The 12 Best Payroll Software for Small Businesses of 2026

We’ve carefully demoed and tested dozens of payroll systems to arrive at this selection of the best payroll software for small businesses. See below for expert insight, pricing info, pros & cons, integrations, and more.

Small business payroll software automates, organizes, and optimizes payroll processing tasks for SMEs who don’t enjoy the luxury of limitless budgets and copious capacity. Selecting the correct tool for the task can quite literally make or break a small business, so it’s crucial you know what to look for when making a decision.

We have collated evidence and insight from multiple sources including demos, interviews, and user questionnaires to provide you with the best possible buyer’s guide for small business software below. We have been writing about these tools for years, so we know what makes one platform stand out from the rest.

We considered numerous factors when whittling down our list of small business payroll software tools to the select few featured in this guide, chief among which are automation capabilities, compliance features, and price.

- Payroll Automation: One of the primary considerations for any small business looking for payroll software is reliably automating tasks. We prioritized the tools with the most advanced features here, which translates to saving more hours each payroll cycle.

- Compliance: Then there’s the question of peace of mind. You want to know that the system helps you remain compliant and avoid fines. The companies we chose all do an excellent job when it comes to helping small business owners adhere to all regulations regarding payroll.

- Pricing: Lastly, we know that price is a significant consideration for most small businesses. We picked tools that would adapt to all kinds of budgets and situations. This ranges from tools that are good for solopreneurs paying contractors to premium plans designed for larger headcounts but that still won’t break the bank.

To learn more about our process for evaluating software companies, read this blog on how we select the best HR tech.

Paylocity

Paylocity earned its spot on our list for small business payroll software due to its blend of automation, configurability, and integrated HR tools. For small businesses aiming to scale, this unified approach delivers efficiency gains that many entry-level payroll tools don’t usually offer. In other words, you get an enterprise-level feature set that’ll grow with you, but with SMB-oriented pricing.

PROS

- Streamlined payroll automation with smart defaults and custom filtering.

- Employee self-service portal for pay stubs, direct deposit, tax info, and PTO requests.

- Robust reporting suite with 500+ templates and dynamic custom reports.

- Performance, onboarding, and recruiting tools are built into the same platform.

- Mobile-friendly experience for time tracking, onboarding, and task completion.

- Marketplace of prebuilt integrations with QuickBooks, NetSuite, Acumatica, and more.

- Paylocity’s customer support is highly rated for always being available to answer questions.

- Global payroll support for 100+ countries.

- Provides free and unlimited training modules on the website.

- Paylocity’s mobile app has a good UI and functionality

- The tool is easy to use for both employees and employers.

- Has 350+ pre-built integrations.

CONS

- Pricing is not publicly available, and you usually only get a quote after a demo

- The feature set may be excessive for very small teams (<10 employees).

- Reports can be complex to configure without initial training.

- Undisclosed pricing.

- It doesn’t have a free trial or free plan.

- Support is available in English only.

- It isn’t the best solution for remote teams looking for a tool to manage payroll and benefits for their contractors.

Paylocity made the cut for our SMB payroll page thanks to their purpose-built functionalities that bundle an enterprise-grade HRMS into a small business's one-stop tool. Beyond payroll, it includes an applicant tracking system, mobile onboarding, electronic document signing, performance management, and even asset and access management. These HR workflows are all part of a unified employee dashboard that’s accessible via desktop or mobile, which gives employees the power to self-manage everything from PTO requests to updating tax withholdings.

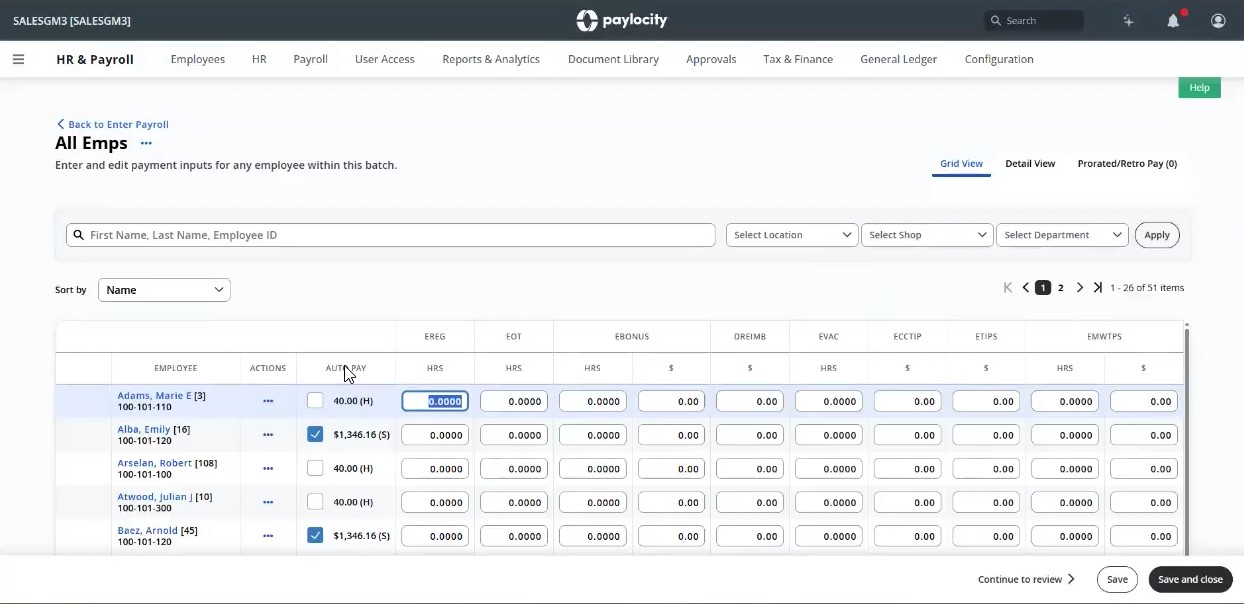

As we dove deeper into each feature via a recent demo with their SMB team, what immediately stood out was how easy it was to run payroll in a batch view with pre-filled salary, deduction, and benefits data pulled from integrated systems. We could make one-off adjustments, filter by department or pay group, which could be particularly helpful, for example, to isolate hourly employees or run a bonus batch for managers. There’s even support for nuanced edge cases like manual tax withholding edits, which we found simple to apply in real time.

From user interviews, we’ve heard lots of good words about Paylocity’s automation, so we had high hopes when testing this feature out. And thankfully, it lived up to our expectations. Recurring earnings and time data sync automatically, and it’s not an exaggeration to say reports are time-savers, given how convenient it allows HR to receive reports at the interval of their choice, securely stored within the platform.

That being said, it’s not the right choice for every small business. A 5-person startup, for example, may find the system more robust than they need. We’re also not fans of the fact that the pricing is undisclosed. Unlike many competitors, such as Deel, Gusto, OnPay, and Paychex, which typically list their rates openly, Paylocity tends to keep its pricing hidden behind a sales demo. While this approach isn’t necessarily a bad thing, it's definitely not what most small businesses prefer.

As a final note, Paylocity is also well-equipped to handle payroll for international contractors or even full-time employees, thanks to its acquisition of Blue Marble back in 2021. They can help SMBs run payroll in the US and in over 150 countries, all within the same platform.

Paylocity is used by 40,000+ companies, including POLYWOOD, The Kennedy Group, and Hathaway Brown School.

Paylocity pricing is custom and based on employee count and feature selection. A demo is required to receive a quote.

Paylocity has added several 2025 updates that significantly improve compliance, integrations, and reporting:

- New general ledger integrations with QuickBooks Online, NetSuite, and Acumatica now allow native, real-time syncing of payroll data with your accounting tools. The setup also includes a step-by-step mapping tool and real-time error checks, so you can catch issues before they affect your books.

- Custom journal entry logic allows you to automatically generate accounting entries based on employee details, including department, location, or job type. This helps customize financial tracking without requiring manual calculations each time payroll is processed.

- Reporting has also improved. New templates group earnings, taxes, and deductions into cleaner summaries, while a company-wide tax report consolidates historical and current data for faster audits.

Best For

Paylocity is best suited for U.S.-based small and midsize businesses with 20-500 employees that want to unify payroll and HR workflows in one platform.

