8 Best Enterprise Payroll Software for Large Companies (2026)

We’ve picked out the 8 best payroll software platforms for large companies. Use our extensive research for pricing guidelines, benefits, pitfalls, and more.

Looking to get your large company new payroll software? Payroll is a crucial part of every organization, especially for companies with over 250 employees. Not only does it help streamline and automate an essential HR service, but it can even help protect companies from confusing tax laws. We also go in-depth on cloud-based payroll software features, benefits, ROI, pricing, and more.

It’s important to understand all the net positives that payroll software can provide so that you can make an informed decision. Is getting payroll software the right move for your organization? Or are you guys better off outsourcing payroll to a PEO?

To help you with those decisions, we’ve condensed months of research into this article about the best payroll software for large companies. Though the vendors listed below are more geared towards US-based companies, some of them would be able to accommodate an international business. Also, before you dig in, it’s worth mentioning that some of the vendors listed below can even act as a PEO if that’s better for your situation.

We demoed dozens of tools to determine the best enterprise payroll software options. We also leveraged user feedback and our years of experience in this field, since we’ve been writing about various types of payroll and accounting software since 2018. It wasn’t hard to reach a shortlist of the tools we knew or had recommended by our community of HR experts that could tackle payroll for large businesses.

However, we wanted to pick the top 8— the best of the best. Hence, we conducted an extensive evaluation based on numerous criteria, not least these three key points: enterprise payroll capabilities, expert payroll services, and integrations with essential payroll-related software.

- Enterprise Payroll Capabilities: We prioritized payroll software solutions that offer robust capabilities specifically designed to meet the needs of large companies. These solutions provide advanced features such as multi-country payroll management, complex earnings and deduction calculations, support for various employment types (including full-time, part-time, and contract workers), employee self-service, and extensive reporting capabilities.

- Expert Payroll Services: Access to expert payroll and compliance services can be paramount in the enterprise space. We identified payroll software solutions that enable enterprises to leverage the expertise and support of dedicated professionals. These services typically cover payroll tax compliance, regulatory reporting, and comprehensive HR support.

- Integrations: We focused on payroll software that seamlessly integrates with essential payroll-related software, such as accounting systems, human resource information systems (HRIS), time and attendance tracking systems, and benefits administration platforms. The selected solutions offer robust integration capabilities, enabling smooth data flow between systems and minimizing manual data entry.

Our unique guides are exhaustively researched and follow a refined, rigorous approach. To learn more, read our blog on evaluating HR tech vendors.

Related HR Software Categories

.png)

Deel

.png)

Deel is easy to automate and makes scaling a breeze in 150+ countries. Their support and set-up assistance are also worth a mention.

PROS

- Deel boasts exceptional customer support, offering around-the-clock in-app assistance and an impressively rapid onboarding process, usually completed within just 2-3 days.

- In various jurisdictions, dedicated local payroll experts ensure comprehensive and tailored assistance.

- Features APIs and native integrations with over 100 recruiting and HR solutions.

- With a self-service focus, Deel enables users to swiftly immerse themselves in its functionalities. Our research indicates that setting up is hassle-free, often finalizing identity verification in under 24 hours, sometimes even minutes.

- Automated invoicing streamlines financial tasks, benefiting both companies and contractors.

- Excellent 24/7 customer service with fast onboarding (2-3 days) and local payroll experts in each jurisdiction.

- Seamless integration with platforms like QuickBooks, BambooHR, and Greenhouse, plus custom integration options.

- User-friendly, self-service features enable quick setup; identity verification often takes under 24 hours.

- Automated invoices simplify payments, provided they're in English.

CONS

- Additional charges apply for specific advanced features, such as onboarding automation.

- Deel's rigidity in altering contracts or service agreements may be limiting for companies seeking greater adaptability. Modifications often require addendums, introducing potential administrative intricacies.

- Incurring a $5 fee per payout, Deel's pricing structure could accumulate over time, potentially impacting cost-efficiency for businesses frequently processing payouts.

- Currently, Deel exclusively supports invoice generation in English, which could pose constraints for organizations or individuals requiring multi-language invoicing capabilities.

- Key features like onboarding automation are add-ons, which may increase costs.

- Limited flexibility in modifying contracts or service agreements; changes often require an addendum.

- Invoices cannot be generated in languages other than English.

If you're looking at payroll solutions to help with paying a remote and global team, you should definitely check out Deel. This American company offers a wide range of services, but at their core is the ability to hire both contractors and full-time employees compliantly. You can create contracts for the former or go the EOR or PEO route for the latter.

We find their software product to be user-friendly and intuitive to navigate on the employee and manager side alike. One thing we appreciate as researchers is how much it has grown since we first encountered them. Recently, they added Core HR features and more hiring-related capabilities— like immigration services, background checks, equity management, and flexible workspaces.

Over 35,000 companies have used Deel, including HomeLight, Makerpad, and Duffel.

Deel offers multiple payroll solutions with varying prices: Deel Payroll ($29/employee/month) for businesses with existing entities; Deel U.S. Payroll ($19/employee/month) for U.S. companies; Deel Contractor ($49/month) for compliance, payments, and contractor management in 150+ countries; Deel EOR ($499/month) for international hiring without an entity; and Deel US PEO ($89/employee/month) for U.S. companies needing HR, payroll, and benefits administration.

As a new product, Deel has changed a lot since its inception. Its newest offering, DeelHR, allows companies to complete most of their HR operations tasks in Deel.

Best For

Deel is a worthy consideration for enteprises with an international workforce.

Paylocity

Paylocity is a well-established payroll tech provider in the United States for many reasons, but its friendly user interface and exceptional customer support take the cake. It is also quite comprehensive, covering a host of features for tax management, global payroll, and benefits administration.

PROS

- Paylocity is easy to get the hang of, even for people who may not be tech wizards.

- Users highly rate the responsiveness of Paylocity’s support team, both for employer and employee questions and problems.

- Reasonable price compared to other enterprise payroll software in the space.

- The Paylocity team will walk you through the tool setup.

- Employees found Paylocity’s mobile app quite intuitive.

- Paylocity’s customer support is highly rated for always being available to answer questions.

- Global payroll support for 100+ countries.

- Provides free and unlimited training modules on the website.

- Paylocity’s mobile app has a good UI and functionality

- The tool is easy to use for both employees and employers.

- Has 350+ pre-built integrations.

CONS

- Large teams may want a tool with better reporting capabilities.

- You need to use a broker for benefits integration.

- Only English customer support, no country-specific support.

- It isn’t the best solution for global teams to manage payroll and benefits for both their employees and contractors.

- Undisclosed pricing.

- It doesn’t have a free trial or free plan.

- Support is available in English only.

- It isn’t the best solution for remote teams looking for a tool to manage payroll and benefits for their contractors.

Paylocity is among the largest payroll providers in the United States and is an excellent option if you’re looking for payroll tech by a well-established company.

