you need to invest in an EOR/HCM system that is responsive and easy to navigate. It's hard enough to learn each country and their payroll/compliance laws. The partner you pick needs to be engaging and responsive. G-P is on the lower end of the responsiveness scale. I suggest increasing your budget for an EOR tool because of this, as cheaper is not always better.

Yes, they recently added an Advisor feature that will help streamline client issues moving forward.

It is suitable for businesses and HR admins that need to expand to other countries where they do not have a legal entity. Outside of that, G-P is not better than any other HCM service.

If you are looking for a payroll solution or an HCM solution to support your legal entity in a country you operate in, there are far better options than G-P.

Lano

Lano is a B2B and B2C platform. Businesses can use it to process global payroll, hire remote talent, and manage contractors, while employees and freelancers can benefit from its payslip service, invoicing app, multi-currency wallet, and more.

PROS

- Collaborates with local payroll experts for compliance and reliability.

- Offers flexibility by integrating with existing payroll and HR systems but can also be used as a stand-alone.

- The platform provides real-time insights and reporting to enhance data-driven decision-making.

- Users have also praised the personalized customer support with a single point of contact for issue resolution.

- Collaborates with local payroll experts for compliance and reliability.

- Offers flexibility by integrating with existing payroll and HR systems but can also be used as a stand-alone.

- The platform provides real-time insights and reporting to enhance data-driven decision-making.

- Users have also praised the personalized customer support with a single point of contact for issue resolution.

CONS

- Lano is not ideal for small businesses with less than 50 employees and three locations; and more straightforward payroll needs, as opposed to a focus on automation.

- No mobile app, limiting accessibility for on-the-go users.

- Lano is not ideal for small businesses with less than 50 employees and three locations; and more straightforward payroll needs, as opposed to a focus on automation.

- No mobile app, limiting accessibility for on-the-go users.

Lano is a cloud-based platform offering comprehensive global payroll and workforce management solutions. Designed for medium-to-large international companies, Lano simplifies hiring, onboarding, and payroll processing across 150+ countries and 50+ currencies. By working with a vetted network of local payroll experts, Lano ensures precise, compliant payroll tailored to each region.

The platform’s Global Payroll Consolidation Tool centralizes data, reduces errors with automated audits, and enhances visibility through real-time reporting. Businesses can make data-driven decisions while streamlining payroll operations. Recent updates include a redesigned user interface and advanced automation features to improve efficiency for payroll and HR teams. Additionally, Lano integrates seamlessly with HRIS and ERP systems like Workday, SAP SuccessFactors, and Personio, further supporting flexible payroll management.

However, Lano’s extensive capabilities may be excessive for small businesses with straightforward payroll needs. Additionally, the absence of a mobile app limits accessibility for users requiring on-the-go solutions.

Lano serves a variety of industries and notable clients, including Preply, Phrase, PrestaShop, and Ironhack.

Lano offers flexible pricing tailored to specific needs:

- Contractor Management: €20/contractor/month

- Employer of Record: €600/employee/month

- Multi-Country Payroll: €30/employee/month (minimum 5 employees)

- Payroll Consolidation: €3/employee/month (minimum 100 employees)

A free trial for the Payroll Consolidation feature is available.

That being said, SSR Readers can get an exclusive discount.

Lano has introduced enhanced automation features, real-time payroll reporting, and a redesigned user interface. These updates address common challenges like payroll errors and lack of visibility while improving user experience. New workforce management tools now allow businesses to manage onboarding, contracts, benefits, and payroll changes within a single platform.

Best For

Medium to large international companies based in EMEA with complex payroll and workforce management needs.

WorkDay

Workday is a popular HR software that includes payroll functionality. It focuses on enterprise needs and offers international payroll solutions for the US, Canada, the UK, and France.

PROS

- Ability to make changes and update payroll in real time.

- Customizable automated calculation engine streamlines payroll processing.

- Provides audits for compliance and payroll accuracy.

- Employee self-service to pay slips, W-2s, W-4s, and payment elections.

- Offers pay on-demand.

- Automatic tax updates

- Support mergers and acquisitions (M&A).

- Accessible customer support from the community, live chat, and telephone.

- Compatible with 300 HR systems such as ERP/GL, CRM, HR, and PSA.