We use Paylocity for various purposes, such as payroll, onboarding, and managing employees' work hours and wages. Our payroll processing is done weekly. Each week, we review the hours reported by our employees in Paylocity to ensure that the final payment is accurate and make any necessary adjustments for deductions, such as child support, health insurance, paid time off, or pending payments.

The onboarding module is used once or twice per week, depending on the number of new employees. With the module, you can add an employee's basic information, employee earnings, PTO, deductions, and simultaneously send a candidate a link to access the Paylocity platform, where they can review and sign necessary documents such as policies, NDA, and handbooks. This helps us streamline the onboarding process, ensuring that new employees have all the required documents and knowledge for their first day of work.

- Their customer service is quick and easy to reach.

- You can integrate modules and customize them according to the company's needs.

- The payroll module integrates with the workforce time management module, allowing employees to clock in and out and generating reports for payments.

- They keep you informed about changes in federal and state employee laws, especially those related to taxes and changes that may affect your company's payroll.

We are a growing company and can no longer manage payroll manually. In 2020, we started using Paylocity. It has greatly improved the time it takes to process payroll and the accuracy of the payments, particularly for our hourly employees. Additionally, our onboarding was done manually. We spent a lot of time sending emails, attaching documents, and transcribing applicants' information into our system. This task could take a full day and did not allow the HR team to focus on other tasks.

To address this problem, the company decided to purchase the onboarding module. It helped us automate the process and save time. Now, on one platform, employees can authenticate, sign, and submit documents, as well as input their information. This has reduced the need for printing and handling physical documents. I have used Paylocity for the past four years, and I believe it is an excellent tool worth the investment.

- The platform is challenging to navigate.

- You still need to add information manually to the payroll, such as holiday pay.

- The employee clock-in and clock-out system sometimes freezes or stops working without reason, requiring a reinstallation of the app.

I have worked with several tools, most of which are similar, but the workforce time management module stands out. It effectively tracks employee hours worked daily and is simple to use. It also integrates seamlessly with the payroll module, offering an advantage that no other HR system provides.

If you are looking for an efficient HR system that you can customize according to the organization's needs, Paylocity is a great tool. Also, if you are looking for payroll software but know that you will need performance appraisal or another HR process in the future, Paylocity allows you to acquire and integrate more modules.

Paylocity continuously changes to offer a better experience to its customers, especially HR departments. When I started working with them, some processes were still manual, but over time, they improved and automated these processes, saving us time that we can now invest in other tasks.

Paylocity is a valuable tool for companies with hourly workers as it allows for easy tracking and control of their time.

Paylocity is an excellent tool for any organization. It is important to define the company's priorities to understand which modules are correct for the organization.

.png)

Deel

.png)

Deel offers an intuitive and highly automated solution which we found particularly useful for international teams, big and small. Its ability to simplify payroll across 100+ countries while ensuring compliance, combined with a free HRIS makes it a strong option for small businesses managing global talent.

PROS

- Payroll automation supports payments in over 200 currencies.

- 15+ payment options including bank transfers, Wise, PayPal, and cryptocurrency.

- Strong compliance support with 2,000 in-house legal, tax, and payroll experts.

- Competitive pricing for salaried employees.

- Excellent 24/7 customer service with fast onboarding (2-3 days) and local payroll experts in each jurisdiction.

- Seamless integration with platforms like QuickBooks, BambooHR, and Greenhouse, plus custom integration options.

- User-friendly, self-service features enable quick setup; identity verification often takes under 24 hours.

- Automated invoices simplify payments, provided they're in English.

CONS

- No free trial available.

- Pricing for contractors is slightly higher than some competitors.

- Key features like onboarding automation come as add-ons.

- Key features like onboarding automation are add-ons, which may increase costs.

- Limited flexibility in modifying contracts or service agreements; changes often require an addendum.

- Invoices cannot be generated in languages other than English.

We picked Deel’s payroll because it’s easy to use, offers a variety of payment options, and provides strong compliance support.

The payroll automation immediately caught our eye during testing. Running payroll across multiple countries is as simple as a few clicks, and we can pay both employees and contractors in over 200 currencies. Furthermore, with so many payment options, including bank transfers, Wise, PayPal, Payoneer, and even cryptocurrency, it feels like Deel has thought of every possible way to ensure employees and contractors get paid efficiently.

One of our favorite features is the Deel Card, which allows global contractors to receive payments in USD and use the funds directly without the hassle of currency conversions—something we believe most, if not all, distributed teams will appreciate.

Beyond ease of use, Deel’s built-in compliance support is also well executed. As a 14-person startup, we understand that many small businesses don’t have an in-house legal or tax team, so knowing that Deel has over 200 experts ensuring compliance in more than 100 countries does provide great peace of mind. There is also a Shield module for those needing extra protection against compliance risks. However, we did find that modifying contracts wasn’t as flexible as we wanted—any changes require an addendum, which could mean additional administrative work for HR.

When it comes to pricing, Deel is priced from $24 to $29 per employee per month for global or US, which is quite reasonable. However, its employment and payroll offerings—for example, contractor payroll charging $49 per contractor per month—are somewhat steeper than competitors like Papaya Global ($30 per contractor per month) and Oyster ($29 per contractor per month). We also noticed that some key features, such as onboarding automation, come as add-ons, which can increase the total cost of ownership.

Deel has served over 40,000 companies, including Brex, Makerpad, and Andela.

Deel provides a range of payroll services:

- Managed Payroll: Priced from $24 to $29 per employee per month for global or US payroll, tax, and reporting.

- Employment & Payroll: Ranges from $125 to $899 per employee per month for global hiring (EOR) or US co-employment (PEO), including HR, benefits, and legal assistance.

- Hire Contractors: Between $49 and $325 per contractor per month for compliant global hiring and payment, with options for standard management or Contractor of Record.

Best For

Deel Payroll is a great fit for small businesses managing a global workforce.

Deel is a crucial tool for payroll systems. As a payroll admin, you would use it almost daily to optimize payroll operations, manage payroll structures, and handle Employer of Record (EoR) services.

Some organizations opt for additional compliance support or custom reporting features. Deel workflows also include employee onboarding, offer letter generation, document collection for compliance, and payroll-related benefits administration.

- Deel is an excellent solution for organizations with international contractors, offering a smooth and simplified process.

- It provides EoR services in over 150 countries and includes additional features like onboarding and time-off tracking for international contractors.

I worked with a company expanding into two international markets as part of a tech stack selection project. My engagement lasted about six months and involved selection, implementation, and change management for onboarding.

Deel is a global payroll solution designed to streamline compensation operations for organizations. The company needed a system to manage international payroll efficiently while ensuring compliance across different regions.

- Deel is only worthwhile if you fit its niche. It can be expensive, and if you don’t have a high volume of international hires, the cost may not be justified.

- If you need a more streamlined international hiring process with lower volume, alternatives like Oyster, Remote, or Papaya may be better options.

- Customer support is lacking.

Deel is uniquely positioned to expedite international hiring, particularly for contractors, seasonal hires, or high-turnover roles. It outperforms most competitors in this area for the price. However, if your needs don’t align with this niche, Deel may not be the best choice.

- What does your international hiring strategy look like, and what types of employees are you hiring?

- What is your budget?

- What HRIS features do you need?

Deel’s primary strength is its extensive EoR services, which have expanded to meet user demand. The company has focused on increasing its EoR coverage in new countries to strengthen its niche. Additional onboarding and benefits features support this strategy, but overall, Deel has not evolved significantly beyond its core offering.

- Companies with high-volume international hiring can benefit from Deel, particularly for contractors or high-turnover roles.

- Organizations managing extensive international payroll and compliance requirements.

- Employers needing to sponsor immigration visas.

- Companies that do not hire internationally don’t need Deel.

- Organizations prioritizing integrated HRIS features or complex HR operations.

- Honestly, most organizations.