Our first impression of Paylocity is that it is easy to navigate. It is mobile-friendly too. While the features on the mobile version are not as rich as the ones on the web app, from an employee perspective, we found the functionality of the mobile app decent enough to access payroll, HR, and make changes as needed.

Self-service is another pro of Paylocity: employees can manage their payrolls, such as direct deposit and tax withholdings, and get real-time notifications on things like direct deposit status and tax refund information. This, while seems small, can help quite a bit in reducing time spent on payroll administration.

Another thing worth highlighting is Paylocity’s reporting function. We were able to easily generate reports on things like payroll history, tax withholdings, and more. That said, it does lack some reports which can be found in other payroll tools. To use such reports, you do have to pay extra. We also looked at Paylocity’s integrations. The good news is that the payroll module can integrate with several HR tools, thanks to its API support. But if you use bSwift for your benefits management, we’d recommend you get in touch with the Paylocity team, as we’ve heard from users in our community that they encountered delays in processing payroll due to occasional disconnects between the two tools.

Momentus, Watters, Weigel’s, ILC, Upward, HMC, Polywood.

The exact pricing for Paylocity's offering is not publicly-disclosed.

Best For

Paylocity works best for medium-sized companies, especially for those based in the U.S. who are looking for a well-established solution that can help them streamline their payroll processes.

We used it for accounting and recruiting. We also used it to pull quarterly tax reports. It helped retain employees by allowing them to access their pay early. We considered using it to organize our employee benefits but ultimately did not utilize that feature. We used it to streamline our operations so the office could work more harmoniously.

- Paylocity was great for onboarding and tracking time/attendance.

- It was a time saver when inputting payroll.

- I liked that employees could access their pay before the paycheck was issued.

We used Paylocity for just a few months. It wasn't quite what we had expected. We were looking for payroll software combined with a program for our HR needs. We had one person completing payroll, and it was not efficient. The amount of money spent on the accounting manager was not conducive to the company's budget. We also struggled with our recruiting process. It was nice for employees to access their pay before payday.

- The program itself was not "quick and simple" to set up.

- It was not always user-friendly, especially for staff members who aren't tech-savvy.

- We did not like customer service; the agents weren't as knowledgeable as those from other HR programs I've used.

- Teaching the program was difficult, and we wanted more how-to videos and tutorials.

I did not care for Paylocity. It was difficult, not user-friendly, and customer service was lacking.

If they are a small company, Paylocity is not going to be a good fit. They should evaluate their company's needs and weigh all options. This could be a good program for international companies looking for a basic solution.

I did not see it change much in the short period I used it.

I feel Paylocity would be a good program for large, international companies.

Paylocity would not be suitable for small companies.

ADP

ADP is a widely-trusted payroll solution that also offers many other HR tools if you need them. Their expertise is a good fit at SMBs but also enterprises.

PROS

- Native, all-in-one technology suite for recruitment, payroll, and compliance.

- 17 RPO service centers in 14 countries and provide services in 42 different languages.

- Dedicated team of AIRS-certified recruiting professionals.

CONS

- Technology options outside ADP’s dedicated HR tools are limited.

ADP is probably one of the largest names in the payroll space. They have been in the industry since payroll processing was done manually 70 years ago. Now, their product is able to cater to companies with the largest organizations in the world. Aside from PEOs and payroll management, ADP is also a complete HRIS.

- The Boston Globe

- Whole Foods

- The Bancorp

- BP

- Douglas Ellman Real Estate

- Margaritaville

- LongHorn Steakhouse

Sometimes ADP has special offers, like getting 3 months free when you sign up for their small business payroll processing plan. However, they don't share the prices for their payroll packages, so you'd have to request a quote to move forward.

Best For

ADP can work for companies with less than 50 employees, less than 1,000, or those with well over a thousand team members.

I managed payroll, processed employee benefits, tracked time and attendance, and handled talent management functions. ADP's interface allowed me to easily navigate and input relevant data. This helped streamline day-to-day tasks.

Additionally, the reporting features helped me generate valuable insights into workforce analytics and compliance. Overall, ADP served as a comprehensive tool that supports our organization in various HR management aspects.

- I appreciate ADP's user-friendly interface to simplify complex HR processes.

- ADP's robust reporting capabilities provide valuable insights for strategic decision-making.

- The scalability of ADP allows seamless adaptation to the evolving needs of our growing organization.

One of the primary reasons ADP was selected was its reputation as a reliable HR solution provider. The platform is known for its ability to streamline payroll processes, manage employee benefits effectively, and ensure compliance with changing regulations.

Additionally, ADP's scalability was a crucial factor. It accommodated the evolving needs of our workforce and provided the flexibility to handle increased employee numbers.

- I find occasional glitches in the user interface of ADP frustrating.

- The limitations in customization options can be restrictive for our specific needs.

- There's a concern about potential increased costs as our organization grows with the continued use of ADP.

ADP user-friendly interface makes HR tasks more accessible for our team, and the reporting features provide insights into workforce analytics. Also, the customer support from ADP has been consistently responsive and helpful.

Consider the tool's functionality to ensure it aligns with your HR needs, evaluate scalability for future growth, and assess integration capabilities with existing systems. You will need to scrutinize compliance, security, and the total cost of ownership. Additionally, research the vendor's reputation, inquire about the product's upgrade plans, and take advantage of trial periods to assess real-world performance before making a final decision.

ADP has evolved to meet user needs by enhancing its user interface and expanding its features to address a broader range of HR requirements. This would include payroll processing, benefits administration, and talent management. ADP's scalability has improved, accommodating the diverse needs of both small businesses and large enterprises. The platform's increased integration capabilities enable seamless connectivity with other systems, enhancing overall workflow. Over time, ADP has embraced mobile accessibility, allowing users to manage HR tasks remotely, reflecting its adaptability to changing work dynamics.

In my experience ADP is adaptable to the specific needs of growing companies. It is an excellent choice for users seeking a comprehensive HR solution, encompassing payroll processing, benefits administration, time and attendance tracking, and talent management. The platform is beneficial for those who prioritize user-friendly interfaces that require robust compliance features and reliable customer support. ADP is a valuable and supportive HR management solution.

ADP may not be an ideal fit for very small businesses with basic HR needs. Its comprehensive features may be more robust than necessary. Additionally, companies with an existing HR software system that is deeply ingrained in their processes may face challenges transitioning to ADP. Highly specialized industries with unique HR requirements might also find ADP less tailored to their specific needs.

