10+ Best Employee Financial Wellness Programs (2026)

The best employee financial wellness programs, handpicked by HR tech experts. Find in-depth vendor reviews below including features and pricing comparisons.

Financial wellness has been getting a lot of buzz these past few years— and for good reason. After all, today’s workforce is still crippled by mounting student debt and other rising expenses due to rampant inflation. The resulting financial stress often damages an employee’s engagement, productivity, and attendance. It’s no wonder then that companies are launching financial wellness programs to help their employees take control of their finances with tools to spend smarter, reduce debt, and save more. If you’re one of those companies, then this guide is for you.

But where to begin? There is so much to consider here, from the different types and providers of financial wellness, to how to budget for such a program and measure ROI, to optimizing implementation and employee usage, and more. In this guide, we break it ALL down, so you can make the best decision for your employee— and, in turn, your bottom line.

We determined the best employee financial wellness platforms by testing multiple products, gathering user feedback, and leveraging expert insight. Starting with a list of more than 20 platforms, we narrowed it down using evaluations for how each performed across multiple criteria, but most importantly in terms of education, integration, and customer service.

- Education:

Financial wellness is a lifelong endeavor, so we evaluated each platform for the long-term benefit it represents for employees. For short-term benefits, we looked for access to licensed financial coaches, one-on-one coaching, and personalized budgeting help. We also checked for access to educational resources, including guides, articles, blogs, and workshops. - Integration:

Functionally, a good financial wellness platform should connect your employees and their everyday bank accounts to awesome financial products. We evaluated each software platform for the number and quality of offerings represented by their benefits portal, and the ease with which they could be connected to top banks. - Custom Service:

To inspire workers to use this optional software, our experience tells us that it must be backed by excellent customer service. Our evaluation process here focused on customer satisfaction data and on factors more closely related to employee engagement. This is critical because ROI metrics are contingent on tool use, so adoption and continued engagement are necessary to justify the purchase.

Our personal experience and the input of our network of thought leaders led us to this conclusion: there is a trend toward employers providing resources for comprehensive financial literacy to their employees. The proliferation of employee financial wellness tools is evidence of this trend.

We use empirical criteria and decades of cumulative HR experience to create lists like this one. If you want to learn more about our methodology, you can read this article on how we assess HR tech vendors.

Your Money Line

Your Money Line empowers employees to achieve financial stability through a host of educational resources, user-friendly money management tools, and personalized coaching that’s unbiased and empathetic; they don’t promote or sell any financial products and strive to maintain consistent coaches to build trust and deliver seamless service.

PROS

- Your Money Line has a team of certified coaches that guide employees on financial management and getting out of debt. Once an employee is assigned a coach, the same coach will remain with them so they don’t have to repeat previously shared info or context to different coaches.

- The employer covers all costs to use the platform; there are no fees imposed on employees.

- Employees can instantly access Your Money Line’s coaches via live chat, phone, or email. For complicated questions, Your Money Line’s team is still committed to providing an answer in under 24 hours.

- Your Money Line has a team of certified coaches that guide employees on financial management and getting out of debt. Once an employee is assigned a coach, the same coach will remain with them so they don’t have to repeat previously shared info or context to different coaches.

- The employer covers all costs to use the platform; there are no fees imposed on employees.

- Employees can instantly access Your Money Line’s coaches via live chat, phone, or email. For complicated questions, Your Money Line’s team is still committed to providing an answer in under 24 hours.

CONS

- There isn’t a mobile app yet, but the web app is fully optimized for mobile use.

- Like with many financial wellness platforms, some employees may be hesitant to share financial information with others which means a lower adoption rate across the organization.

- There isn’t a free trial at this time.

- There isn’t a mobile app yet, but the web app is fully optimized for mobile use.

- Like with many financial wellness platforms, some employees may be hesitant to share financial information with others which means a lower adoption rate across the organization.

- There isn’t a free trial at this time.

Your Money Line’s financial wellness platform aims to help individuals achieve long-term financial stability and reduce stress related to personal finances. There are core offerings you can access upon signing up: personalized coaching, educational resources, and intuitive financial management tools.

Starting off with the personalized coaching, the way it works is that as soon as you’re onboarded, each of your employees gets assigned one of Your Money Line’s certified financial coaches, also referred to as Financial Guides. These experts provide unbiased, confidential guidance tailored to each individual's unique circumstances and goals; whether someone is just starting their financial journey, facing specific challenges, or looking to build generational wealth, the coaches are equipped to offer empathetic support and actionable recommendations.

Employees can easily reach their coaches through various communication channels and scheduling options, including phone, email, text, live chat, or virtual appointments. Complementing the coaching aspect, Your Money Line's platform offers a wealth of educational resources, including articles, videos, and comprehensive courses covering a wide range of financial topics. From budgeting and debt management to homeownership and retirement planning, these resources are designed to empower individuals with the knowledge they need to make informed financial decisions.

One neat feature the platform offers is account aggregation, which gives employees a consolidated view of all of their financial accounts - including bank accounts, investments, and outstanding debts - so they can monitor their spending, track their net worth, and receive AI-based personalized insights.

Another particularly noteworthy aspect of Your Money Line is their expertise and commitment to guiding individuals through the complex process of Public Service Loan Forgiveness (PSLF). Their team of experts frequently helps eligible borrowers navigate the program's intricacies, increasing their chances of successfully obtaining loan forgiveness, which can result in substantial financial relief.

While Your Money Line's offerings are comprehensive, one potential barrier to adoption could be a lack of trust in financial coaching. However, the team does a good job of addressing this by emphasizing the confidential and unbiased nature of their services, focusing on guiding individuals through everyday financial challenges rather than solely catering to those with significant wealth. Your Money Line’s experts also don’t promote or sell any financial products, so employees can trust that the advice they’re receiving is free from bias and without any ties.