Homebase

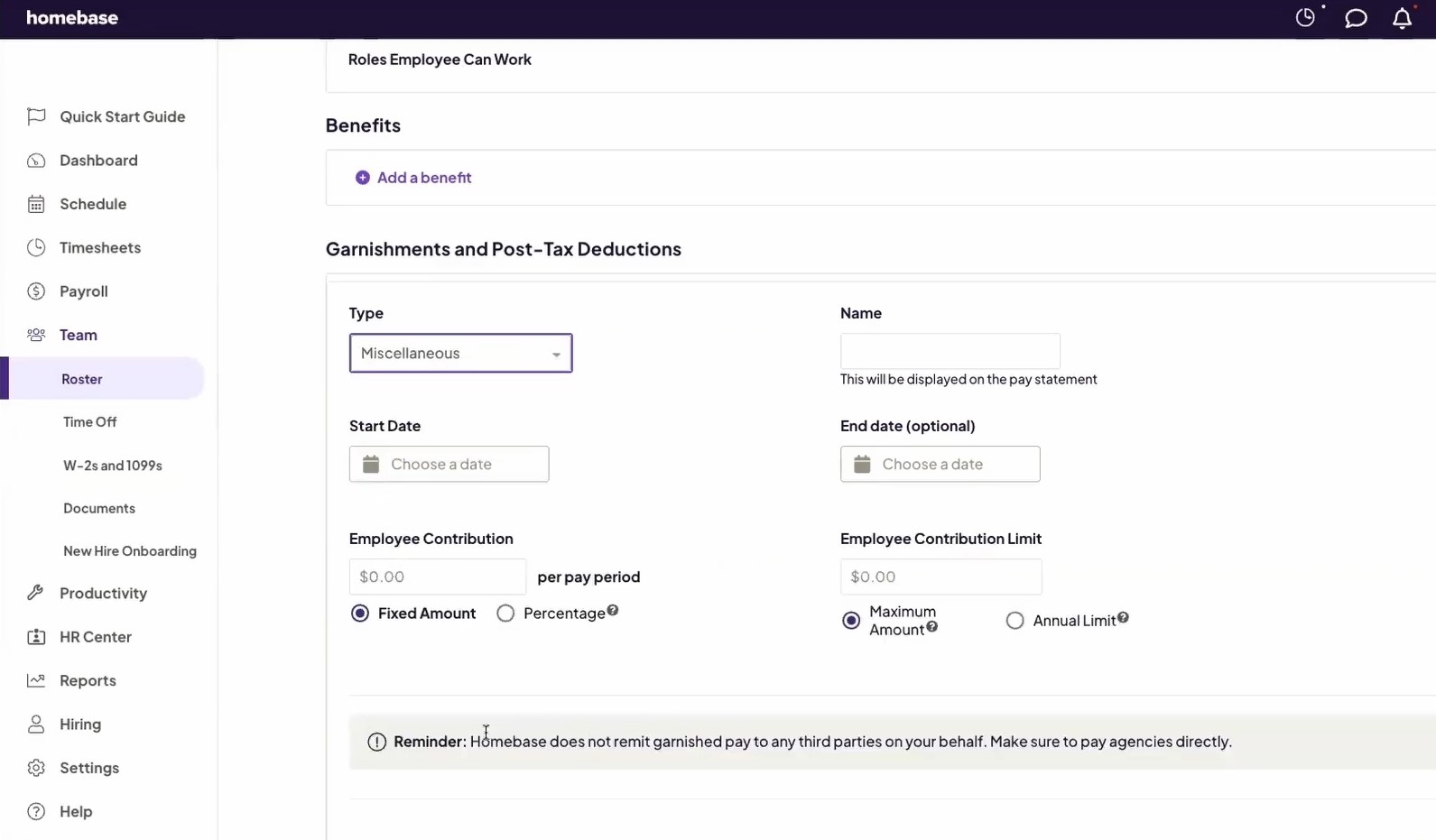

We found Homebase Payroll to be a strong choice for small businesses with hourly workers, particularly those already and/or looking to integrate scheduling and time tracking into their payroll workflow. The vendor is also running a notable promotion through January 31, 2026: new customers receive six months of free payroll on the Payroll and Plus Plans, along with free scheduling, time tracking, and team communication tools.

PROS

- Offers 6 months of free payroll on the Payroll and Plus Plans (including free scheduling, time tracking, and team communication), available until January 31, 2026.

- Provides AI-powered tools and insights to save time and simplify workflows.

- Native integrations with Square, QuickBooks, and over 20 leading platforms.

- Competitive affiliate payouts and high conversion rates for partners.

- Transparent pricing structure with a free plan for basic time tracking and scheduling.

- Separate dashboards for managers and employees

- Real-time communication features allow for schedule changes on the move

- Requesting and approving paid time off is easy

- Great scheduling templates help managers streamline work

CONS

- Homebase doesn't offer benefits administration directly. (it can be obtained through their partnership with Stride though.)

- Not suitable for businesses with salaried employees due to its focus on hourly workers.

- Currently only supports U.S.-based businesses.

- Limited third-party integration support

- Additional features are somewhat expensive

If intuitive time tracking, compliance support, and transparent pricing are high on your priority list, Homebase is a solid option worth considering.

There are many great payroll solutions on the market; however, many bury their costs in the fine print. For a transparent priced option, we like Homebase. Right on its website, you can easily find out how much the payroll tool costs.

As of this writing, it’s priced at $39 per month plus $6 per active employee, which is relatively affordable. To sweeten the deal, the vendor also has a free trial. The only thing to keep in mind is that payroll is an add-on, so you'll need to choose one of their four plans to access it. That being said, their basic plan is free to start with—good enough for companies with one location and up to 20 employees.

Another thing we loved about this payroll software is its automation capabilities, particularly its real-time syncing with the time tracking system. To test this out, we set up a schedule for an hourly team and had employees clock in and out using their mobile app.

The system didn’t disappoint: it automatically pulled hours worked, calculated overtime, and factored in PTO, all without requiring manual timesheet adjustments. Compared to Gusto’s Simple Plan, which lacks built-in time tracking, Homebase includes this feature natively, making it a better option for businesses managing shift workers.

We also liked the overtime prevention tool, which automatically clocks out employees at the end of their shifts to prevent unnecessary labor costs. In this area, Homebase outshines QuickBooks Payroll, which does not offer built-in overtime prevention.

With Homebase, your tax filing is automated at the federal, state, and local levels. We prefer this to Patriot’s Full Service Plan, which charges $12 per month per state for the feature. We think many users would, too.

However, Homebase doesn’t have built-in benefits administration features the way Gusto does, so you’d need to rely on a third-party tool for such needs.

Another drawback we noticed while assessing the product was that this payroll system does not offer automatic compliance reporting, or real-time GPS tracking, all of which are available in Gusto Premium and QuickBooks Payroll.

100,000+ companies, including The Blind Goat & Xin Chao, Fuzzy Goat Yarn Shop, and Forth & Nomad.

Homebase Payroll costs $39/month + $6/month per active employee and is offered as an add-on.

Best For

Homebase Payroll is a great option for small businesses with shift-based employees, such as retail stores, restaurants, and service providers.

Gusto

Gusto is a top-notch option for SMBs when it comes to full-service payroll and customer service. Plus, its UI is among the best we’ve seen in this space.

PROS

- Features online signatures, automated tax filing, unlimited pay runs, and automatic deductions for benefits administration.

- Supports payroll for U.S. W2 workers and domestic or international contractors.

- Reliable customer support. Licensed benefits advisors assist with all plans.

- Transparent pricing with no long-term contracts or setup fees.

- The dashboard feature keeps tabs on compliance tasks

- The hiring and onboarding sequence is nicely streamlined between HR and the new hire

- Post-offer, pre-start tasks are made easy with integrations like CorpNet (state tax set up) Checkr (background checks)

- Easy payroll for U.S.-based W-2 folks, domestic, and international contractors

- Person-to-person phone support, email, and other customer service resources

- The business model is responsive to customer needs

CONS

- No support for international full-time salaried workers.

- No accounting tool for tracking earnings and spending.

- Simple plan lacks time tracking and online signature features.

- Compliance alerts and broker integration cost extra.

- No free trial available.

- Gusto can support payments for international contractors, but not employees

- No native accounting feature to keep earning and spending under the same roof

- Analytics dashboard is simplistic

We’ve kept track of Gusto for years, and in our view, they have done a great job avoiding a common software pitfall. The vendor has kept a steady pace through the years and their primary focus on payroll and benefits has not been clouded by impulsively building more features into their stack. Instead, they work with numerous integrated partners who take the wheel on new initiatives, letting Gusto focus on what they do best.