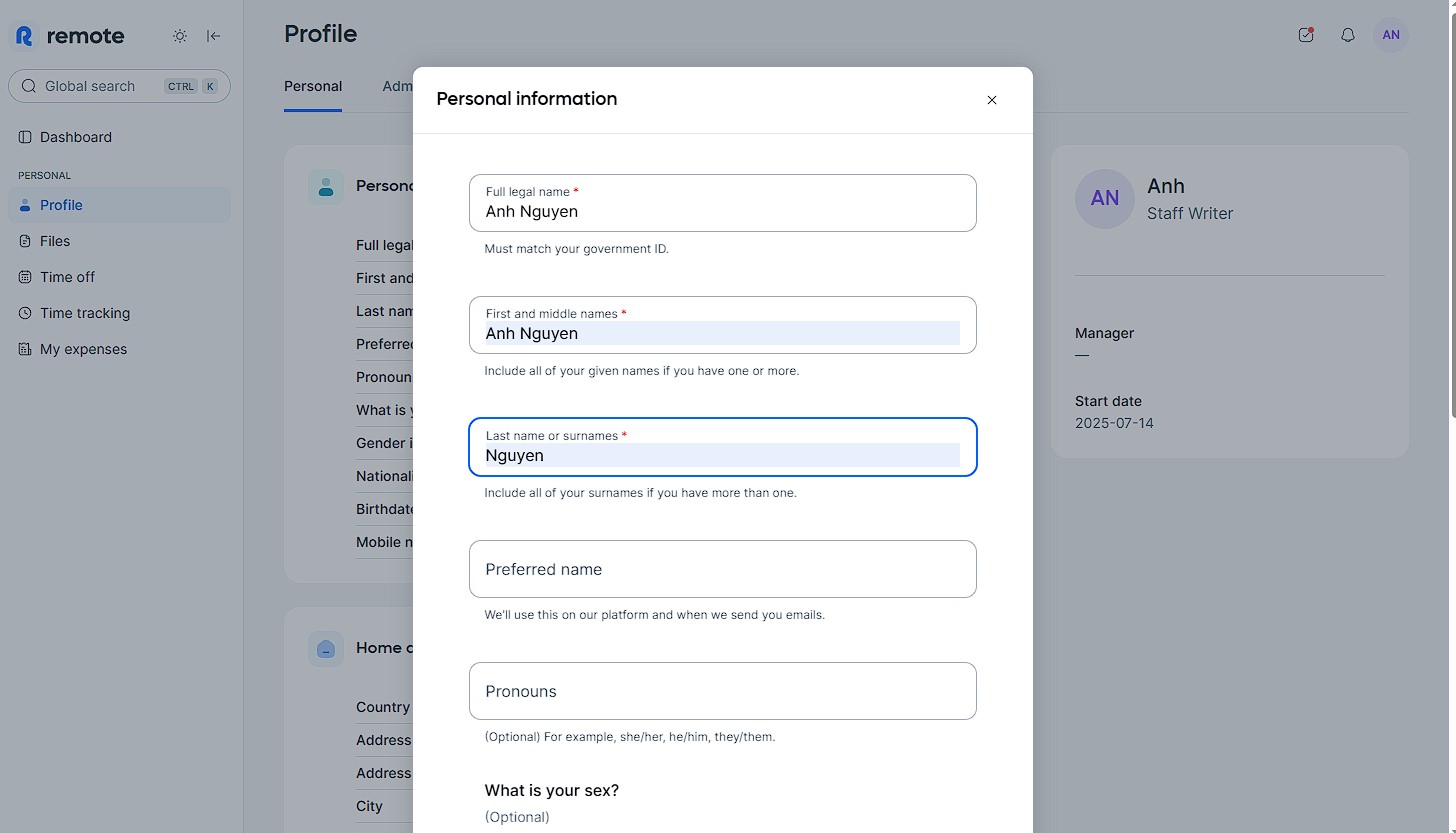

Remote

Remote is one of a few that wholly owns the entities it services. With its 24/7 customer service, Remote is a well-trusted partner for teams to hire and pay their contractors and employees with international compliance considerations in mind.

PROS

- Remote provides flat rates – no markup on the platform’s benefits premiums.

- Discounts and incentives for startups, nonprofits, and employers hiring refugees

- Supports multiple currencies for billing: EUR, USD, AUD, CAD, DKK, GBP, JPY, NZD, NOK, SEK, or CHF.

- Mobile apps are easy to use and updated frequently.

- 24/7 support is reported to be highly responsive.

- Remote offers free HR tools and guidelines specific to the places they operate.

- Equity-based compensation available.

- Fast and compliant payroll in 170+ countries.

- Live chat support with local payroll experts.

- Flexible, localized benefit packages.

- Flat-rate pricing structure, no deposits or hidden fees.

- Mobile app streamlines expense reimbursement with autofill from receipt photos.

CONS

- Some employers reported difficulty using the platform, particularly when navigating tax management and compliance.

- Doesn’t provide phone support.

- The platform only supports direct deposit and wire transfers in USD, GBP, and EUR. There are no off-cycle payrolls.

- Doesn’t have a free trial.

- Redundant for organizations solely recruiting within the U.S.

- Help center documentation isn’t easiest to understand.

We recommended Remote because of its smart features and fair price guarantee.

For companies that own local entities in the countries in which they operate, Remote can provide local services for payroll, benefits administration, and contractor payments.

Those who do not have legal entities can use Remote’s global employment services: the platform acts as an employer of record (EOR) by employing workers on their behalf. It provides intellectual property protection, takes on labor law compliance, and manages invoices, payments, and benefits.

In this field, Remote is among the few that “owns local entities” in the countries where they offer global payroll services. In the most basic terms, this business structure allows Remote to pay people who live and work in those countries directly.

However, if you’re in the market for a payroll solution with extensive built-in integration options, Remote may not be the platform for you, though they do offer free access to their custom API.

Arduino, GitLab, Paystack, Loom, cargo.one, Secureframe, Phaidra.

- Contractor Management plan: $29/contractor/mo

- Employer of Record plan: $599/employee/mo (when paid annually)

- Global Payroll and Remote Enterprise plans: Custom prices – contact Remote.

- Startup and nonprofit discount: Eligible startups and nonprofits can get 15% off EOR and Contractor Management services for 12 months.

- Refugee discount: Up to 10 employees free when hiring refugees.

Best For

The platform is excellent for remote-first businesses operating in countries where Remote has local entities.

Remote was introduced to an international employee or contractor after they were hired and the first part of their onboarding process. They were asked to complete basic personal information; such as address, contact info, emergency contacts, and bank details for payment. Medical benefits were offered to employees and could be elected through the platform. Once employees and contractors were onboarded they could access their portal at any time to view their personal details, and pay stubs. Payroll ran on a bi-weekly and semi-monthly basis for employees and contractors, this was dependent on their in-country laws and was processed completely by Remote. We would fund the platform a month in advance for payroll. In some cases we had employees who submitted timecards for overtime differential.

The platform was easy to onboard new employees, and select and edit all personal and employment details. Employees and Contractors were paid timely and we never ran into any payroll issues of people not being paid on time. We had monthly calls with our Account Rep who was always willing to step in to escalate or help answer any questions we had or anything that came up that was employee specific.

Our org purchased the platform so we could pay and offer benefits to our international employees. I used Remote for just under 2 years. We had over 50 employees in 5-10 different states and using this platform allowed us to offer benefits in those local countries, along with any other country-specific benefits that in some cases we were required to offer. Remote also served as our EOR, employer of record, and provided legal protections related to employee terminations. All international employees and contractors were onboarded into the platform at hire and could access their portal at any time.