Over 250 organizations use YourMoneyLine’s solutions including The University of Chicago, OneAmerica, and Hyland.

The pricing for Your Money Line’s solutions ranges from $3 to $6 per user per month, depending on the packages, deal terms, etc you agree on. To get an estimate based on your business size and needs, we recommend booking a demo with Your Money Line’s Sales team.

Best For

Companies of all sizes use Your Money Line to provide financial guidance to employees, though it’s worth noting that the platform is most impactful for businesses with 500-2000 employees.

We introduced Your Money Line as a new perk for U.S. employees during open enrollment. We then hosted a lunch-and-learn with the team, which resulted in decent enrollment following the session. We track registration and active cases in our HR dashboard metrics.

From an admin perspective, I haven't used it much beyond implementation, aside from occasionally reviewing the dashboard. The tool is introduced during open enrollment and included in the benefits guide for new hires.

The simplicity of Your Money Line from the user perspective makes it easy to search for needed information. The admin dashboard is helpful for tracking enrollment over time. The resources and courses included appear to be useful tools.

Your Money Line was not something we were actively researching, but our broker suggested it as a value-add for our employees at no cost to them. We were looking to add additional perks for employees, and some expressed interest when we surveyed them about financial resources. We have used it for a year.

It provides employees with access to financial counselors who assist with planning for life events, budgeting, saving, and more. It also offers tools for credit monitoring and budgeting.

The admin dashboard is limited in terms of the data it provides. There are not enough touchpoints to encourage consistent employee engagement. It also includes credit insights on employees, which do not seem necessary.

I don't have another comparison. At the time, we did not evaluate other tools. Your Money Line was offered as an add-on through our broker.

Consider whether this is a tool employees are requesting. Think about the demographics of your workforce. Consider how much time you can dedicate to promoting the resource. The tool and financial counselors offer valuable information, but what kind of ROI can you expect if employees don't engage with it?

Your Money Line appears to regularly add new courses and content.

Your Money Line may be helpful for employees in certain life stages, such as those paying off student loans. It's also reasonably low-cost, making it a potentially useful perk.

Smaller companies might be better served by investing in more essential benefit offerings.

Enrich

Enrich is used by companies for creating personalized financial wellness programs for their employees. With it, you can educate your employees on their benefits, increase productivity, impart financial literacy, and measure their efficacy.

PROS

CONS

Enrich is an easy-to-customize financial wellness program that aims to educate workers about achieving financial goals.

Through articles, videos, infographics, and more, they can help your employees increase credit scores, maximize 401(k) contributions, and decrease the financial stress that may take away from employee satisfaction and productivity.

Enrich is from the same company as iGrad, a financial education program that partners with more than 600 colleges to teach students how to better manage their finances.