- Configurable dashboard with AI and ML-driven insights.

- Ability to maintain real-time alignment of budgets and workforce plans.

- SOC 2 Type 2 compliance.

CONS

- Enterprise-focus; not a great choice for smaller businesses.

- Time-consuming and complicated setup process.

- No free trial. Undisclosed pricing.

- Mobile app lacks stability and user-friendliness.

- Undisclosed pricing.

- No free trial for its talent management software.

- Time-consuming implementation period (average 4.5 months).

- Challenge navigating for first-time users may require training.

- Issues with logging in were reported by users.

Workday's payroll software is scalable, highly secure, and great for enterprise companies. However, user reviews on the mobile app and implementation vary. It covers the US, Canada, the UK, and France and integrates with Activpayroll for 140+ country coverage.

Workday's payroll software excels on the tech front. It ensures accurate deductions and tax information through automatic updates and audits. It offers flexibility with multiple pay cycles based on employee groups and supports workers' financial well-being by providing a pay-on-demand option for accessing accumulated wages before the scheduled payday.

Workday's mobile app offers customizable dashboards with access to payslips, time off, and time tracking. However, user feedback suggests that it lacks ease of use, with reports of app glitches and logging-in issues.

While Workday boasts impressive scalability and valuable HR features for large enterprises and global companies, it may not be ideal if your company is looking for a simple setup and a super-intuitive mobile app.

Quicken Loans, AstraZeneca, Target, Dell, Bank of America.

The exact pricing details of Workday are undisclosed. Contact Workday’s team for a quote.

Best For

Large enterprises looking for a global payroll solution within a broader HCM suite.

I used it for recruiting, internal mobility, onboarding, and reporting. It was an excellent tool for internal mobility because it gave visibility into information like compensation, leveling, and performance reviews. This helped ensure that candidates had eligibility to apply to roles internally. The onboarding workflow was also very straightforward and configuring the to-do tasks was easy. Reporting took a little bit of time to learn and I would recommend taking the Learn Workday course if you have no experience with it because you will learn Workday's logic.

The ATS portion of Workday is a struggle. It is difficult to schedule candidates and build structured interviews.

Pros:

- The information you can get access to is extremely helpful

- The UI/UX is very clean

- All-in-one type solution

Workday was selected because it offered a comprehensive people solution. Instead of having different portals for compensation, performance management, recruiting, and people analytics, Workday allowed everything to live in one system of record. This reduced costs and ramp time in some ways because it allowed everyone to be in one place.

I've used it for a combined 2-2.5 years in my career in all facets from selection to design and then every day use for reporting and recruiting.

Cons:

- The Recruiting module for recruiters and recruiting coordinators is not intuitive and user friendly

- The Recruiting module for candidates is lengthy and miserable. It does a terrible job of parsing resumes

- Job management versus position management makes data funky in some instances (for example, if you were hired into a position, it can look like you hired your whole team unless you put in specific calculated fields)

- If you don't have the right access controls, it is borderline impossible to do your job effectively.

The Workday Recruiting Module (their ATS) is one of the most reviled in the Recruiting space. It doesn't compare well to other ATS like Greenhouse, Lever, or Ashby because the latter offers better functionality, controls, and ease of use.

- Ease of use. Workday has the ability to be so much but you have to know exactly what to look for and how to configure it.

- Implementation time. Workday requires a focused implementation and testing period. Without it, you will run into a number of problems. If you need to roll out something quickly, Workday isn't the tool for you.

It is difficult to tell because they release big updates every 6 months so requests for solutions might be forgotten by that point.

HR Business Partners, HR Operations, Finance, Compensation, and C-Suite

Recruiting, Analytics, Interviewers, Candidates

.jpeg)

Atlas HXM

.jpeg)

Atlas is an EOR and HR services-focused global payroll provider. They work well for teams of all sizes and offer a good combination of in-house expertise and a functional tech platform.

PROS

- Hire people through direct EOR entities in 160+ countries.

- They are a services-focused company with the tech to back it. For example, with the help of a locally-versed expert to guide you through the process, you can onboard employees and process their payroll in any of the 160+ countries they cover – and it can all be done online.

- Strong focus on compliance: regulations, taxes, local labor laws, etc.