There was no reporting function. There would be payroll reconciliations each month, sometimes there was a payment due to us and other times we underfunded accounts, this posed problems with forecasting and budgeting for our finance team. It was unclear and not detailed on employee pay stubs to see what the benefits breakdown was for employees and employers. Meaning who was covering what percentage or what amount was being paid by each party on a biweekly or monthly basis.

I know Remote is an EOR and not all international platforms are. Over the last year I used a different international platform and did prefer that over Remote. The functionality was built out more, support was more responsive and as the HR admin I had more control over the contracts and editing.

How many employees or contractors you are planning to hire internationally. Does Remote support those countries and in what way? What is your annual budget for an International HRIS tool? How do you want federal taxes to be withheld from international employees or contractors? Do you want to offer benefits to international employees? If so, what benefit tiers are you looking to offer, can Remote support your company goals.

Remote increased the number of countries they offered onboarding and hiring during the time I used the platform.

Companies looking to hire internationally and ones' where they do not want to be the Employer of Record and would prefer the HRIS have an entity in the countries you are looking to hire in and be the EOR.

Organizations that do not have any plans to grow globally.

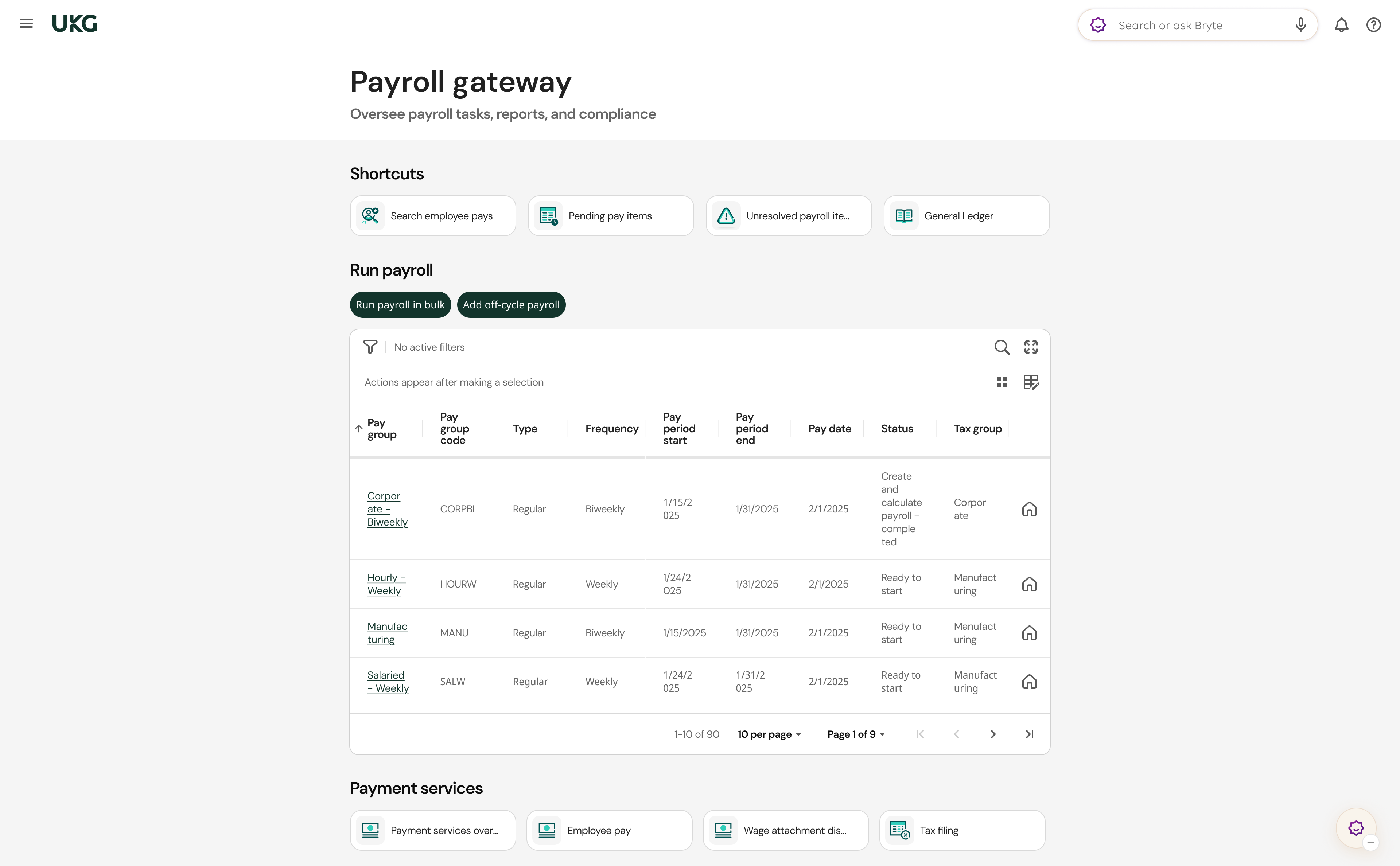

UKG

UKG is more than a payroll tool. The platform offers enterprises worldwide solutions for paying, managing, and developing employees, and everything in between.

PROS

- Supports off-cycle payments and on-demand pay.

- Configurability allows administrators to determine what each user group can see within the system.

- The Ultimate Community feature offers valuable on-demand information and facilitates networking with other UKG Pro users.

- Customer support includes dedicated account managers and 24/7 customer support in English and Spanish.

- A mobile app is available for both Android and iOS users.

- Payroll + HRMS + workforce management needs can be met with one tool

- Super robust product, packing years of experience with HCM and Workforce Management technology

- Since they offer UKG Pro for HRMS and UKG Ready for workforce management, you could arrive at a combination of products that suits many of your HR needs from the same set of tools.

CONS

- Compared to many newer tools, it lacks a unique selling point or specific focus. Though suitable for enterprises across industries, niche operations are not well-matched.

- UKG is an all-in-one, so it’s not good for uses with just a few, specific use cases.

- Can be expensive for teams with limited budgets.

- Some users reported issues with logging in on the Android app.

- Compared to newer tools, UKG Pro and UKG Ready tend to miss a unique selling point or a specific focus on a certain type of business. While they work great for bigger companies in all sorts of industries, very niche operations might have a hard time adapting to the tool.

- Similarly, UKG offers many solutions under one umbrella, so it's not the best fit if you're looking for only a handful of specific use cases.

In our assessment of UKG Ready, we dove deep into its offerings beyond payroll management. The platform aims to address the scope of needs of enterprises worldwide, providing diverse solutions for payroll, employee management, development, and more.\

Their support for off-cycle payments and on-demand pay is a stand-out feature. This flexibility allows employers to adapt to unique situations and gives employees timely access to their earnings. Additionally, UKG Ready covers multinational payroll, ensuring compliance and accuracy in the complex landscape of global payroll processing.