One of our favorite features is the full-service payroll. Gusto supports payroll for U.S.-based W-2 employees and domestic and international contractors. This vendor also offers e-signature collection, automated tax filing, automatic deductions, varied payroll schedules, and unlimited pay runs so businesses can ensure employees receive pay and benefits promptly.

For a long time, we have also appreciated how transparent Gusto is about pricing. The payroll software does not require long-term contracts or setup fees, allowing SMBs to manage their payroll efficiently without any unexpected costs.

A fair warning, though, international payroll through Gusto is only possible for contractors, not for full-time employees. In other words, they don’t offer an EOR model. Another feature Gusto lacks is accounting, meaning you must use third-party integrations for complete financial management.

Furthermore, while the Simple plan is cost-friendly, it lacks essential features like native time tracking and the e-sign. Lastly, compliance alerts and broker integration are terrific features, but the platform requires you to either opt for its Premium plan or pay extra to use them.

Gusto serves over 400,000 customers across all the United States. They don't specify which portion of that is Small Businesses, but from our experience, a myriad of SMBs across the US love using Gusto and feel confident sticking with it as their payroll expands.

Gusto's payroll pricing starts at $49/month, plus $6 per team member for the Simple plan, which is suitable for single-state payroll, reporting, and support. The Plus plan starts at $80, and the Premium plan at $180, with additional per-person fees of $12 and $22, respectively. They also offer a Contractor Only plan at $35/month. Add-ons, such as HR Resources ($50 + $5 PEPM) and Priority Support ($30 + $3 PEPM), are available for Simple and Plus plans.

- 5 new add-ons for Simple plans (Time tracking, next-day direct deposit, performance, priority support, and HR resources).

- Personalized health insurance suggestions during shopping.

- Vestwell, Guideline, Betterment at Work, and Human Interest as new 401(k) integration partners.

- New feature Smart Import automates payroll data import from spreadsheets or time-tracking software.

Best For

Startups with limited budgets (Basic plan) and SMBs with smaller HR departments and greater financial capacity (Premium plan).

I'm an HR Generalist, so I mainly use Gusto to add new hires, update salaries, and ensure that payroll is correct. I also use Gusto to disperse employee documents for signature/acknowledgment (Employee Handbook) and to store employment documentation (offer paperwork, background checks, etc.). Others on my team use it to run payroll and enroll in state tax registration.

I love their customer service, they always have an answer for you and make my job so much easier. The interface is fantastic, and the design is very appealing, which is a huge factor for someone that uses it quite often. I also really like the admin dashboard, Gusto will list outstanding tasks with their deadlines and will prompt you with helpful information to finish the task.

My company is a portfolio company for High Alpha Innovation. Gusto is the go-to HRIS for all portfolio companies. We have been using it since we started in 2020 and have even used it for one of our own portfolio companies. Gusto is a very easy-to-use tool that has fantastic customer support. When you're working for a start-up, you don't want to spend a long time on payroll and Gusto really helps with that. It's also very easy to set up a new instance of Gusto for a company - it took like two hours and was a painless experience due to Gusto's interface.

Sometimes the outstanding tasks aren't accurate, we recently had tasks pop up for an employee that has been gone for two years. This is very specific, but I wish that you could make some employee documents private to employees, all the documents you upload are automatically public and don't give you an option. I dislike their benefits -- we ran a quote before and it took a few weeks to get back the quote and it was incredibly expensive.

The only similar tool I've used is a PEO called Justworks. I'm not sure if it's a fair comparison, since PEOs pretty much do everything for you. I will say, it was nice that you could set up Gusto in a day and run payroll the next day if needed. For Justworks, you have to wait until the system start date, which can be weeks later.

I think that customer service is a huge buying criteria, especially if you have an inexperienced team. It's invaluable to have experts that you can call or chat with at any time. Cost is definitely a big factor that differs from organization to organization. It's sometimes worth it to pay a little bit more to make your life easier and that's what we've found with Gusto. Lastly, I think that it's important to have an easy-to-use system for both HR and employees. Payroll is VERY important which makes it vital to have a system that is easy to comprehend.

Gusto has become more well-rounded over the years. Last year, they added performance reviews into the mix. It's definitely not perfect and not very customizable, but it's a free add-on, which can be a huge value to organizations that don't have performance management built out.

Small to mid-sized organizations. I think it could work for a small start-up, but would be better for slightly more mature organizations.

Gusto would not be good for a small startup that doesn't have someone with HR experience on its team. Definitely would recommend a PEO over Gusto.

Patriot

Patriot offers unlimited payroll runs, free account setup, U.S.-based inhouse support, and takes full responsibility for any issues pertaining to user tax filings.

PROS

- Intuitive and simple service.

- Guaranteed tax filing accuracy with free end-of-year payroll tax filings.

- Free U.S.-based software support via phone, email, and chat.

- Transparent fee structure, 30-day free trial available.

- Regularly rolls out new features and enhancements.

- Intuitive and simple service.

- Guaranteed tax filing accuracy with free end-of-year payroll tax filings.

- Free U.S.-based software support via phone, email, and chat.

- Transparent fee structure, 30-day free trial available.

- Regularly rolls out new features and enhancements.

CONS

- No support for teams with members outside the U.S.

- No employee benefits management services.

- Limited integration capabilities.

- No support for teams with members outside the U.S.

- No employee benefits management services.

- Limited integration capabilities.

We didn’t expect this level of flexibility from an economical payroll tool. With Patriot, there’s no limit to the number of payroll runs, and you can pay your team members at the frequency of their choice, be it weekly, biweekly, semi-monthly, or monthly.

Moreover, this platform does not charge any fees for its account setup assistance. Should you opt to DIY, it probably won’t be much trouble, thanks to the platform’s payroll startup wizard and the in-house support team. In our tests, it took just 7 minutes to hear back from them.

As long as all your team members are based in the U.S., you’ll find Patriot to be an invaluable ally, as this vendor can handle payroll processing and direct deposit payments for both full-time salaried workers and contractors. If you opt for the higher-tiered plan, this platform can also take care of your payroll tax filing and payment at both the federal and state levels.

That said, we should caution you that Patriot will charge $12 per month for each state tax filing. And unlike some competing tools like Gusto, this vendor does not support employee benefits management.

Another point to note is that Patriot’s payroll services are tailored to US-based companies. In other words, it’s not a good fit for those with international hires.

10,000+ companies, including Ninja Window Washing, B Squared Fine Homes, and Coblentz Cabinets.

Patriot offers two payroll plans:

- Basic costs $17/month plus $4 per employee or contractor. The business owner is responsible for payroll and tax filing.

- Full Service costs $37/month plus $4 per employee or contractor. The business owner runs payroll, but Patriot handles payroll tax filings.

- Patriot up its fees from $17/mo to $37/mo plus $4/employee or 1099 contractor.

- Starting August 13, 2024, all payroll software customers get free law alerts, a compliance dashboard, and an HR assessment tool.

- It also just launched a contract portal and a mobile app for employee timekeeping.

Best For

Small businesses whose employees and contractors are based in the U.S.

Paychex

Paychex is worth mentioning as a top SMB payroll tool because of Paychex Flex, a simplified but powerful version of its product. It’s an all-in-one payroll system designed to grow with your business, built as a simple-to-use solution that gets it done without any fluff.

PROS

- Timecard processing can be fully automated.

- Integrates well with benefits providers like Benetrac for benefits management.

- User-friendly interface for reviewing W2s and paystubs.

- Timecard processing can be fully automated.

- Integrates well with benefits providers like Benetrac for benefits management.

- User-friendly interface for reviewing W2s and paystubs.

CONS

- Limited third-party integrations.

- Some users reported slow app login.

- Less modern looking compared to competitors.

- Limited third-party integrations.

- Some users reported slow app login.

- Less modern looking compared to competitors.

When it comes to SMB payroll tech, Paychex Flex has been our perennial favorite, thanks to its scalability. We first tested this software a couple of years ago, and until now, we’re still impressed with the simplicity and the range of plans it offers for various business sizes.

From HR to retirement packages, online payroll services, and benefits, you get the flexibility to choose what really fits your team’s needs. And as we’ve kept a close eye on every HR tech we review, we’ve barely heard negative comments about this platform’s usability.