Humana, Mutual of Omaha, Geico Credit Union

Best For

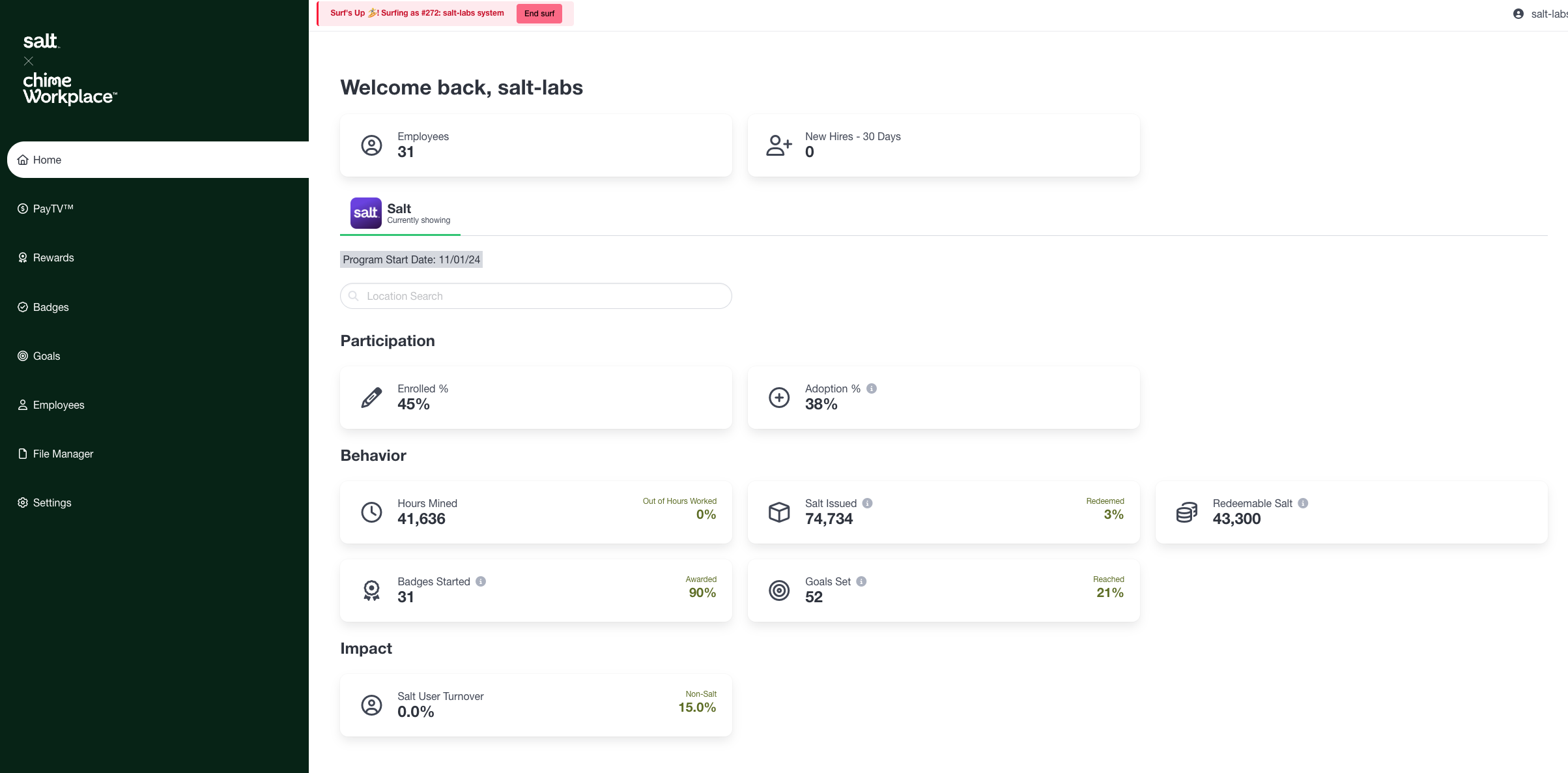

Chime Workplace

We selected Chime Workplace for its frictionless integration of earned wage access (EWA), digital banking tools, and employee-facing financial education — all in a fully mobile, employee-centric format. What stood out most during our demo was how quickly and easily employees can access their earnings directly through a debit card, with no fees or interest involved.

PROS

- Employer-led earned wage access with no employee fees or credit impact

- Fully mobile onboarding with instant virtual debit card access

- Integrated savings and spending tools to promote healthy financial behavior

- Includes Salt, a digital rewards and education hub to boost financial literacy

- Quick implementation — can be up and running in a matter of days

- Free to offer — no employer fees or per-user pricing

- Employer-led earned wage access with no employee fees or credit impact

- Fully mobile onboarding with instant virtual debit card access

- Integrated savings and spending tools to promote healthy financial behavior

- Includes Salt, a digital rewards and education hub to boost financial literacy

- Quick implementation — can be up and running in under 2 days

- Free to offer — no employer fees or per-user pricing

CONS

- Requires employer funding, which may not suit all payroll structures

- Only available in the U.S., with no current support for international teams

- For now, it doesn’t have deeper financial wellness functionality like retirement planning tools or insurance/401(k) integrations offered by other financial wellness software platforms. That said, they do offer various saving incentives if they partner through the employer. In a similar manner, the employer can use the tool to offer more financial wellness tools of their own initiative.

- Requires employer funding, which may not suit all payroll structures

- Limited reporting features in the HR admin portal at the time of writing

- Only available in the U.S., with no current support for international teams

- For now, it lacks deeper financial wellness functionality like retirement planning tools, savings incentives, or insurance/401(k) integrations offered by other financial wellness software platforms.

Chime Workplace is a digitally native employee financial wellness platform developed by the internationally renowned digital bank. For their enterprise tool, it’s remarkable that they bring together early wage access, smart banking tools, and financial education under one roof.

From the moment we explored the MyPay portal, we appreciated how streamlined and approachable the experience is, both for HR and end users. Employees gain instant access to a digital debit card, real-time pay visibility, and the ability to access their earnings ahead of payday if needed. All this happens with no loan underwriting or predatory fees, which are unfortunately still common in some EWA programs.

Beyond core EWA, Chime sets itself apart as a financial wellness tool with its consumer-grade digital banking features. Employees can opt into automatic savings, receive real-time spending notifications, and utilize the PayTV feature to track their spending, adding a somewhat gamified approach to saving and budgeting. For example, employees using the instant loan feature can improve their credit score via a recently-added tool. These tools might be familiar to Chime’s tens of millions of retail users and bring that same UX polish to workplace benefits.

HR teams, on the other hand, receive a lightweight dashboard that allows them to manage employee enrollments and payroll file uploads. The trade-off is that Chime isn’t built for deep analytics — it doesn’t currently support advanced financial wellness scoring or engagement segmentation. However, suppose your goal is to offer high-impact financial access with minimal administrative effort. In that case, this platform is ideal, especially if you are dealing with great numbers of deskless employees who might prioritize mobile access.

For a premium, Chime also bundles in access to Salt, a financial learning and rewards platform. Employees can earn incentives for completing money education modules — a feature that not many EWA vendors offer.

That said, Chime Workplace doesn’t provide the holistic financial well-being ecosystem you’d get from more dedicated platforms. There are no “what-if” financial planning scenarios, 401(k) or insurance integrations, or behavioral savings nudges. It also doesn’t partner with brokers or advisors to support household-level financial decision-making, meaning it's better suited for short-term financial stability than long-term wealth building.

Still, if your company wants to offer real-time access to wages and digital-first banking tools without employer fees or complex setup, Chime is a compelling option, and it's definitely one worth considering for HR teams seeking a mobile-first approach that's quick to implement. It’s also one of the only free tools in this space.

Chime does not publicly disclose its employer customers, but its flagship app serves over 20 million users in the U.S. To us, that’s indicative of a strong infrastructure and user familiarity.

Chime Workplace is free for employers. There are no setup fees or per-user charges, as the platform is monetized through interchange revenue from employee spending.

Best For

Chime Workplace is an excellent fit for U.S.-based companies that want to offer earned wage access and comprehensive financial wellness solutions which also include no-fee banking for employees without fees or compliant and regulation risks.

LearnLux

Unbiased, configurable, and holistic, LearnLux helps employees reach their financial goals. With LearnLux, employees get a financial advisor who guides them personally and helps them create a plan.

PROS

CONS

LearnLux helps employees increase their financial wellness through intuitive lessons and workflows designed to drive tangible results (decrease financial stress, increase IRA contributions, pay down debt, etc).

In addition to lessons and workflows, LearnLux comes with calculators to help employees figure out the ROI from changing their financial behavior. They also have certified financial planners that can be reached by chat or phone to answer questions.