We've found that UKG Ready's configurability plays a crucial role in tailoring user experiences. Administrators can fine-tune what each user group can see within the system, providing enhanced security and personalized access to relevant information.

The Ultimate Community has been a valuable resource as we explored UKG Ready. It offers on-demand information and facilitates networking opportunities with other UKG Pro users. This community provided insights, and we learned from the experience of other organizations.

Customer support is an important aspect of any software, and UKG Ready doesn't disappoint. With dedicated account managers and 24/7 assistance in English and Spanish, users can find support when needed.

While UKG Ready boasts a mobile app for employees, accessible to both Android and iOS devices, we must acknowledge that user reviews have been mixed. Some users have encountered issues logging in and accessing timesheets, which can negatively impact the overall user experience.

Tesla, Marriott, Yamaha, Aramark, Puma, Sony Music, Samsung.

- Pricing for UKG is not disclosed on their website.

- It is typically based on a per-employee-per-month model, with options for annual or monthly billing.

- Based on our research, licenses typically start at around $600.00 per year for every 5 users. For an accurate quote, contacting a sales representative is necessary.

Best For

UKG Pro primarily targets businesses with over 75-500 employees, while UKG Ready is designed for companies with more than 500 employees. Its versatile software finds utility across diverse industries. Even smaller teams seeking an HCM-driven approach to workforce management can effectively harness the capabilities of this software solution.

We use UKG for HR, payroll, and benefits administration. We plan to use it for training and recruitment later on. I added fleet management once the core modules were in place. We also added the recruitment module, which easily integrates with all the major hiring platforms. This feature allows you to follow an applicant from application to hire.

It is multifaceted. It can be used to monitor your fleet, issue ID cards, and handle many other HR functions. It is excellent for a larger-sized workgroup.

We bought this tool to replace our existing platform, ADP. ADP was cumbersome and outdated. They no longer provided user support for the version we had been using. After completing an RFP, we decided on UKG, which had many more features. We have utilized this tool continuously and still do. I have used this tool for one year. I am always adding and testing new functionality within the system, such as fleet management.

It is so robust that many of the screens are unnecessary. It is difficult to customize screens to meet the organization's needs. Implementation was difficult and time-consuming.

It is different in that it offers a variety of screens that help you track everything from ID cards issued to company cars assigned to keys issued.

Consider the size of your organization. This product is not suitable for a small organization. Additionally, you need extra staff to implement it properly.

Although I no longer use it, I believe that, due to market competition, they have improved.

It is ideal for larger organizations with a broad spectrum of tracking needs and multiple locations. A moderate level of computer proficiency is also recommended.

Smaller groups with fewer than 2,000 employees won’t find UKR to be the right fit.

Papaya Global

Papaya Global is one of the fastest-growing companies in the global workforce management space. It’s one of a few that can do a bunch of things — global workforce spending, connecting HCM and ERP processes, and strategic payroll data — with speed and accuracy.

PROS

- Papaya has a transparent pricing structure. The platform even provides a 60-day money-back guarantee if you are unsatisfied with its performance.

- The BI analytics suite lets you get a snapshot of your current payroll spending, drill down and compare costs over periods, projects, or locations.

- Local customer support. Dedicated account managers or compliance experts are available for all plans.

- Full-service payroll guaranteed payouts in 72 hours and EoR services in 160+ countries.

- The current starter monthly fee for the full-service payroll plan has decreased to $12 per employee (it was previously priced $20).

- Recently added data and insights, supplemental benefits & immigration support, payment services, and employee data management as four individual solutions, making the tool more affordable and scalable.

- Papaya Global packs the EOR services you need to do global payroll and employment compliantly in over 160 countries.

- Automated payments in over 100 currencies, 80 of them directly to the worker's bank account through its global banking partners.

- Dedicated customer support providing locations-specific knowledge regarding employment and payroll.

- End-to-end payroll guaranteed payouts in 72 hours.

- Offers four standalone solutions: data and insights, supplemental benefits & immigration support, payment services, and employee data management, making the platform more affordable and scalable.

CONS

- Doesn’t have local entities in the countries it services. No tax penalty guarantee either.

- No free trial or free plan.

- Additional fees include a set-up fee per location, an onboarding fee, a cycle fee per employee, and a year-end fee for tax filing. A refundable deposit is required.

- 24/7 support is only available for the payroll payments category.

- Bulit-in integration options are limited.

- No free trial or free plan.

- Doesn’t own entities in all the countries it serves. The platform forms relationships with existing local in-country partners to handle employment in a specific region on the client’s behalf.

- BI analytics reports and global immigration services cost additional fees.

- Charges extra fees for setup, onboarding, employee cycle, and tax filing. Also requires a refundable deposit.

- Built-in integration options aren’t very robust. However, the platform does offer pre-built APIs, SFTP, and custom API integrations for free.

We have tested a dozen payroll software tools, and Papaya Global is among the most robust options for international operations. One of the main reasons we chose Papaya Global is because of its cross-border payment capabilities. The payroll software can handle multinational payouts and offers customized benefits packages tailored to each country. The platform also provides pay slips in the native languages of staff in over 160 countries. The self-service portal is also in good shape, allowing employees to submit their onboarding documents, request time off, and manage their payslips. Papaya Personal, the platform’s mobile app version, will be released this February, allowing users to view and download their payslips and supporting documents on their phones. The development team has been working on product updates, which will include a payment calendar, the ability to edit bank details, and company announcements.

Another unique feature of Papaya Global is that it can be used for hiring global contractors and assessing their worker classification to prevent labor compliance issues. The platform even leverages AI-based engines to validate invoices for payment accuracy. It also offers a 72-hour payment guarantee and local tax filing assistance, along with 24/7 support. Additionally, it is unique in offering a global equity management tool that helps offer equity to employees as part of their compensation, regardless of where they are.

However, the most notable drawback of the product is that it does not have local entities in countries where it provides services. Instead, Papaya Global relies on its third-party network. While the platform's local partners handle payroll, the responsibility for payroll audit and approval remains with the user, along with any tax penalties that may arise. Furthermore, users should be aware of certain additional fees, such as a set-up fee per location, onboarding fee, cycle fee per employee, year-end fee for tax filing, and a refundable deposit. It is recommended that users contact the Papaya team to obtain exact numbers and compare them with other solutions before making a final purchase decision.

Microsoft, Intel, Toyota, Wix, Fiverr, Johnson & Johnson, Deezer

Papaya Global has added four standalone services in addition to its three plans:

- Full-Service Payroll service: Depending on your operation, fees start from $20 per employee per month. The solution includes its advanced payroll platform, embedded payments, global partner network, and employee portal.

- Payroll Platform License service: Starting from $20 per employee per location, this solution is for those that want to upgrade their payroll and payments technology without replacing the current payroll partners.

- Data and Insights Platform License service: Starting from $150 per employee per month, this solution includes tools for real-time analytics on payroll costs and headcount.