We are not big fanz of Paychex’s appearance (the design looks quite dated compared to modern-looking competitors like Gusto or Remote, actually), but what’s underneath didn’t disappoint—the platform’s features are constantly improving. The timecards are a good example. Each time an employee punches in and out, the system generates a timecard and is ready to process once it’s time to run a payroll cycle. This alone can save dozens of hours of company time.

Paychex products have evolved a lot, but unfortunately, the integration capabilities have not. As of this writing, the platform still lacks native integration with Quicken. While we can’t say this is a deal breaker for most, those seeking to remove manual entry for certain tasks like 401k transactions may find this bothersome and might be better served by another tool.

745,000+ companies, including Warner Bros, Denny's, Grubhub, and Frito-Lay.

Paychex Flex offers three curated plans: Essentials, Select, and Pro. Essentials has a monthly base rate of $39 plus $5 per employee. Select and Pro are custom plans that require a call for a quote.

- Vermont Child Care Contribution Tax now available.

- Paychex Oasis customers can now access the Mineral platform for custom handbooks, HR resources, and legal information.

Best For

Small to medium-sized businesses that require a scalable payroll and HR solution.

I primarily used the tool to support the full employee lifecycle, including hiring and terminating employees. It was also a reliable system for checking employment and benefits data, running reports, and updating employment status changes such as leave or promotions.

In addition, it helped ensure that information was shared seamlessly with Payroll for processing. The tool made it possible to manage essential HR functions in one place, reducing the need for separate systems and making daily operations more efficient.

- It is a user-friendly online tool that both employers and employees can use to access employment data.

- Employees can easily choose benefits and view details such as accrued PTO.

- It allows live reports with up-to-date information on turnover and other key data.

- The system includes training tools, such as courses and webinars, that are interesting and easy to use.

My organization purchased this tool to automate payroll and streamline the way payment, benefits, and employment data were managed across HR, Finance, and other departments.

One of the main goals was to provide employees with easy access through both the online platform and mobile app. Another benefit was the ability to allow multiple authorized users, which made it easier to share and update information as needed. We also valued the ability to run live reports, which provided up-to-date insights on employment data.

Overall, the tool was intended to improve efficiency, accuracy, and accessibility in payroll and HR processes.

- Some reports were generated with missing information, even when requested.

- Graphs could only be exported in PDF format, limiting usability.

- We did not take advantage of all the resources Paychex offered.

I don’t believe it is much different from other tools, but it is very user-friendly for both employers and employees, especially since it has its own app.

- Even though it is user-friendly, the system provides more resources than most organizations will ever need.

- It serves as a marketplace where you can add partnerships with external companies and link their resources for employees, such as financial advisors, tax services, or rewards programs.

- The training resources available online are also useful for both employees and managers.

I am not sure, as I only used the tool for a short period of time.

Organizations that do not already have their own payroll system and want to upgrade to a more sophisticated option. Paychex is especially worthwhile for companies with 50 or more employees.

Smaller companies or organizations that do not offer benefits, partnerships, or training opportunities won’t need Paychex.

QuickBooks

QuickBooks' direct deposits are super fast, and if you're already using other products from this vendor, it's a major bonus. The payroll tool integrates beautifully with the rest of QuickBooks’, which makes it a breeze to manage timesheets, invoicing, and expenses.

PROS

- Unlimited pay runs, auto full-service payroll, and same-day deposits included.

- Supports unscheduled payrolls and automatic year-end tax filings.

- Reminders for tax readiness provided.

- Pricing transparency. 30-day free trial available.

- Unlimited pay runs, auto full-service payroll, and same-day deposits included.

- Supports unscheduled payrolls and automatic year-end tax filings.

- Reminders for tax readiness provided.

- Pricing transparency. 30-day free trial available.

CONS

- No employer app.

- More expensive than some competitors like Patriot.

- Limited third-party integrations.

- No global payroll features.

- No employer app.

- More expensive than some competitors like Patriot.

- Limited third-party integrations.

- No global payroll features.

Millions of small businesses have used Intuit QuickBooks accounting software for their lightweight bookkeeping, so we bet this brand is no stranger to most of you. It is effective, simple, and affordable. And as we tested its online payroll product, the same is true for this tool.

QuickBooks payroll processes employee pay stubs and automatically files taxes in a simple, intuitive interface. Remarkably, the direct deposits are among the fastest we’ve seen, with next-day payments offered in the cheapest plan and same-day ones in the rest.

The platform also helps with calculating and submitting your payroll taxes, and it gives you reminders to make sure you're tax-ready.

Many HRs we talked to praised this payroll for its seamless integration with other QuickBooks products, which was also part of the reasons they chose this software in the first place.

However, we would not recommend this tool for businesses with international staff, as global payroll is currently beyond the vendor's capabilities. The same goes for those on a tight payroll budget. For context, QuickBooks charges $25 per month plus $6 per employee, while Patriot does $17 plus $4 per employee.

Regarding the mobile experience, although the browser version is optimized for both desktop and mobile use, there is no dedicated mobile app for employers, and the employee app lacks some features found on the web version. For example, on the web, we could match our receipts to incoming bank transactions, whereas in the mobile app, we were only able to take photos of the receipts.

29,000,000+ companies, including Industrial Manila, Tamar's Hope, and Hiplus.

QuickBooks has three plans as below and a 30-day free trial:

- Core: $25 per month plus $6 per employee

- Premium: $55 per month plus $8 per employee

- Elite: $80 per month plus $15 per employee

- Both the base fee and employee fee across plans have been increased. For example, Core plan used to be $22 per month plus $4 per employee now is $25 per month plus $6 per employee.

- QuickBooks Online Payroll now offers organizational charts and directories.

- The platform now can automatically match new bank transactions for QuickBooks Payroll and Payments.

Best For

Small businesses that are already using QuickBooks accounting.

We use QuickBooks on a weekly basis for all of our AP and AR needs. We send client invoices through QB, and we pay vendor invoices through a QB integration with Bill.com. We also use QuickBooks to distribute team payroll on a bi-monthly payroll. All of these features are directly tied to our management of the company's P&L and Balance Sheet.

- QuickBooks is very affordable and reasonably intuitive.

- Out-of-box, it comes with a generous offering of features, and you are able to add more through its ability to connect with third-party applications (Bill.com).

- The online version allows us to access our financials from any computer, and there is a mobile app available for quick views and expense tracking.

- QuickBooks also has a fairly extensive self-help library if you are unfamiliar with certain features or processes.

My company was in the market for a new accounting software to handle AR, AP, and payroll. The software we used before QuickBooks Online was too complex and more robust than what we needed, and the pricing structure was simply unaffordable. We've been using QuickBooks Online for 3+ years. It handles all of our invoices and vendor payments, and also helps us manage and distribute our payroll.

- Unfortunately, QuickBooks has terrible customer service. In most cases, it is extremely difficult to contact a human customer service representative, and their support ticket system is very slow.

- QuickBooks also has issues connecting with smaller banks, so some features may not be available if you use a local bank or credit union.

- There are also a number of CSS and UX issues that hide certain Call To Action buttons or make them altogether unusable.

QuickBooks stands out from its competitors through its offering of a robust set of features at an affordable price. The price structure allows for affordable scalability, as you only need one license for each business entity. The interface is user-friendly and does not require a lot of details steps in order to customize your experience.

Before purchasing a license, you should think about how businesses you want to connect to the application. Other platforms may accommodate more elaborate business structures. You should also think about the total feature set you are looking to obtain. QuickBooks is great for general accounting, but its reporting capabilities are somewhat limited compared to other more customizable platforms.

QuickBooks continues to add integrations that increase the number of available features without directly altering the platform. Connections to third-party services like Bill.com allow you to do more than what is offered out of the box.

QuickBooks is great for small businesses and business owners that handle all of their own accounting needs.

QuickBooks is not ideal for companies that are looking for advanced accounting reports or performance metrics. Larger organizations that have dedicated implementation teams would be better suited for a more customizable platform.

.png)

Netchex

.png)

We really like Netchex because it's super easy to use. Your team won’t need a bunch of training to get started, and if anyone’s got questions, there’s always a dedicated customer support rep ready to help out.

PROS

- Seamless plan upgrades without data loss.