One of the most important differentiators is that LearnLux makes money off the fee they charge companies - they are not getting affiliate fees for pushing certain financial products, nor are they backed by a major financial institution.

LearnLux is priced on a per employee per month rate, with enterprise preferred-pricing available.

Best For

LearnLux's financial wellbeing program was created for employees of all incomes in mind.

InvestCloud

InvestCloud Pink is an intuitive financial wellness solution that companies can offer their employees to help them achieve their financial goals and overall wellbeing. Pink uses gamification, behavioral science and educational tools to encourage individuals to be more actively engaged in their financial wellness journey.

PROS

- Offers unique features like what-if scenarios and lessons on household planning, and insurance protection coverage.

- Comprehensive well-being features showcase the platform's holistic approach, which integrates financial stability with general wellness

- Powerful features and unique capabilities such as what-if scenarios, household planning, and life scores.

- Includes an insurance overview called “protection coverage”.

- Also features a general well-being section with content on lifestyle, exercise, diet, etc. which is powered by external content providers. This feature is a nice demonstration of the role that financial wellness plays within general wellness, taking a holistic approach.

CONS

- Free trial option not available

- Though companies may opt to continue providing access to retired employees, workers cannot continue to pay for coverage if they leave the company

- Coaching is primarily conducted virtually or via phone conversations through partner firms, with no in-person meetings currently offered.

- No free trial

- Not available for individuals, so one can only access it if it’s purchased by their employer on the team’s behalf. Effectively, this means that if the employee stops working for said company, they’d lose access to the tool. However, companies can choose to keep providing it to employees once they reach retirement.

- Via the partner firms, Pink doesn't currently offer in-person meetings with financial coaches. Most are done virtually, or via phone conversations.

InvestCloud have created one of the most comprehensive tools we’ve seen in the employee financial wellness space with InvestCloud Pink. Through it, they’ve leveraged some of the tools used by some of the largest financial institutions and present them in an individualized form that your employees can use for their whole household.

Employees can keep track of all their account balances, assets, and insurance through a single tool and get personalized reports based on all this data. Should employees wish, the platform can also connect them to financial advisors who can provide even more detailed insights on the visual reports that InvestCloud Pink generates.

Pink has been designed to help businesses bridge the divide between individuals’ current financial status and their futures.

Across all Pink clients, there are over 110,000 enrolled users with some of the largest companies in the world leveraging InvestCloud’s unique approach to helping employees with their financial wellness.

InvestCloud Pink has a flexible economic model based on a minimum annual subscription (with an allotted number of active users), functionality utilized, and per-user pricing for additional users above the allotment. They strive to ensure the economic model fits any budget and work with organizations big and small.

Best For

InvestCloud Pink is a scalable solution, with current clients in SMB, Mid-Market, Enterprise, and Fortune 500 organizations. Although their primary client base is in the US, due to their global presence they are able to support all jurisdictions. They are quick to adapt to a new customer base since their core product can be translated into all languages.

Gradifi

Designed to help your employees with their financial goals, Gradifi comes with many compelling features such as financial wellness learning modules, interactive tools and calculators, and Gradifi student loan refinancing marketplace.

PROS

CONS

Gradifi enables companies to offer student loan repayment as a company perk. This is huge in an era with student debt nearing $2 Trillion in the United States alone. As part of E*TRADE, Gradifi helps companies large and small to enable their employees to pay down their student debt 25% faster. In addition to student loan repayment, Gradifi also offers financial wellness tools, resources, and college savings solutions for employees' families.

Pricewaterhouse-Cooper, Carvana, Peloton, Mattel

Best For

Gradifi is best for larger companies.

Spring

What makes Spring great is that it's packed with many useful features: customized financial education, simple budgeting tool, goal setting and tracking, progress reports and insight, financial wellness coaching, among others.

PROS

CONS

Formally known as Holberg Financial, Spring helps employees to get on the right financial footing through goal setting, financial educational materials that are bespoke to an individual, and 1:1 coaching. Whether you're saving for life events, or paying down debt, their offering can help meet your goals. In addition, they have some unique tools that let HR see employee engagement and progress with the tool.

PerkSpot, Kipp, Teach For America

Spring has three pricing tiers:

- Small Business: $1,000 per year for Financial Wellness Platform, additional $8 per employee for coaching.

- Emerging Business: $2,500 per year for Financial Wellness, additional $7 per employee for coaching.

- Medium Sized Business: $5,000 per year for Financial Wellness, additional $8 per employee for coaching.

- Large Business: $10,000 per year for Financial Wellness, additional $5 per employee for coaching.

- Enterprise: Custom pricing.

Best For

Spring has flexible pricing plans for companies of all sizes.

Payactiv

Payactiv’s financial wellness platform allows employees to access up to 90% of their earned wages between paychecks. At no cost to the employer, the platform also provides features like 1:1 consultations with financial coaches, savings guidance, discounts, and expense tracking.

PROS

- Payactiv costs nothing to the employer and helps them boost employee engagement and reduce turnover by supporting the holistic financial improvement of their employees.

- Payactiv allows employees to withdraw their earned wages at any point during the month to pay for bills, medical expenses, and more. You don't have to wait for payday, pay overdraft and late fees, or borrow money.

- Payactiv's financial assistance program provides employees with an opportunity to consult with professional coaches and get advice on saving, budgeting skills, debt management, and more.

CONS

- Employees will have to pay between $1 and $2.99 every time they withdraw money from their earned wages.

- Users have reported that they are extremely disappointed with Payactiv's customer support as representatives either do not respond on time or don't fix the issue quickly.

- Payactiv is slow to update employees' accounts with their earned wages, despite repeated requests from users.

- Many employees have reported that they were unable to withdraw their earned wages despite their employer updating their hours in the system.