- Atlas has legal entities in over 160 countries. They’ll help you take care of employee onboarding and payroll processing in any of those countries, eliminating the need to engage any local service providers.

- The platform simplifies how you hire, manage and pay employees and contractors abroad, without needing to set up an operation where they are located.

- Atlas helps you stay compliant with local labor laws and frees you from employer liability.

CONS

- Some users noted communication with support can be tricky. An individual expert (or one representing a small team) may be involved in addressing compliance issues specific to a geographic region. Though this has been reported to slow the process, our reviews suggest ongoing improvements.

- No native integrations, but they do have API

- Atlas currently doesn’t offer global managed payroll for non-employer of record (EoR) clients; so if your company doesn't need Atlas to take on from you as EoR, but need to use Atlas' global payroll services, you can't do so at this time. Do note though that the team at Atlas is planning to offer this service next year.

- Atlas currently has limited prebuilt integration modules but they do offer API access for users to plug in third-party tools.

Atlas is a comprehensive global payroll and direct employer of record (EOR) solution that empowers businesses to hire and compensate talent across the globe effortlessly. We’ve seen a demo of Atlas and tried the tool, finding them a solid company to entrust with your legal employer responsibilities.

What does this mean? We found that Atlas can dependably manage most of the operations aspects of the employee life cycle, for several employees, in several countries, from a single platform.

Atlas is used by over a thousand companies, including Toyota, CACI, Bath & Body Works, Coupa, PAE, and Namely.

- Essential: For $99 per month, this plan encompasses features and services that help users navigate the labor & employment laws in over 160 countries (+50 US States), manage employee lifecycle, compliance information between countries, be compliant with their accounting for travel and business expenses, receive personalized notifications, as well as have moderate access to expert insights and HR templates (which are priced separately).

- Premium: For $149 per month, this plan packs everything in the Essentials plan, plus compliance audit interactive checks, people analytics and planning features as well as dedicated account management.

- Enterprise: The pricing of this plan varies according to the number of purchased licenses and customer needs. You can reach out to Atlas’ Sales team for a custom price quote.

Add-ons:

- Contractor Pay: Starting at $49 per contractor per month

- Employer of Record: $595 per employee per month

- Visa & Mobility Sponsorship: Starting at $2,500 per visa

Best For

Companies of all sizes would find an ally in Atlas, but it’s especially good for those looking for a service-oriented offering rather than a DIY, employee-driven, self-service platform.

We used Atlas HXM as our Employer of Record (EOR). It was used as a payroll and global HR database for records. Atlas was our company's legal employer. Atlas acted as a liaison for our HR department, connecting and assisting us with global compliance questions and needs. It is compliance-focused.

I liked the reliable customer-centric focus of the Atlas team. I could count on their compliance and global regulatory guidance. I liked the cost-benefit.

We used Atlas HXM for three years. My company had cross-border employees, both inside and outside of the US. A pain point for them was maintaining one database, one source of truth for their employee records, and needing the flexibility to hire people quickly in new global regions. The key benefit of Atlas was that they were the employer of record, which was better than a PEO, saving me a lot of time setting up employer and other tax-related accounts. It is a good system and an alternative to the big players who are only interested in the bottom line. Customer-focused system.

It lacks flexibility in customized functionality. They could improve their customer support response time (but it wasn't bad considering the time zone differential). They could reduce costs or provide more incentives for smaller businesses or startups.

I have used many similar tools. Atlas HXM is truly a global provider! From Western to Eastern Europe, they are everywhere! I preferred this system over others because I could rely on them consistently in areas of global rules and regulations I was unfamiliar with.

Are you in need of a global employer of record for your business? How many countries do you have employees in? Do you struggle to keep current with global compliance at your company?

I haven't seen many changes, but since they are small, I assume evolution will happen quickly.

Global entities with cross-border employees.

An organization not wanting an EOR.

Papaya Global

Papaya Global made our list of best global payroll software providers for enabling distributed teams to legally auto-pay contractors and employees in 160+ countries while making sure their data is protected by leading security and compliance software.

PROS

- Papaya’s full-service payroll guaranteed payouts in 72 hours in over 160 countries.

- It has a straightforward pricing system with a 60-day money-back guarantee if you are unsatisfied with the platform’s performance.