- Payments-as-a-Service service: Starting from $3 per employee per month, this solution comes with an embedded platform designed for workforce payment.

- Global EOR plan: Papaya Global’s in-country partners function as employers of record, being responsible for payroll, workforce management, employee benefits, compliance, and more. You can still stay up-to-date on everything through the platform, and this plan is between $770 and $1000 per employee per month.

- Contractor Management & IC Compliance plan: Particular services are outsourced to a domestic or foreign contractor for periods of rapid growth and the need to reduce labor costs. This plan starts at $25 per employee per pay cycle.

- Payroll Intelligence Suite plan: This plan lets you consolidate all workforce and payroll data from all your operations into a single dashboard, priced at $250 for an annual plan or $320 quarterly per location.

Best For

With the additional standalone solutions, Papaya Global has become a sound option to handle cross-border payments and multicurrency payouts for not only large enterprises but smaller ones that are expanding their global teams.

I primarily used Papaya Global to ensure we were hiring the right people globally while complying with local labor laws. It was invaluable when onboarding new employees, making sure everyone felt welcome and informed, no matter their location. The tool’s reporting capabilities were also extremely useful, particularly when reviewing compensation to ensure fair and competitive pay.

Additionally, it helped manage day-to-day HR tasks like monitoring employee well-being and managing benefits. It was essential in keeping everything organized and transparent across the company, regardless of where employees were based. I used it frequently, as it was like a Swiss Army knife for all HR tasks, especially for managing global operations.

I liked the main dashboard because it was user-friendly, allowing me to access important information quickly. Papaya Global integrated well with the client's existing HR tools, making it easier for everyone and ensuring smooth data flow. The reporting was accurate, providing the exact details needed for decision-making. Lastly, the tool had great scalability, adapting to the client’s needs as they grew without any issues.

I used Papaya Global while working with a client as a freelancer in HR. They started using it because managing HR tasks across different countries was becoming overly complicated and time-consuming. They struggled to keep up with the various labor laws and maintain communication with their team spread around the globe. The tool was a lifesaver, providing a single platform to handle everything and keep everyone aligned.

Personally, I’ve been using it for about two years, and it has been incredibly helpful. It automates repetitive tasks that used to take up a lot of my time, all with the click of a button. It also integrates seamlessly with their other HR systems, allowing information to flow smoothly. It has saved both me and the client significant time and effort.

One major downside is that Papaya Global is quite expensive for what it offers. It doesn’t have enough advanced features to fully justify the cost. Additionally, it’s not very customizable, so it can be difficult to adapt it to specific business needs. While it automates some tasks, many actions still need to be done manually, which is disappointing considering the price. It also has a steep learning curve, so new users might struggle to get accustomed to it quickly, which can slow down adoption. Finally, customer support is not very responsive, which can disrupt workflows when issues arise.

Papaya Global stands out for its Employer of Record feature, which is especially helpful for managing legal compliance overseas. It effectively handles the regulatory challenges of working across different countries, providing peace of mind without the need for a large legal team. Although I haven’t used other tools, this one excels in handling international employment and compliance. The biggest advantage is the confidence it offers in ensuring compliance globally. Managing complex HR tasks across different countries is much easier with this tool, making it invaluable to our company.

When considering a tool like Papaya Global, it’s crucial to assess your company’s global footprint and ensure the tool can handle payroll, legal matters, and hiring across multiple countries. It’s also important to choose a tool that works in locations where you don’t have an office, as this helps you stay compliant with local laws.

Usability is another key factor; a user-friendly tool will help your HR team get up to speed quickly and keep operations running smoothly. Lastly, verify that the tool integrates well with your existing HR systems to allow for seamless data transfer.

By expanding to more countries, Papaya Global has stayed ahead of the competition. It now offers a broader range of services, helping companies manage global offices effectively. Over time, it has improved its legal compliance capabilities, which is critical when dealing with different countries' regulations. The tool has also become smarter with automation and reporting, streamlining processes and freeing up users to focus on more important decisions.

In addition, the platform has been enhanced to make navigation easier, even as it grows more powerful. This has made it a go-to choice for companies with employees spread across the globe.

Let's not forget about the look and feel of the thing. Papaya Global has put a lot of effort into making sure that using their platform is as easy as pie. It's all about making it simple to understand and navigate, even as it gets bigger and more powerful. This has turned it into a go-to choice for companies with employees scattered across the globe.

Papaya Global is ideal for large businesses that deal with complex salary management, especially when they operate in multiple countries. It’s perfect for companies with a diverse global workforce that need a robust system to comply with various labor laws and regulations.

Businesses that value seamless integration with existing HR systems and require advanced technology to handle complex tasks will find this tool especially beneficial. Even if a company doesn’t have offices in every country they hire from, this tool can manage payroll effortlessly.

Papaya Global might not be the best pick for companies with basic payroll needs because it could come with more bells and whistles than they actually need. If you're a small business with a tight wallet, the price might seem a bit steep, especially if you're not looking to manage payroll across different countries.

Plus, if your team isn't full of tech personnel or HR minded individuals, you might find it a bit tricky to use and might not get the most out of all its fancy features. For places like that, something simpler and easier on the budget might be the way to go.

Rippling

Rippling is a scalable payroll and HR solution designed for organizations with under 2,000 employees. Besides US and global payroll, the platform packs thousands of benefits plans and hundreds of integrations. It even lets you work with your preferred broker.

PROS

- Rippling payroll software automatically updates work hours, deductions, and tax filings.

- Supports US and global payroll.

- 500+ integration options.

- Lets users work with their chosen broker.

- Accessible via mobile devices.

- Modules can be bought separately or jointly.

- All-in-one platform for employee management + PEO services offered, and even a suite of other IT products

- With 500 integrations, it’s very likely that they integrate with other key tools from your tech stack.

- Operates globally with any currency

- Workflow automation

- Analytics opportunities

- Provides a holistic view of company outflows—headcount costs included

CONS

- No option to automate payroll.

- Undisclosed pricing. Doesn’t offer a free trial.

- Support via phone calls costs extra.

- Not the best solution for organizations with 2,000+ employees.

- The mobile app doesn’t perform as well as the browser version.

- Total buy-in to Rippling is essential

- Very SMB-oriented, in case you’re a larger company.

- New features tend to be buggy in ways that tech teams are not accustomed to fixing

Rippling is a capable option that helps businesses manage their HR and payroll with greater efficiency. Despite the software's relative youth in the market (the company was founded in 2016), we are impressed by how quickly it has evolved since it was first introduced.

With over 500 integrations, Rippling stands out as a highly connected platform. The benefits management tool allows flexibility in choosing brokers and benefits packages, although the mobile app could benefit from improvements in speed and functionality.

Rippling's extensive feature set is another decisive factor for why the software is consistently on our best-of payroll selections. It consolidates payroll and HR tools in one place, enabling quick payments to employees and contractors. While full payroll automation is not available, many workflows can be automated, including updates to work hours, deductions, and tax filing.