Payactiv is a financial wellness platform that allows you to access earned but not paid wages between paychecks. Using the Payactiv app, an all-in-one digital wallet, you can transfer your earned wages either directly to your bank account or the Payactiv Visa card - a reloadable prepaid card that can be used to pay bills and make purchases. On payday, the wages you withdrew will automatically be deducted from your paycheck.

Apart from this, Payactiv offers other services like a budgeting tool, an expense tracker, guidance on savings and spending, 1:1 financial coaching, and a savings calculator.

Over 1500 companies use Payactiv including Uber, Pizzahut, Subway, Alorica, Hilton Hotels & Resorts, and Signature Healthcare.

Payactiv costs nothing to the employer. Employees can access their earned wages by ACH bank transfer, real-time transfer to a Payactiv Visa Card, or direct transfer to a bank account. Depending on the transfer mode, each transaction can cost the employee between $1 and $2.99.

Best For

Payactiv can be used by businesses of all sizes. It is especially beneficial for lower-income hourly workers who want to access their earned wages between paychecks.

We used Payactiv to give our employees more flexibility and control over their pay between regular pay periods. After integrating it with our payroll and timekeeping systems, team members could download the app, create an account, and access a portion of their earned wages before payday.

Many employees used this feature to transfer funds directly to their bank accounts to cover unexpected expenses or better manage their budgets. Some also took advantage of additional features like bill pay, savings tools, and financial wellness resources.

From the employer side, the implementation required minimal effort, as Payactiv advanced the funds and was reimbursed automatically through payroll.

Overall, it functioned as a valuable benefit that helped reduce financial stress, improved employee satisfaction, and contributed to retention—at least for those who used it.

- Payactiv was offered to us as a no-cost benefit.

- For the employees who used it, it helped reduce financial stress, which in turn supported retention and improved morale.

- Implementation and rollout were quick and required minimal administrative effort.

My organization purchased Payactiv as a way to enhance our benefits offerings. We used it for one year but ultimately decided to discontinue it, as it wasn't widely utilized within our company.

The goal was to provide employees with greater financial flexibility and to help manage unexpected expenses between pay periods.

- There was limited documentation about the platform, which caused confusion among employees about how it worked.

- Customer support was slow to resolve issues.

- Employers had no control over how much employees could withdraw.

Payactiv is similar to other tools in this space. We didn’t find significant differences in features or functionality compared to its competitors.

One important consideration is state compliance. While we weren’t located in states with tighter regulations, this could present issues for other organizations. It’s also helpful to assess the financial literacy of your workforce.

In our case, many employees were high earners and didn't need the service, while some of those who did use it overextended themselves and experienced more stress at payday.

Understanding your workforce’s needs and habits is essential before implementing a tool like this.

We discontinued use, so I do not have insight into how Payactiv has evolved.

Payactiv is well-suited for organizations with a workforce that includes mid- to lower-income earners who may benefit from added financial flexibility between pay periods.

Payactiv may not be a good fit for organizations with predominantly high earners, as the service may not be necessary for them.

It may also be unsuitable for companies with employees who lack financial experience, as some may request more funds than they can comfortably repay at payday.

Branch

Apart from allowing employees to withdraw an advance of up to 50% of their paycheck before payday, Branch also provides additional financial wellness benefits like the ability to set up direct deposits, access your bank statements, and personalized saving plans.

PROS

- Unlike payday loans that usually charge interest on the amount withdrawn, Branch has a 0% interest policy.

- Besides allowing employees to withdraw cash before payday, Branch also lets them communicate with their peers. They can instant message each other, keep track of their schedules, and drop/pick up shifts when needed.

- Branch does not charge users a fee for instant transfers to the Branch Debit Card.

- All paycheck advances through Branch are confidential - your employer will not be notified of your advance requests.

- According to users, Branch is fairly simple and easy to use.

CONS

- While transfers to the Branch debit card are instant, transfers to your connected bank account or debit card can take up to three days. If you want to bypass the wait time, you will be charged a minimum of $3.99.

- Unlike other banking applications that automatically sign you out of the app when not in use, Branch keeps you logged in. Some users find this feature problematic from a data security point of view.

- While Branch gives you early access to your paycheck, the amount of money you can withdraw is limited. This means that you cannot entirely depend on the advance money from Branch in the case of expensive emergencies.

- The Branch app is currently not available for remote workers.

Branch is an advance cash platform that allows employees to withdraw up to 50% of their earned wages before payday. Unlike traditional money lenders, Branch does not charge an interest fee. All transfers to the Branch debit card are instantaneous and free. Transfers to a connected bank account or debit card can take up to 3 days. However, those who wish to bypass the wait time can pay a flat fee for an instant deposit.

It’s important to note that you can use Branch if your employer has signed up for it, and before being able to withdraw an advance on your paycheck, you must have already received at least two consecutive months of pay through Branch.

Uber, Henry Ford Health System, Domino’s, Kelly, and Continuum

Branch does not disclose their pricing upfront. Employers can contact their sales team for a custom quote. Employees pay nothing for instant transfers to their Branch Debit Card. However, transfers to all other debit cards incur a fee of $3.99 for amounts under $75 and $4.99 for amounts greater than $75.

During its early days, Branch was an employee communication tool. It then morphed into a schedule manager, allowing employees to post their schedules, assign shifts to each other, and pick up extra shifts when needed. While it still has those features, today, it is primarily a financial wellness tool that offers advanced paycheck payments at no interest.

Best For

Branch can be offered as an employee benefit to full-time staff and independent contractors across various industries, including manufacturing, healthcare, retail, logistics & trucking, franchise, and restaurants.

Tuition.io

A comprehensive education assistance benefits platform, Tuition.io is equipped with student loan management tools, student loan repayment assistance, tuition assistance, and more.