- Offers a dedicated customer success manager or global payroll expert in your time zone who assists you in the local timezone and language. You also get access to their in-house specialists on global employment in 160 countries without extra fees.

- The latest starter monthly fee for the full-service payroll plan has dropped to $12 per employee (the previous one was $20).

- Provides four individual solutions (data and insights, supplemental benefits & immigration support, payment services, and employee data management) at an affordable starter price.

- Papaya Global packs the EOR services you need to do global payroll and employment compliantly in over 160 countries.

- Automated payments in over 100 currencies, 80 of them directly to the worker's bank account through its global banking partners.

- Dedicated customer support providing locations-specific knowledge regarding employment and payroll.

- End-to-end payroll guaranteed payouts in 72 hours.

- Offers four standalone solutions: data and insights, supplemental benefits & immigration support, payment services, and employee data management, making the platform more affordable and scalable.

CONS

- Lacks local entities in the countries where it sells services. We found no information regarding its tax penalty guarantee either.

- Doesn’t offer a free trial or free plan.

- There are a few additional fees, including a set-up fee per location, an onboarding fee, a cycle fee per employee, and a year-end fee for tax filing. There’s also a required deposit (refundable).

- There aren’t many existing integrations, but you can use the platform’s pre-built APIs, SFTP, and custom API integrations for free.

- No free trial or free plan.

- Doesn’t own entities in all the countries it serves. The platform forms relationships with existing local in-country partners to handle employment in a specific region on the client’s behalf.

- BI analytics reports and global immigration services cost additional fees.

- Charges extra fees for setup, onboarding, employee cycle, and tax filing. Also requires a refundable deposit.

- Built-in integration options aren’t very robust. However, the platform does offer pre-built APIs, SFTP, and custom API integrations for free.

Papaya Global is loved by several users we have talked to and also by our editorial team. It is one of a few vendors that provide a straightforward pricing point (no one likes hidden fee surprises!), a solid set of HR tools, robust BI analytics reporting, and in-country customer support.

We appreciate how the platform has kept both employers and staff in mind when developing its HR tools. As an employer, Papaya Global gives you access to payroll, payments, and workforce analytics in one unified platform. The global payroll software provides automated payments in local currency, country-tailored benefit packages, pay slips in the languages of employees across over 160 countries, and AI-based engines to audit invoices for payment accuracy. Papaya Global backs you with in-house benefits experts who advise you on the soundest plans for specific locations without costing you extra. As an employee, there is a self-service portal you can easily access and navigate through. You can find onboarding documents there, request time off, check your docs, and review payslips. The newly launched mobile app (February 2023) will soon allow you to do these things, plus access payment calendars, bank details, and company announcements on the go.

Papaya Global’s global equity management is another thing that sets it apart from other payroll software. With this tool, you can offer equity to employees as part of their compensation, regardless of their location. As we mentioned earlier, the platform does a great job of providing advanced analytics reporting. By "advanced," we mean that you can access dynamic and visual insights into not just payroll, but also HR, billing, and admin data.

However, there are a few things you should keep in mind when considering Papaya Global as your global payroll software. First and foremost, Papaya Global does not own any local entity where it provides services. The platform relies entirely on its third-party local partners. While its pricing is transparent, there are additional costs besides the plan’s price, including a set-up fee per location, onboarding fee, cycle fee per employee, year-end fee for tax filing, and refundable deposit. It is worth getting in touch with Papaya Global’s team to get a full quote for your specific requirements to evaluate the platform further.

Microsoft, Intel, Toyota, Wix, Fiverr, Johnson & Johnson, Deezer

Papaya Global has just added four standalone services to its offerings besides the three plans:

- Full-Service Payroll service: It starts from $20 per employee per month, depending on your operation. It includes its advanced payroll platform, embedded payments, global partner network, and employee portal.

- Payroll Platform License service: Starting from $20 per employee per location, it is for businesses that need to upgrade their payroll and payments tech without replacing the current payroll partners.

- Data and Insights Platform License service: Starting from $150 per employee per month, it includes tools for real-time analytics on payroll costs and headcount.

- Payments-as-a-Service service: Starting from $3 per employee per month, it provides an embedded platform designed for workforce payment.