- Pre-payroll reports for critical error checks before payroll processing.

- Highly praised customer service, entirely U.S.-based.

- Payroll grid for easy input, changes, and error fixes during payroll cycle.

- Diverse payment options: paper checks, direct deposit, and pay cards.

- Grows with your team: With Netchex, it’s very easy to opt for a new plan and keep all your data in the same place even if you outgrow your current pricing plan. Other vendors require a switch to a new service in that kind of event.

- Dedicated support team: Netchex are note-worthy for their award-winning and often lauded customer service. It’s all US-based and provided in real-time through email, live chat, and phone calls.

- Pre-payroll reports: Allows for critical error checks before submission.

- Flexible payroll grid: Easy to make changes or correct errors on the fly.

- Versatile payment options: Includes paper checks, direct deposit, and pay cards.

CONS

- Users must use the payroll module to access other functionalities.

- Overkill for teams with under 50 employees.

- Undisclosed pricing. No free trial available.

- Requirement of payroll: Users must use the payroll module to access other functionalities, so it wouldn’t work as stand-alone HR software.

- No free trial: Potential users can't test the software without committing to a purchase. The demo with a sales rep is the closest thing.

We know that most small businesses are pressed for time, so their payroll tool must be extremely easy to use. And the fact that Netchex remains easy and pleasant to work with in all our test cases is truly impressive.

You can add employees, set payroll cycles, and fix issues with minimal training. Plus, no matter which plan you pick, you’ll get a customer support rep from Netchex who not only helps with the initial setup and then vanishes, but stays approachable for any snags that may arise post-implementation.

Given how pricey payroll mistakes can be, being able to spot issues before everything is finalized is a lifesaver - and that’s exactly what Netchex’s pre-payroll does, which we love. It gives you a heads-up if there's a paycheck going out to someone who shouldn't be getting one or if the numbers aren’t adding up right.

Another big thumbs up for Netchex is its eye for innovation. They’ve recently added some neat features like AskHR, where employees can get quick answers to their questions, and Netchex AI, which is stellar at crunching data in complex ways.

As much as Netchex is geared towards SMBs, if you've got fewer than 50 employees, it might feel a bit much and lean towards the expensive side. And just like Paychex, they don’t let you take their service for a test drive before committing.

6,500+ organizations, including Xpressdocs, BK Corrosion, Regal Hospitality, and The Colony ER Hospital.

Netchex uses a per employee per month pricing model, which varies based on company size and products.

The platform has undergone significant advancements since we first became familiar with Netchex. They recently introduced several new features, including AskHR for automated employee assistance, NetChex AI for intelligent data analysis, and Community to boost employee engagement and recognition.

Best For

Businesses with 50-500 employees.

Remote

We highly recommend Remote to SMBs looking to hire employees and contractors worldwide. With this platform, you can easily handle salaries, benefits, expenses, and incentives compliantly in over 170 countries—all in one place.

PROS

- Fast and compliant payroll in 170+ countries.

- Live chat support with local payroll experts.

- Flexible, localized benefit packages.

- Flat-rate pricing structure, no deposits or hidden fees.

- Mobile app streamlines expense reimbursement with autofill from receipt photos.

- Fast and compliant payroll in 170+ countries.

- Live chat support with local payroll experts.

- Flexible, localized benefit packages.

- Flat-rate pricing structure, no deposits or hidden fees.

- Mobile app streamlines expense reimbursement with autofill from receipt photos.

CONS

- Doesn’t have a free trial.

- Redundant for organizations solely recruiting within the U.S.

- Help center documentation isn’t easiest to understand.

- Doesn’t have a free trial.

- Redundant for organizations solely recruiting within the U.S.

- Help center documentation isn’t easiest to understand.

Scaling internationally is exciting news for any business, but it also comes with a huge HR headache. Each country and state has different laws (which change over time), and local talent has varying interests in compensation packages. Having been there ourselves, so we can't help but appreciate how much easier Remote has made it for SMBs looking to expand their teams globally.

Remote offers two plans: one for global payroll and another for Employer of Record (EOR)—which includes everything from payroll to benefits, HR, and tax needed to hire and pay people from over 170 countries compliantly. Both come with transparent rates and no hidden fees. However, what really stands out to us is that regardless of the plan chosen, you gain access to in-house, local payroll support. We bugged these people a couple of times in our testing, and they have never let us down once—always quick turnaround and thorough guidelines.

That said, we do wish there was a free trial so the platform is more accessible to small businesses. Also, those preferring self-help documentation instead of always having to reach out to human support might not be satisfied with what's available in Remote's help center. In our experience, the instructions are not the easiest to follow, as they are mostly in written form with very few product screenshots for illustration.

Since our last review, there have been several notable changes. A new integration with Coinbase now allows employers to pay employees in cryptocurrency. Additionally, Easop was acquired to automate equity compensation compliance for globally distributed teams. The employee app has also been improved to display time-off statistics and automatically add public holidays to the calendar.

Remote customers include brands like GitLab, Paystack, and Loom, but the exact number is undisclosed.

Remote offers two packages for payroll management:

- Global Payroll: $50 per employee per month

- Employer of Record: Starting at $599/month billed annually

- New integration with Coinbase enables employers to pay employees in cryptocurrency.

- Acquired Easop to automate equity compensation compliance for globally distributed teams.

- Improved employee app shows time-off stats and auto-adds public holidays to the calendar.

Best For

Remote-first companies to hire and pay employees and contractors worldwide.

We use Remote to maintain and track payroll and PTO for our international hires.

- Very organized to track international payroll and PTO.

- User friendly for both hiring manager and employee.

- Great dashboard and easy to navigate.

We made international hires. Remote provided a safe space for us to negotiate, track and provide timely payments to our international employees. Remote provides similar HR/Payroll usage as another in-house system for example like TriNet.

- If you’re unfamiliar with international payroll processing, it can be confusing.

- Invoices need to be attended to so employees do not miss timely payouts.

- Benefits and policies can be different country to country.

Remote is the only platform I have used for international hiring purposes.

- What does the hiring manager and employee need access to regarding payroll, benefits and HR purposes when hiring internationally.

- Confirmation that Remote can support the respective country you are hiring someone

I’ve used Remote for about 6 months now and it’s worked like a charm. They provide a great customer support team that is responsive and knowledgeable about everything related to hiring and payroll policies with respect to regions and countries.

Companies that are looking to expand hiring internationally.

This tool would not be a fit for departments outside of talent acquisition, payroll and/or HR. Remote is primarily used for hiring and tracking invoices of international hires. It would not make sense for someone in sales, marketing or CS to ever use remote.

Square

Square’s level of flexibility is amazing. It supports unlimited pay runs and next-day direct deposit, comes with some add-ons that you can choose to pay for if you need them, and can beautifully integrate with its ecosystem as well as several third-party business tools.

PROS

- Integrates with Square POS and other Square tools. Strong third-party integrations.

- Free seasonal inactivity provided.

- Reasonable, flat pricing. Free trial available.

- Free federal and state tax filing and payments.

- U.S.-based phone support for all plans.

- Integrates with Square POS and other Square tools. Strong third-party integrations.

- Free seasonal inactivity provided.

- Reasonable, flat pricing. Free trial available.

- Free federal and state tax filing and payments.

- U.S.-based phone support for all plans.

CONS

- Does not support employers in household and agricultural sectors.

- Automated payroll, PTO, sick leave tracking, time tracking, shift scheduling, and overtime calculations can only be accessed on higher-priced plans.

- Does not support employers in household and agricultural sectors.

- Automated payroll, PTO, sick leave tracking, time tracking, shift scheduling, and overtime calculations can only be accessed on higher-priced plans.

We first tested Square in 2020 and have kept a close eye on the tool ever since, and we have to admit that this is one of the best payroll options available when it comes to flexibility.

Square has two simple plans: one for contractor payroll and another for both contractors and full-time employees. The pricing is transparent and reasonable, with no annual commitment required. The best part, though, is that users can pause their subscription and won't be charged until it resumes after 9 months or when they process payroll again, whichever comes first. For businesses dealing with off-season, this is a huge money saving.

If you're a retailer, especially a store owner or in the restaurant business, you’ll find the combination of Square POS and Square payroll useful in many ways. Plus, if you're looking for third-party integrations, there are still plenty of options offered.