Last but not least is Rippling’s UI. It looks nice and clean, with features that are easy to figure out. However, the one area where Rippling falls short is that we cannot use our brand color to tailor the interface.

What could be done better? We thought of the tool's pricing structure. Pricing details are not transparent, requiring a demo with a sales representative for module costs and potential additional fees. It's worth noting that Rippling Unity is added by default to any module purchase, and while Rippling has support via phone, it will cost you additional fees.

Vox, Maximum Games, Superhuman, Compass Coffee, Highnoon.

Rippling pricing starts at $8 per employee per month. For more information, please contact the Sales representative.

Best For

Rippling can be used by US-based businesses as well as global organizations to pay their employees and contractors. The ideal team size is between 50 and 2,000 employees.

Rippling was primarily used for recruitment, with some use for onboarding since the number of employees being hired was still relatively small. The ATS and onboarding systems integrated seamlessly, allowing for an efficient workflow.

The tool was predominantly utilized during recruitment, where its dashboards and customizable recruitment processes proved especially helpful. Rippling's features significantly simplified the hiring process.

The hiring process was transparent and straightforward. I found Rippling's dashboard particularly helpful and user-friendly. The onboarding process became significantly easier, and the smooth integration between the systems was a major advantage.

I was working with a start-up where everything related to resume management, onboarding, and offboarding was done manually. Payroll was managed through QuickBooks.

Rippling was introduced because there were plans to expand the workforce, creating a need for a system that could streamline and organize processes efficiently without consuming too much time.

Rippling proved useful as it offered both an applicant tracking system (ATS) and tools for onboarding and offboarding. It also includes payroll options that can be leveraged in the future.

I felt that the customer service could be improved. The pricing was a bit high for our budget, but the company went ahead with the purchase based on positive reviews. After implementation, we realized that the payroll system might not be the best option for our future needs.

The company chose Rippling because of its positive reviews. I would prefer a system that includes an integrated payroll system in the future so everything can be managed in one place.

It is important to plan how the company will use the system in advance. Pricing should also be carefully considered, especially if expansion plans are uncertain, as was the case with the company I worked for.

I haven’t used it long enough to observe any evolution. It appeared to be the same during my time using it.

This tool is ideal for companies transitioning from manual processes in recruitment and onboarding to automation. I am unsure about its suitability for other features or use cases.

It might not be suitable for companies that don’t plan to expand significantly. In such cases, the onboarding, offboarding, and recruitment portal features may not provide much value.

Paycom

Paycom is known for being an all-in-one payroll solution. The software handles data analysis or tax responsibilities, expenses, and garnishments without needing a third-party tool. They’ve also recently launched a global HCM, making it accessible for both U.S.-based and global enterprises.

PROS

- Paycom is easy to use for both administrators and employees.

- It offers a variety of features, including payroll, time and attendance, benefits administration, recruiting and onboarding, performance management, and more.

- It has several pricing options that are relatively competitive.

- Customer support includes phone support, email support, and online resources.

- The self-service portal makes it easy for employees to access their information and submit timesheets.

- It has a mobile app.

- A dedicated customer success manager is available.

- They recently launched the Global HCM software to expand access to users in over 180 countries.

CONS

- Paycom does not directly load into QuickBooks, which can be a hassle for businesses to manually enter the data.

- Access to tax reports may be slow.

- Some members of the customer support team are new and may not have the best knowledge to answer customers’ questions at times.

- Paycom has raised its prices in recent years.

- There isn’t a free trial.

- Limited integrations

After extensive research, we decided to list Paycom as our recommendation for enterprises due to the comprehensiveness of their payroll and HR offering.

We were particularly impressed with Beti, their guided self-service system, which empowers employees to review and approve their pay accuracy before submission. Beti also allows employees to manage their HR data, including work hours, expenses, promotions, and personal information. On the employer side, real-time updates are available on the dashboard, providing visibility into pending tasks, required actions, terminations, retroactive pay needs, and check adjustments. HR is promptly notified when checks are ready after employee confirmation.

We also had a positive experience with the Paycom mobile app, featuring a well-designed user interface and intuitive functionality. However, it's important to note that Paycom only supports direct deposit and paper checks, lacking the pay card option available in other payroll solutions like ADP.

We chose Paycom primarily for its wide range of features, including payroll tax management, time and attendance, and talent acquisition. However, what sets it apart now is its recent expansion into global payroll and HR services. With the introduction of Global HCM, Paycom now serves users in over 180 countries, a significant improvement from its previous coverage of only 9 countries.

While all of the above is great, we haven’t seen much progress in Paycom’s integration capabilities. The platform only supports API integrations and does not offer specific integrations with other providers, resulting in potential time-consuming tasks such as manual data entry. Additionally, while the customer support team is generally helpful, some of the newer representatives lack expertise, leading to delays in issue resolution.

The pricing of Paycom’s plans isn’t disclosed upfront, so you must contact their sales team to get a custom quote.

Best For

Paycom is an excellent choice for medium and large-sized enterprises to house all their payroll and HR tasks in one system.

I use Paycom for HRIS, talent screening, payroll and to pay contractors.

- Reporting is great

- Payroll is straight forward.

- User friendly.

Printfly switched to Paycom following a brief stint with Namely. The switch was made because we didn't feel that Namely was robust enough for our organization. We switched to Paycom to enable the HRIS system, payroll, and scheduling.

- Tax team is HORRIBLE. They are not customer interfacing and are not held accountable for their errors.

- Problem tickets are not resolved quick enough.

- If you have an issue and you need to call customer service, there is a 99% chance you are not connected to your dedicated rep. The rep you are connected to is usually clueless and cannot assist.

I've used Paychex, Intuit and Gusto in the past. I think that I like Paychex the best because they were easy to get in touch with to answer questions.

Price - It's a costly system. Time - The set up is annoying. You are shuffled around and really need to take the time to teach yourself the system.

Paycom has added things like "ask here" and it allows for users to more easily ask questions about paychecks or benefits. Paycom also launched Beti which pushes employees to approve their own timesheets to ensure that there are no missing hours.

Anyone that is tech savvy

People that do not understand mobile apps

Large Company Payroll Software Use Cases

There are more than a few good reasons for large companies to acquire payroll software. Having a large number of employees means tasks revolving around human capital management can take an exorbitant amount of time and resources. Here are some of the common use cases and benefits of having payroll software:

- Pain-free payroll: The main reason for large companies to get payroll software is for them to have their payroll processes streamlined and automated. Payroll consists of highly extensive and tedious data entry, which can take employees long periods of time to finish.

- Access to experts: For the most part, payroll is repetitive and meticulous work. However, payroll becomes relatively complicated and confusing when it comes to federal taxes. Some payroll software allows access to experts to help during these times.

- Save time: Payroll software saves companies time in a few ways. Primarily, payroll software saves time in its automation. For example, payroll software allows companies to allocate more time and resources to other productive tasks when payroll software takes care of payroll, taxes, and withholdings. The same goes for employees. From new hires to seasoned team members, everyone can see their workload and stress levels reduced if the chosen tool helps them navigate the often complex world of state and federal taxes.