- Global EOR plan: This plan is between $770 and $1000 per employee per month and lets you manage all your EOR locations on one platform.

- Contractor Management & IC Compliance plan: Particular services are outsourced to a domestic or foreign contractor for periods of rapid growth and the need to reduce labor costs. This plan starts at $25 per employee per pay cycle.

- Payroll Intelligence Suite plan: This plan lets you consolidate all workforce and payroll data from all your operations into a single dashboard, priced at $250 for an annual plan or $320 quarterly per location.

Best For

Those that want to automate global payroll in countries where they have entities can benefit from Papaya Global. The platform is also a go-to payroll software for businesses whose international hires (employees, contractors) are based within Papaya Global’s country coverage.

We used it on a continuous basis. We had some weekly and monthly payroll, so it was used throughout the month. We mainly used the Global Payroll Plus service and the Employer of Record service. We also used the contractor payment service for contractors in specific locations when we needed a more flexible resource. Additionally, we used the Global Payments solution for paying expenses and suppliers.

Pricing flexibility was great and affordable for smaller enterprises. The representatives and customer service staff were very knowledgeable and experienced, offering excellent guidance and a can-do attitude, which was very welcome as we had become bogged down in red tape. We liked that there were very relevant add-on services that could be used on an ad-hoc basis.

We bought Papaya Global because we were expanding internationally. Our business meant that we had small offices and remote workers in many countries. It was time-consuming and error-prone to individually pay staff in so many countries. We needed a tool that could centralize global payroll and pay multiple international staff seamlessly and effortlessly, and Papaya Global did this. I used it for about a year.

It would have been good if they had a solution for 50 to 100 employees. We had to take the minimum 100-employee tariff even though we initially had fewer than 100 employees. Reporting could be improved; I found that the invoices were a little low on detail. It is a bit more expensive than the competition.

I have used other similar tools, and while a little more expensive, I found that this one has better global coverage and a more comprehensive service offering.

Consider global coverage, e.g., what countries they serve and if they have a depth of knowledge and expertise. Ensure it has a good and efficient global payroll service at its core, but also has the appropriate add-on services (like EOR, global payments, contractor payments) so you can quickly adapt to changing business circumstances.

I think the library and knowledge base have grown substantially, providing more on-demand information and advice about global payments.

Papaya Global is good for any international organization with employees in multiple countries.

Papaya Global is not a good fit for an organization with 50 or fewer employees in just one country. This product might be overkill.

Why Use Global Payroll Software

International payroll is necessary when businesses of any size want to pay people abroad while staying fully compliant in each country. It’s not just about being able to process payments internationally but about being able to hire international workers and run payroll as if you had a registered company in each of the nations that at least one of your hires calls home.

One could argue that you could do just that by having a payroll provider or a PEO/EOR in each country. However, global payroll systems take it to the next level. These tools help you avoid the extra costs and logistical headaches of having multiple providers. This can be especially challenging when you need a central repository from where to manage them all, and the data inherent to payroll processing is scattered across various systems.

A basic example of the simplicity of using global payroll services is that, at least with the ones we’ve mentioned here, you’re assumed to pay each worker in their local currency. They can literally decide this with a couple of clicks.

This ease of localization extends beyond salary as well. Some of these tools can provide all the employee benefits required by law in each individual’s country as if they worked for a local company. Depending on the payroll software vendor, these can include social security, benefits insurance, retirement funds, disability, and more. It also means that taxes are handled for them using the same tool. This is what global payroll systems mean when they tout full compliance.

Key Considerations & Pitfalls of Multi-Country Payroll

Certain considerations must be made before assuming that the right global payroll providers will do the heavy lifting for you, ensure your people are paid on time, and present everything in a user-friendly way.

- Knowing Local Laws: Just because the global payroll services provider will be doing part of the work for you doesn’t mean you shouldn’t be aware of what that work is. Like with any good manager, delegating doesn’t mean ignoring. As an employer, you must adhere to the international HR and regulations in each country where you’ll pay someone. This not only helps with making sure that you’re staying compliant but also aids when creating a budget, deciding whether to hire someone, shifting from contractor status to full-time, etc.