Just keep in mind that Square Payroll only works for businesses that file Form 941 or Form 944 and doesn't support employers in the household and agriculture sectors.

We should also warn you that even though the contractor plan is incredibly affordable — at $6 per contractor per month — it doesn’t cover features like automated payroll, PTO, and overtime calculations. You’d have to choose the higher-priced plan to access these features.

Square's clients include The Art of Donut, Glamourax Salon, and Live by the Sword, but the exact number of customers remains undisclosed.

- Employees and Contractors: $35/month + $6 per person paid per month. Free trial is available.

- Contractors Only: $6/contractor paid per month

- Price increase slightly: Same monthly base fee, per-person fee up from $5 to $6.

- New Time Off reports allow users to view, manage, and track team time off in a reporting view.

- Admins now can control access to wages and labor cost data when managing permission sets.

Best For

Seasonal employers, including store owners and restaurants.

I use Square every day to manage various aspects of our sales and payment processing. It seamlessly handles payments from both in-store customers and online orders. The tool also displays our inventory in real time, helping us maintain optimal stock levels to meet customer demand.

Square’s capabilities extend beyond payments; it provides sales data that allows me to identify the most and least popular items, enabling adjustments to pricing and marketing strategies. The POS system also helps us gather customer information in one place and send targeted special offers.

In essence, Square has streamlined our business operations, acting as a comprehensive tool that enhances our efficiency. We have grown to rely on this technology.

In short, Square has revolutionized the way we do business. It is like having a whole toolbox in one simple convenient system that just makes everything run better. We are almost at the stage of dependence on this technology.

- Square's simplicity allows us to process transactions quickly without integration issues.

- It works smoothly with our inventory management system, streamlining overall processes.

- The sales reports provide valuable insights, improving our business decisions.

We chose Square as a payment method for our business, store, and online platform because it is both effective and easy to use. Previously, our old systems were a constant source of stress, leading to frequent mistakes and lacking the flexibility to support business growth. Square was the solution we had been waiting for.

It provides all the essential services we need in one place. It enhances stock management, offers weekly visual presentations of sales proceeds, and helps us better serve our loyal customer base.

Additionally, it is user-friendly, allowing us to accept payments immediately after installation without requiring external assistance. I have been using Square for three years, and it has truly transformed our sales process, making it easier and more efficient, while also improving customer satisfaction.

- One downside of Square is the transaction fees, which can be high for businesses with high sales volumes.

- Although customer service is generally good, response times can be slow for more complex issues.

- The customization options for receipts and reports are somewhat limited.

Square distinguishes itself from competitors by offering a comprehensive package that addresses all payment processing needs, inventory tracking, and sales analysis in one easy-to-use system. It’s like having a dedicated business assistant. The transparent pricing, with no hidden fees, is another advantage.

Unlike other tools that might complicate business processes, Square integrates well with other systems, ensuring a smooth operation whether you sell products in person or online.

Also, devices like the Square Reader are more affordable and easier to use compared to those offered by competitors, making it an ideal choice for businesses looking for cost-effective yet efficient payment solutions.

When choosing a payment processing solution like Square, consider the transaction fees, especially if your business has a high sales volume, as this can affect your costs. Look for a tool that is easy to use and requires minimal training so that employees can quickly adapt.

Also, evaluate the quality of customer support to ensure that help is readily available when needed, with the ability to resolve issues efficiently.

Square has significantly evolved to enhance its services. Initially, it was a simple payment processing tool, but it has since expanded to include features like sales tracking, customer relationship management, and generating insightful sales reports.

Their devices, such as the Square Reader and Terminal, are designed to be user-friendly and adaptable. Square has also embraced the surge in online shopping, offering solutions that support both physical and digital retail, reflecting its commitment to growth and relevance for all types of businesses.

Square is ideal for small to medium-sized retailers, including those in retail, food service, and hospitality. It is excellent for managing business operations and payment processing, making it particularly useful for businesses that operate both in-store and online.

Entrepreneurs and startups appreciate Square for its simplicity and scalability, enabling them to manage stock and analyze sales data effectively as their businesses grow.

Square may not be suitable for large enterprises or businesses with complex payment needs that require advanced features. Companies needing frequent customizations or specialized integrations might find Square lacking.

Additionally, businesses with high transaction volumes may incur higher fees, as Square does not offer tailored deals for enterprises with extensive daily sales transactions.

OnPay

OnPay is fast, and you won't have to spend hours figuring out how to use this tool. In addition to payroll, this vendor provides some nice HR basics in its one-and-only plan, at no extra costs.

PROS

- Free tax form handling for W-2 employees and 1099 contractors.

- Some HR services included within the plan at no additional cost.

- 30-day free trial available (starts after OnPay verification).

- Well-developed online help resources.

- Free tax form handling for W-2 employees and 1099 contractors.

- Some HR services included within the plan at no additional cost.

- 30-day free trial available (starts after OnPay verification).

- Well-developed online help resources.

CONS

- Poor functioned employee mobile app.

- Requires payment four days before payday for direct deposit.

- Doesn’t support automatic payroll.

- Customer support sometimes hard to reach.

- Poor functioned employee mobile app.

- Requires payment four days before payday for direct deposit.

- Doesn’t support automatic payroll.

- Customer support sometimes hard to reach.

If you’ve already read our reviews of other payroll tools we’ve included in this guide, you may have noticed that OnPay is not the only vendor that can perform full-service payroll plus HR and benefits. However, it is the only one that has bundled all these functions into a single, affordable plan.

Starting at $46 per employee per month, you'll receive everything from multi-state payroll processing to automated onboarding, e-signing, broker-of-record integration, employee self-service, and account migration—all without additional fees or the need for plan upgrades.

Moreover, this platform is one of the few in the industry that offers a 30-day free trial, which you can easily sign up for online through its website. The only thing to note here is that the trial starts only after OnPay verifies your provided information, including your bank account. So make sure you double check the form before submitting.

Compared to its peers, OnPay has done an outstanding job providing online free guides. Despite being free resources, the guides are rich in information and offer many good insights into payroll, benefits, and HR.

Unfortunately, the vendor’s support didn’t meet our expectations. It took some time to receive a response from their live chat, and our email also had to wait until the next day for a reply.

Lastly, a few things to be clear: Unlike Gusto, OnPay has no native time tracking tool. It also doesn’t support automatic payroll.

OnPay charges a $40 monthly base fee plus $6 per employee. It also offers a free trial.

- Price increase: OnPay: $36 monthly base fee + $4/employee.

Best For

Small business owners that need full-service payroll and HR basics.

We use OnPay regularly, typically once a week, to manage payroll processes in the organization. The tool has helped us automate payments to employees and contractors, calculate taxes, and file them on time. We also use it to track employee benefits and time off, making it easy to keep everything organized. OnPay is especially helpful for generating reports, which we use for financial planning and compliance. Overall, it has streamlined payroll and HR tasks, reducing manual work through automation.

- Payroll processing is made simple for users of all levels by OnPay’s user-friendly interface.

- Its comprehensive suite of payroll solutions ensures accuracy and saves time, offering features like direct deposit, automatic tax calculations, and compliance management.

- The customer service provided by OnPay is excellent, with professional support agents available to help with any queries or issues.

My company chose OnPay because we needed a less time-consuming and more straightforward solution to manage employee benefits and payments. Before OnPay, we had trouble tracking taxes and ensuring accuracy. Payroll automation, tax computation, and benefit tracking became easier with OnPay. It has helped us save a lot of time and minimize errors over the past year. Additionally, the customer service has been excellent in answering queries and providing support.

- Compared to some of its competitors, OnPay offers limited integration with third-party apps, which can hinder seamless data flow for companies relying on multiple software programs.

- The pricing structure can be expensive for smaller firms that require more services or products beyond the basic payroll package.

- There are limited options for customizing payroll settings and reporting, which can make it challenging to adapt the system to specific business requirements.

OnPay sets itself apart from rivals by offering a simple, user-friendly interface that makes payroll processing accessible, even for those with minimal accounting experience. In contrast, some competitors have more complex systems that require in-depth training.

OnPay’s transparent pricing, with no hidden fees, allows businesses to budget for payroll services more easily. Other competitors have more variable pricing structures, which can become complicated and expensive as they scale.