- Compliance guarantee: Complications in filing taxes are not uncommon in businesses, and human error can play a role in certain penalties such as late or incorrect filings and payments. Payroll software is often updated with the latest information regarding tax laws to avoid these common issues.

Large Enterprise Payroll Software Pitfalls

While payroll software can indeed be quite the asset, HR management has to consider some important factors when choosing a payroll service provider for their organization. Choosing payroll software for a large enterprise is a different challenge compared to choosing payroll software for different sized businesses. Here are pitfalls that we’ve identified to help you avoid when choosing payroll software:

- Size Capability: Vendors typically target clients of a certain size. It is important to choose a vendor that has a track record for serving companies your size.

- Scalability: Once you have determined that a vendor is capable of serving a company your size, check whether they are capable of growing along with your organization. Payroll software that could not keep up with your growth trajectory would just be replaced eventually.

- Remote Operations: Since payroll software typically deals with taxes, features are potentially limited to certain geographic regions. It is crucial to choose a vendor that operates in all the remote locations your organization operates in as well. Employer of record services can also help to reduce friction here.

- Compliance: Payroll software is often featured to be up-to-date with all the most recent regulations, but it’s beneficial to make sure. HIPAA and tax violations can be extremely costly.

Large Enterprise Payroll Software ROI

It can be quite tricky to measure the ROI of payroll software, especially for larger companies. For small businesses, outsourcing payroll is a simpler decision as pricing for companies of this size is usually cheaper than having a dedicated payroll administrator with an average salary of $50,000 a year. However, since prices increase as the size of the company increases, larger companies might find it more cost-effective to keep payroll in-house instead of getting a full-service payroll provider.

Because of this, some vendors specifically offer flexible pricing plans that allow their clients to do most of their payroll in-house throughout the year, except when it comes to reviewing and filing tax forms.

Since payroll software is more expensive for larger companies, these companies would have to accurately determine which payroll system is cost-effective for them. This entails accurately determining how productive their current payroll system is, as well as considering their system’s accuracy. How much time does it take to process payroll? How quickly can their payroll system correct errors? How much time does it take to produce payroll reports? What are the business needs? These are some questions that can help tip the scale when deciding if a company could benefit from payroll software.

Large Enterprise Payroll Software Pricing

Pricing for payroll software varies greatly from one vendor to another. Usually offered as a SaaS product, a typical pricing structure for basic payroll without any add-ons would revolve around a base fee and then additional fees per user per month. However, many of these vendors offer customized plans where organizations can structure their plans so that they only pay for what they actually need. Understandably, plans with additional features will cost more.

You can find a sample pricing chart below for a few company sizes. The estimated cost already includes the base fee that organizations would have to pay upfront. You’d still need to contact and consult with each vendor to get an accurate quotation since there are many factors that go into payroll software pricing.

Take note that the price chart above is a highly rough estimate. Some vendors might only charge depending on the number of employees, while some would add a monthly base rate. Remember that there are times where you could still negotiate the prices with the vendor, especially when it comes to initial setup fees.

Key Features of Large Enterprise Payroll Software

Handling larger companies will require software with core features that can significantly reduce workload and ultimately benefit the company. Knowing the features available in these software is key when assessing a company’s payroll needs.

Most vendors offer feature-rich payroll software with highly intuitive, user-friendly interfaces that elevate user experience. It is key that business owners and HR teams are familiar with key payroll features to allow them to choose the best one for their organization.

- Automated and unlimited payroll runs: One of the primary features of payroll software is to automatically run payroll for an organization. This incredibly powerful function takes care of a task that can otherwise cost the organization significant time and human resources to do.

- Off-schedule payroll runs: While payroll software primarily functions to run payroll on regular pay periods, it can also run payroll off-cycle for certain situations.

- Direct deposit: Employers can use payroll software to pay salaries by electronically transferring funds to their bank accounts automatically.

- All tax filing/payments: Payroll software eliminates the trouble of filing and paying for payroll taxes, compliances, and regulations.

- Multiple pay rates and schedules: Payroll software simplifies payments for employees that may have multiple pay rates and schedules.

- Payroll reporting: A payroll report is an important document that allows employers to check financial data or confirm tax liabilities. Since payroll software has access to all this pertinent information, payroll reporting can be done regularly with ease. Online payroll software can even generate reports for team leaders and managers from anywhere in the world.

Questions to Ask During Large Enterprise Payroll Software Demos

Virtually all vendors can offer demos to showcase their payroll software. During demos, it is important to know which questions to ask to effectively assess their offerings. Here are some questions we think you should ask on demos:

- Are you capable of handling a company of our size?

- What is the size of your biggest customer right now? How far would you be able to effectively scale with them?

- Will pricing change as we scale? If so, how so?

- How do you keep data safe for a company this size?

- Do you have a regulatory compliance team?

- Do you operate in all our locations?

- Are you compliant with regulations in all our locations?

- How flexible are your plans?

- What integrations does your payroll software support? Can it integrate with our current technologies?

- Do you have an employee portal? How is its ease of use?

- How will direct deposit work?

- What’s your implementation like? How is customer support? Is it real-time?

- How does your interface work? Do you have a mobile app?

Large Enterprise Payroll Software Implementation

Implementation can look quite different from one vendor to another, but the primary factor involved in how long implementation will take is how big the client is. Understandably, implementation of new payroll software for a large enterprise can take up to a couple of weeks.

Fortunately, there are ways companies can help expedite the process. For example, implementation can take place much quicker when the client provides the relevant employee information as soon as possible. This relevant employee data includes employee names, departments, positions, salary information, and so on.

Large Enterprise Payroll Software FAQs

What is payroll software?

Payroll software is a technology designed to manage, streamline, and automate payments and invoicing to employees, as well as help maintain tax compliance and regulations. Many of these payroll software vendors also include other services such as benefits administration.

Does a company need software to do payroll?

No. Traditionally, companies have done payroll manually. However, processing payroll without the aid of a payroll software solution requires a significant amount of time and labor. Small business owners might typically assign payroll tasks to Human Resources, while larger companies can acquire dedicated payroll administrators to process payroll.

Last Advice on Buying Payroll Software for Large Enterprises

Payroll software can potentially allow employers to save time and resources that would have been dedicated to a task that software can do better and quicker. However, it’s important to assess which payroll system would actually yield a positive ROI for a company of your size.

If there’s anything we can advise, it’s that you should check out 2-3 demos to get started. Take notes of what you liked and things that you may have found lacking. From there, you can begin to check out other demos and eventually evaluate which payroll software offers the most benefits to your organization.

About the Author

About Us

- Our goal at SSR is to help HR and recruiting teams to find and buy the right software for their needs.

- Our site is free to use as some vendors will pay us for web traffic.

- SSR lists all companies we feel are top vendors - not just those who pay us - in our comprehensive directories full of the advice needed to make the right purchase decision for your HR team.