- Know Your Costs: Fees for some of these global payroll systems may seem high compared to payroll software for small businesses or even some enterprise payroll software solutions. It helps to try and calculate how much you’d spend if you choose to go with individual providers in each country or even set up an operation there and handle it in-house. That should help determine how much is reasonable to spend on the project instead of trying to find the lowest-cost provider. Among these costs, you should also consider the fines you would incur if you stay non-compliant or even the potential cost of churn if your employees and/or contractors leave you for not providing the full range of benefits.

- Loading The Project Mainly into HR: Traditionally, human resources departments tend to have little time, lots of work, and few idle hands. Looking to them to solve the puzzle of international payroll and stick to a budget is one way of ensuring that the project’s outcome will be subpar. Some key payroll software features to look towards are payroll automation and tax filing, as they help free up some of HR’s time while keeping them in the loop. Also, choosing said solution should be taken into the hands of the finance team and upper management since it is, after all, an investment.

- Be Mindful of Data Protection: Data protection laws, especially GDPR, should be one of your concerns if you hire people in new markets. When trusting a software company with your employees’ data, you should know which laws are being obeyed when it comes to said data’s safekeeping. You should also know what kind of practices are put into keeping it safe beyond the legal requirements.

The Evolution of Global Payroll Technology: Current Innovations and Future Directions

While already somewhat novel, global payroll technology is always undergoing profound transformations, driven by cutting-edge innovations and evolving workforce expectations. This analysis examines the key developments that are reshaping how organizations manage international compensation.

- Artificial Intelligence: These intelligent systems now handle complex processes automatically— from calculating precise salary and tax payments to maintaining compliance with diverse regional filing requirements. Some platforms like Borderless, an EOR product and service, have opted for implementing a chat-based agent, which you can consult on the tax implications of employing an individual in a new location; the way you’d ask a seasoned expert.

- Financial Flexibility Through Earned Wage Access: The integration of Earned Wage Access (EWA) represents a significant shift toward employee-centric payroll solutions. This innovative approach allows workers to access their earned compensation before traditional payday cycles, addressing immediate financial needs and improving overall financial wellness.

- Global Payroll Meets Global HR: Given that 94% of business leaders worldwide agree that they would like to see their payroll software integrated across all their HR systems, companies Deel and Remote are incorporating HR workflows into their suite. In a move likely ignited by Rippling’s 2022 incursion into the space with their EOR offering, HR departments have likely figured that if they’re employing people internationally, it also makes sense to handle their HR processes within the same tool. Deel, for example, has had a sturdy HRIS for a couple of years now. Naturally, they are not alone in adding more features to it with each quarter, like onboarding, time management, org charts, and expense tracking.

Pricing: What Global Payroll Systems Cost

Most multinational payroll providers charge a fee per full-time employee and a smaller fee for contractors. Many providers will give you a custom quote if you ask for a demo, but not every vendor discloses its initial pricing scheme online. For reference, check out the following payroll software pricing list:

- Atlas: The Essential plan starts at $99 per month, then $149 for Premium or custom for Enterprise.

- Papaya Global: Starts at a $20-$100 fee per employee per month for the basic payroll. Global EOR starts at $770 and Contractor Management from $25 per pay cycle.

- Deel: Pricing is per worker per month. Contractors start at $49 and full-time employees hired with an EOR start at $500.

- Remote: Pricing for employees starts at $299 per month and they offer custom quotes after that. To hire contractors, you only pay the payment processing fees.

- Oyster: First two contractors are free, then $29 per month. EOR for full-time employees is $399 or $699 per employee per month.

- Multiplier: $400 per month to hire employees, $40 per month for freelancers.

- Rippling: Starts at $8 per user per month, but varies depending on the amount of modules.

- TFY: ATS and FMS are priced separately. The FMS is $5 per team member.

Key Components of Global Payroll Software

When we speak about global payroll, it means much more than paying people internationally, likely with a money transfer company, and using a different system to manage and onboard them. In the full sense of the term, global payroll systems should let you do all this while offering the following services or payroll models:

Global Employment Services

This is when you don’t own a business entity where your remote employees live, so you can set up a legal entity in the country or use employer of record companies to employ workers on your behalf. This is essential if you intend to hire people full-time in a country and don’t plan on opening a new branch where they live. Precisely because of that, it’s an excellent way to go if you plan on hiring as little as one person or a bigger team.