PROS

CONS

Tuition.io helps companies empower their employees to pay down student debt. When offered as an employee perk, they see people increase student loan payments, which results in a 20% decrease in delinquent loans. They offer multiple products, such as student debt management tools, public service loan forgiveness tools, Student loan repayment assistance, and tuition assistance.

ADP, Ford, Hulu

Customers pay a monthly fee based on the products you decide to offer employees.

Best For

Tuition.io is great for any company looking to help their employees pay back debt.

How I use tuition-io is by sharing it as a benefits offering. The platform includes tools to help track debt across lenders and model long-term payment strategies. It also offers calculators with other educational information for future college expense planning. We've also leveraged it for the coaches who can advise on college-funding, and answer questions about student loans. And my favorite feature about tuition-io is the feature our company has implemented about registering your student loan payments, and the company will match the participants' student loan payments as a 401k contribution.

As mentioned before I like the innovative benefit offerings for employees. From the flexibility of how to design a tuition repayment plan for your company, to the usability, it really is a wonderful benefit to add to the list of offerings. Having student loan tracking, calculators, coaches, a loan optimizer tool, and refinancing options are cutting-edge benefits that set a company apart, from young professionals entering the workforce to professionals who may be helping their children with student loans.

The company I worked for purchased tuition-io recently, within the last year and a half. It was purchased as an additional benefit offering to our employees. I've shared it with other employees as a tool for them to help contribute to their retirement while they work on paying off their student loans. The company I worked for already had a strong benefits package, but this broadened the benefit offerings to a larger, more inclusive scope of employees. I love this innovative idea for typically younger employees to be thought of and supported to be able to contribute to their 401k by registering their student loan payments when otherwise they would not be able to save for retirement.

I do not have a lot of experience with this type of tool to be able to compare it to a competitor's product offering. However, I would like to see metrics provided by Tuition-io that HR could use to show aggregate data on how their particular plan design is helping employees. I would also like to see a partnership with various budgeting tools (think rocket money) that could partner with tuition-io as another added benefit that is integrated. Lastly, I would like to see more educational materials shared by my company (not a tuition-io fault per se), but perhaps with support from tuition-io broadcasting the benefit, as I assume many are not taking advantage of this benefit, that may find it incredibly helpful for their future savings goals.

I have not used competitor tools yet in this arena. This is a newer product offering (in my 13 years in HR), but I anticipate there are more on the horizon. So far I have no major complaints to make about tuition-io. I'm happy to see it as a tool to help with employee retention in our benefit offerings.

Firstly, cost should be considered when buying this type of tool. Also retention data, what is the cost of not having this tool as a benefit for employees? There is a monthly subscription fee which could be off-putting to some companies. I would do a benefits survey for my employees, listing off various benefits and seeing how frequently this one pops up. It may be valuable depending on your demographic.

I haven't worked with Tuition-io long enough to give an honest review on its evolution to meet users' needs.

Tuition-io would be great for a progressive organization that has a sizable demographic with student loans that are inhibiting their financial goals.

Tuition-io would not be a good fit for an organization that is aware of the student loan status of its people and where there is not a deep need for tuition assistance/retirement goal planning, which I would estimate is not too many organizations!

CommonBond

CommonBond focuses on helping employees and their family with student loan debts. It's simple and customizable – employees choose from various options for paying their student debts and can make use of education finance tools for decision making.

PROS

CONS

Through CommonBond, companies can help their employees better pay for education. They will customize solutions for your oganization around paying down debt, refinancing, or saving for future educational opportunities.

Michelin, Hilton, Humana

Best For

Brightside

Brightside is an all-encompassing financial care solution. It uses the best-in-class technology but has a human-centric core; there's a dedicated team of Financial Assistants that helps employees with anything ranging from retirement replanning to paying rents.

PROS

CONS

Brightside offers a holistic, mobile-first financial care platform that empowers employees to live happier, more productive lives by tackling the financial challenges they face on a daily basis. Their service connects your employees 1:1 with an expert financial assistant who listens to their unique challenges and needs to then help them navigate the best options available to them.

Whether those are existing employer benefits, Brightside solutions, partner solutions, or community resources, Brightside’s financial assistants are never paid on commission and any kickbacks they receive from their partners are passed along to the employee as part of Brightside’s KickForward™ program. Solutions on their platform include early access to paycheck, payroll linked-loans, auto savings accounts, debt consolidation, budgeting, and plenty more.

Best For

Any company looking to improve its employees financial wellness.

Use-Cases: Why Launch an Employee Financial Wellness Program

There’s a growing need among today’s employees— including recent grads and their still-working parents— to improve their overall financial health. Just look at these results from PwC’s 2023 Employee Financial Wellness Survey:

Sixty percent of full-time employees are stressed about their finances. This is slightly higher even than the number who were stressed about finances during the height of the pandemic. Even among employees earning $100,000 or more per year, nearly half (47%) are stressed about their finances.

So what does this all mean? For starters, if you don’t have a financial wellness program yet, you should get one going ASAP. When you can help your employees overcome their #1 stressor, they’ll be happier and more focused at the office. This means increased productivity, higher retention, and more recruiting leverage. A win-win-win.

However, financial wellness can mean a lot of things — it all depends on the needs of your particular workforce. Laurie Strazzullo, director of strategic partnerships at Gradifi and financial wellness expert, recommends companies think about these three factors: 1) goals, 2) needs, and 3) budget. “Companies need to first understand what they’re trying to achieve with a financial wellness benefit,” she said. “Is there a specific problem that employers are facing with their finances? Understanding this will help them decide if they need a robust, interactive tool that offers a host of financial benefits, or something more simple.” Budgets play a key role in this decision, too — but more on that in the pricing section below.