OnPay is designed with small to mid-sized enterprises in mind, offering features like easy setup, streamlined processes, and extensive customer support tailored to their needs. In comparison, some competitors focus on larger businesses and may prioritize different tools over OnPay.

- When choosing a payroll solution, look for one that is easy to use with a flexible design, like OnPay.

- Ensure there are no hidden fees and that the pricing structure aligns with your organization's budget.

- To make payroll processes more efficient, prioritize features such as automatic tax calculations and compliance tools.

- Choose a service provider like OnPay, which offers dedicated customer support when needed.

- Finally, maximize productivity by selecting a tool that integrates with other apps your organization uses.

Over time, OnPay has added features like payroll compliance management and automated tax computation tools, improving its user interface for a better customer experience. It has enhanced integration capabilities, making data sharing with other apps easier.

OnPay has also invested in attentive customer service to offer timely support. Additionally, the pricing strategy has become more flexible and transparent, catering to the financial needs of small and mid-sized enterprises.

Small to medium-sized enterprises needing a reliable payroll solution with features like automated tax computations and compliance monitoring will find OnPay well-suited to their needs.

OnPay provides an effective payroll processing solution for businesses seeking simplicity without the complexity of larger systems, thanks to its clear pricing structure and prompt customer service.

Larger businesses that require sophisticated payroll features, high customization options, or advanced reporting capabilities typically found in more complex systems may find OnPay unsuitable.

Additionally, businesses with specialized payroll needs or those requiring extensive third-party integrations may find OnPay's services limited compared to its competitors.

Rippling

If your team is lean but spread across states, and you’re tired of managing payroll tax portals or correcting W-2 errors, Rippling is one of the most comprehensive and modern solutions we’ve encountered in this field. The vendor provides significant value for SMBs looking to centralize their payroll, benefits, and compliance workflows with built-in automation features to minimize dependence on manual processes.

PROS

- Automated state tax handling manages registrations and payroll taxes across 50 US states.

- All-in-one payroll platform integrates time tracking, benefits, and accounting, reducing errors and manual work.

- Compliance support provides access to HR experts and tools like Mineral for legal guidance and policy automation.

- Termination workflows automate offboarding payments to meet final paycheck deadlines.

- User-friendly interface for both payroll admins and employees, requiring minimal training.

- All-in-one platform for employee management + PEO services offered, and even a suite of other IT products

- With 500 integrations, it’s very likely that they integrate with other key tools from your tech stack.

- Operates globally with any currency

- Workflow automation

- Analytics opportunities

- Provides a holistic view of company outflows—headcount costs included

CONS

- New customers cannot trial a pay run before going live.

- Self-led onboarding process can leave some users feeling unsupported during setup.

- Users find document uploads clunky, citing issues with receipt attachments and locating drafts.

- Support inquiries via chat can cause delays in escalation.

- Total buy-in to Rippling is essential

- Very SMB-oriented, in case you’re a larger company.

- New features tend to be buggy in ways that tech teams are not accustomed to fixing

We tested Rippling’s payroll platform with an eye toward the challenges SMBs face—tight bandwidth, multi-state compliance, and minimal margin for error. What we found is a system that delivers impressive automation, especially for teams managing remote or distributed workforces.

Take Hovercraft, a small marketing agency with employees in nine states. They leaned on Rippling’s HR Services to handle the notoriously painful task of registering for state payroll tax accounts and staying compliant across jurisdictions.

When we looked under the hood, it was clear how this worked: Rippling automatically creates state accounts, handles tax payments, and flags regulatory updates—tasks that would otherwise consume days of admin time each month. Hovercraft now saves an estimated 30 hours per week, enough to avoid hiring an additional operations staffer.

That said, it’s not just compliance that Rippling streamlines. At The Portland Clinic, a healthcare provider with 500 employees, payroll used to be error-prone due to disconnected systems (ADP for payroll and UKG for time tracking). After switching to Rippling, the clinic integrated time and attendance into payroll, which cut down on data entry errors and post-payroll corrections.

During our evaluation, we liked how Rippling’s approval reminders and auto-calculated overtime reduced manual intervention and improved pay run accuracy. Their payroll admin shared, “I’ve come to a point where I trust it and rarely have to double-check it.”

But Rippling isn’t plug-and-play for everyone. Several users we spoke with described the implementation process as more DIY than expected. There’s no dry run for your first payroll, which left some admins feeling anxious about going live. One user mentioned it was “like flying blind,” and wished for a dedicated setup partner.

Support is another mixed bag. The chat-based system works well for routine questions, but escalations can take longer than some teams would prefer, especially if they’re used to immediate live help.

Notable customers include Hovercraft, Harver, and The Portland Clinic.

Rippling's pricing starts at $8 per user, in addition to a $40 monthly platform fee.

Best For

Rippling’s payroll software is best for small and mid-sized businesses that manage multi-state teams and want to reduce admin hours through automation.

As the Head of People Operations, my daily workflows rely on Rippling. Overseeing the employee lifecycle requires me to use a combination of onboarding/offboarding, reporting, benefits administration, performance management, and general employee data management on a weekly basis. From an onboarding/offboarding perspective, Rippling not only serves as the home base for information but also communicates timely and effective tasks to the necessary parties, ensuring a clear and compliance-first process. With Rippling’s ability to relay information to integrated accounts like Guideline and Carta, my role leans more into oversight, allowing me to focus strategically elsewhere.

Rippling centralizes the majority of the HR processes (+ Finance and IT, if you chose) that would otherwise be spread across multiple systems. For example, our company’s flex benefits, COBRA, and ACA were either managed with a carrier outside of our broker or manually by us and now Rippling handles the administration of all these areas in consolidation with our other health insurance benefits.

The strength of Rippling’s integration library allows for consistent and regular communication to and from Rippling for processes that are not directly managed within the system. For example, prior to Rippling, we manually onboarded and offboarded employees to/from Guideline. With Rippling, the systems speak to each other and manage the employee’s lifecycle with our company-sponsored 401k.

A highly beneficial aspect of Rippling is the workflow feature. Workflows have allowed us to set up Rippling in a way that allows it to speak within the system, initiate processes, and communicate to people/external systems. Rippling is a high-tech HRIS and a constantly progressing platform that meets the needs of today’s operations teams (HR, IT, Finance included).

We selected Rippling to implement a strong HRIS while centralizing other HR operations. By implementing Rippling, we were able to solve and improve several areas. First, we consolidated historical employee data from three to four different platforms into one, allowing us to use Rippling reporting to provide company trends. Second, we simplified benefits administration by transferring health insurance, Flex Benefits, COBRA, and ACA management to the Rippling platform. Third, Rippling offers a cleaner, more centralized, and highly integrated solution for our HRIS needs. I have been actively using Rippling for six months.

Rippling is a complex system. For it to be fully functional to the best of its ability it needs to be given the time to implement and set up in great detail. Knowing this, the implementation should have been much more hands-on. I’d recommend that whoever is leading the implementation internally has experience with other systems, so they know what to look for.

Rippling does not have an employee “notes” section. As the place I rely on for the most up-to-date employee job and personal information, it is missing the ability to keep it up to date with employee relations information directly in their profile. This is a feature I have experience with in other HRIS’s and is a missed opportunity in the Rippling platform.

Unlike BambooHR, a competitor, Rippling does not offer a “missing data” report. To find out who within the company is missing information, we will have to discover it when it is flagged during another unrelated process. I think this puts us at risk if we are unknowingly missing key information or signatures from any employee.

Rippling is a fully functional operations system with a large integration library. It provides HR with the necessary tools and offers Finance and IT tools. Incorporating various clouds and add-ons allows Rippling to carry an administrative weight heavier than its competitors.

Rippling is a complex system, so you should be prepared to invest time and attention to building a strong foundation during the implementation process. It can do a lot, but it needs to be built on the backend for the front end to function at its best. Since many tools within Rippling rely on one another, approach it with a big-picture philosophy for your organization’s intentions. Be clear about what you need during the discovery process, as Rippling has many features, but not all may be necessary for your company.

Rippling continues to introduce small improvements to existing features and entire tools, like performance reviews, and exclusive highly functional built-in integrations, like Carta. These developments are likely to continue as Rippling gains popularity in HR and Finance.