To help you figure out what type of financial wellness benefit would be right for your company, here is a list of the common use cases and what they entail:

- Student debt repayment and/or refinancing: Chances are, the majority of your employees carry student debt, including millennials and parents of recent grads. With a student loan repayment benefit, your company would contribute a certain amount to their student loan balance every month. With a refinancing program, you can help them get a better interest rate on their loan. In either case, you’re helping them pay their balance down faster and save a lot on interest in the process.

- Saving for retirement: 401(k) plans are like the legacy benefit for employee financial wellness. They have been around for a while and allow employees to contribute pre-tax dollars to a retirement plan. In many cases, employers match the contribution up to a certain amount.

- Credit card debt: Help employees who consistently carry balances on their credit cards with programs aimed at consolidating — and paying off — their credit card debt faster.

- Saving for kids college: If your employees have children, chances are they’re thinking about tuition, be it for private school or college — or both. If you’re looking to provide them with an education savings plan, like a 529, many financial wellness providers offer this benefit.

- Better budgeting practices: Through 1-on-1 coaching and other digital tools, your employees can learn how to better manage their money so they spend less and save more.

- Home finance: Buying a home is a huge financial investment that requires a healthy credit profile and a large cash deposit. Use a financial wellness provider to help your employees get up to speed on their mortgage readiness and what they need to do to get approved. And help those already with a mortgage understand their refinancing options.

- Early income access: Platforms like PayActiv and Branch allow employees to access their earned but unpaid income without paying any interest. This benefit is especially helpful for employees who tend to live paycheck to paycheck.

Some providers offer a multitude of these solutions, while others focus on just one. The solution you choose will depend on your employee’s needs.

Considerations & Common Mistakes

As with any new tool or program, you’re likely to run into a hurdle or two — either during the search/demo process or once you’ve launched internally. The following tips (inspired by common considerations and mistakes employers face with regard to financial wellness) will help you avoid these hurdles so you can more efficiently launch your benefit:

- Look for quality, unbiased advisors: Many financial wellness platforms are owned by larger financial institutions, so the advice they give may be biased toward the parent company’s financial products. Look for vendors that have unbiased and/or third-party advisors (or financial wellness programming via video/eBooks/quizzes/etc), that way you know your employees are getting the best advice possible for them. And, see who is giving the advice — i.e. are they certified financial coaches or uncredentialed employees?

- Beware of predatory lenders: While there are reputable platforms that offer pay advances (like PayActiv and Branch), some predatory lenders masquerade as financial wellness platforms. Predatory lenders — also known as payday lenders — charge extremely high APRs to help customers cover their immediate cash needs in between paychecks. Not to mention, they typically require payments close to the next payday and, if a customer is unable to make that payment, they’ll have no choice but to renew their existing payday loan for another, more expensive one. This causes customers to get stuck in a seemingly never-ending cycle of debt. All this to say, make sure to do your research on whatever platform you are considering for this particular benefit.

- Consider the breadth of offerings: Some programs only address one demographic or benefit (like only retirement or only student debt), while others provide a full spectrum of benefits. Think about what you want your wellness program to look like, then choose a platform that offers the benefits you’ll need for your ideal program.

- Don’t be surprised if employees don’t use it: There’s a chance that your employees won’t use the product/benefit you bring on board. Thankfully, many of them offer engagement metrics so you can actually SEE how many are using (or not using) it. Some might even have customer success teams designed to promote usage and measure success. If you’re concerned about how your employees will respond, consider surveying them ahead of time to gauge their interest in the type of financial wellness benefit you’re launching. Or, as a benchmark, look at the usage of benefits programs you already have in place.

Benefits and ROI

Offering a financial wellness benefit will go a long way in helping your company grow. You can more easily grow your headcount. Your employees’ productivity will increase. And, in turn, your company will reach its goals faster.

Here are a few key benefits you could reap with a financial wellness program:

- Employee engagement and retention: Employees want to feel like more than just a cog in a machine when they’re at work. They want to be treated like, well, humans. But more than that, they want to feel like their employer has their best interests at heart. After all, they spend the majority of their time working. Offering a benefit that will directly reduce their #1 stressor and set them on a path to financial success will go a long way. Not only will they feel more supported by you as an employer, they’ll also want to stay loyal to your company (and they might even start referring their friends to apply there, too).

- Recruiting: Want a competitive edge when it comes to your hiring efforts? Imagine how many more top candidates will apply for your jobs when they see you offer a financial wellness benefit — especially one geared towards alleviating student loan debt. There’s no denying that this will set your company apart. After all, it shows that you care about social responsibility, which is another hot topic for employers these days.

- Increased productivity & improved bottom line: When employees are stressed, they underperform and take more days off. Work suffers, goals are left unmet (or barely met), and company performance drags as a result. Alleviating the stressors that keep employees distracted and disengaged will help increase their productivity, boost team morale, and improve overall company performance.

Because financial wellness is still an emerging space in HR, the success metrics aren’t so black and white. Not to mention, success can look different from one company to the next. In thinking about how to measure ROI, talk to your vendor of choice about the metrics they use — or consult their customer success team (if they have one, that is) to help you understand what success looks like for your company, plus how to measure it.

In the meantime, check out our ROI calculator which breaks down the value of things like increased productivity.

Pricing

Pricing varies. Some vendors offer a flat per-employee-per-month fee, some charge implementation or integration fees, and some make money by cross-selling various financial products like debt-refi. Some solutions can be free while others charge as much as $20 per employee per month. Be sure to talk about pricing during your demo.

If you’re concerned about pricing because your budget for this is small or nonexistent, there are some creative ways to make it work. The first is to find a low-cost solution. Or, you could shift budget dollars. Survey your employees to see which benefits they care least about or look at usage data to see which ones are under-utilized. For example, if only 1 or 2% of your workforce is using an existing tuition reimbursement plan, shift those budgeted dollars to financial wellness.

At the end of each year, instead of reimbursing employees for their accrued and unused PTO, give them the option to put those dollars towards their student loans, for example.

Whatever the case may be, one thing is clear: if budget issues are stopping you from creating a financial wellness program, you can — and should — find a way to make it work.

Features: What You Can Expect from Financial Wellness Programs

As we mentioned previously, your financial wellness program should be designed with your specific workforce in mind. In other words, what do your employees need to improve their overall financial health?

In addition to the use cases we outlined above, there are other features you can expect from a financial wellness provider. Let’s take a look:

- Financial advisor/counseling: Many vendors offer licensed financial coaches to provide 1-on-1 financial guidance to your employees. This could involve everything from financial education to personalized budgeting help to saving plan recommendations and more.

- Employee access via mobile: Many platforms have mobile apps so employees can access their benefits portal more easily and/or on the go.

- Link to bank and brokerage accounts: Allow your employees to get a holistic view of their finances by letting them link to their existing bank and investment accounts from their benefits portal.

- Financial education: In addition to counseling services, your financial wellness program could also include literature, presentations, and/or workshops all aimed at increasing your employees’ financial literacy.

- Employee accountability: Want to make sure your employees use the financial tools you’re thinking about investing in? Look for vendors that have customer success teams — such teams are designed to keep employees engaged and help you measure ROI.

Demo Questions: What To Ask During Your Demo

Before investing in any tool, make sure to book demos so you can see how everything works. Be prepared to lead each demo so that you come away fully understanding which tool will benefit your company the most.

How to get to this decision depends on the questions you ask during the demo. To get you started, we compiled the following lists of questions that are a good idea to ask on any demo as well as those more specific to financial wellness.

General questions:

- Will this tool integrate seamlessly with our existing tech stack?

- How can we help other members of the org recognize the value of and use this tool?

- What are some specific features important to our business that I should inquire about?

- What are possible reasons for apprehension about purchasing this type of solution?

- How does the pricing structure work?

- Are there any implementation guidelines recommended by the provider?

Financial Wellness questions:

- What are the most pressing financial issues our workers face?

- On average, how frequently do employees engage with your platform?

Can you guide me through how employees utilize this platform? Is it mobile-friendly? What customer service options are available? - How do companies promote and advocate for this program within their organization?

- How do companies allocate budgets to match employee contributions for student debt repayment, 401(k)s, etc.?

- Are there any tax breaks to know about?

- What regulatory risks should I learn about?

- Can you provide a walkthrough of the HR/admin dashboard?

- How does your company generate revenue?

Implementation

In most cases, implementing a financial wellness benefit is pretty low-tech, meaning you shouldn’t have to enlist your entire IT team or organize a cross-functional implementation team. That said, you should still go over the implementation process in detail during your demos. That way, you will know exactly what is required of you to get up and running. Here are two other implementation recommendations to consider:

- Evangelize with employees: Get your employees excited about this benefit before it launches. That way, they’ll be more inclined to use it once it’s implemented. You can do this by running an initial survey to gauge their specific financial needs, making all staff announcements about the program you’re building, selecting a handful of employees to do demos, establishing office hours on a monthly basis, etc. Then once it’s launched, meet with each team to go over the benefits platform and answer any questions. You could even have a vendor representative on-site as well to offer help, 1-on-1 counseling, and more.

- Link to accounts to understand current financial status: Depending on the actual financial wellness benefit(s) you opt-in for, you might need to link to existing accounts (like the 401k provider you currently use). This will help your employees get a more full and accurate picture of their finances in one place. Additionally, if you’re able to tap into your employees’ actual student loan balances, for example, you’ll be able to confirm that minimum payments are being met. If your combined payment (i.e. your and your employees’ contributions) are not enough to meet the minimum payment requirements, then your employees aren’t actually saving any money on interest. Being able to look up this information is one way to measure program success, find areas of improvement, further help your employees, etc.

Employee Financial Wellness Software FAQs

What is financial wellness?

Financial wellness is a measurement of money security, including emergency savings, investments, salary, and more.

What is financial wellness software?

Financial wellness software are solutions designed to ensure employees are on the right track to positive financial health, using educational tools and personal assistance.

What benefits does offering financial wellness programs provide to your company?

By providing financial wellness services, you’ll see heightened retention and engagement, increased productivity, improved bottom line, and higher candidate interest. Employees get the benefits of early income access, home financing, budgeting practices, college savings, and mitigation of credit card debt.

What features do financial wellness programs offer?

Financial wellness programs offer features such as home financing, student loan and credit card debt planning, retirement saving, budgeting education, early income access, and educational tools.

Next Steps

If financial wellness isn’t a top priority for your company this year, figure out a way to make it one. Money matters are stressing out your employees and negatively impacting their work. To help them get back on track, pay attention to what, exactly, is most important to them. Is it student loan repayment? The ability for workers to get their paychecks faster? Education in general? Retirement options? All of the above?

20-30 years ago, people were retiring at 55 and 60. Today, a lot of people are working into their 60s and 70s because they’re stacked with debt — either because they didn’t plan accordingly or because of things like their mortgages and their kids’ tuitions.

This debt can be debilitating for your employees and, in turn, your company. So ask yourself: do you want to just check a box that you offer a financial wellness benefit, or do you want something that goes beyond open enrollment? Chances are, you’ll want something that will keep employees engaged and actually help them out of the hardships they’re facing.

Whatever the case may be, focus on the areas most important to your company and develop a holistic long-term strategy around them.

About the Author

About Us

- Our goal at SSR is to help HR and recruiting teams to find and buy the right software for their needs.

- Our site is free to use as some vendors will pay us for web traffic.

- SSR lists all companies we feel are top vendors - not just those who pay us - in our comprehensive directories full of the advice needed to make the right purchase decision for your HR team.